Key Takeaways

• Sentiment on emerging markets (EM) is reaching levels consistent with a contrarian buy signal.

• Large pullbacks are quite normal for EM, making the recent pullback a potential opportunity.

• The underlying fundamentals appear to remain solid overall for EM.

Are emerging markets (EM) washed out? Last week the MSCI Emerging Markets Index officially sank 20 percent from its peak in late January. This prompted many bearish headlines, such as “Emerging Markets Slide into Bear Market amid Contagion Concern,” and “It’s Beginning to Look a Lot Like a Crisis.” At the same time, a recent survey from Bank of American/Merrill Lynch showed that global fund managers are underweight EM equities for the first time in more than a year. One thing is for sure: From a contrarian point of view, the level of pessimism we are seeing toward EM could potentially be a bullish sign.

After highlighting here some of the fundamental reasons we remain optimistic on EM equities despite recent weakness, we’ll take a look at EM sentiment this week to try to answer the question: Is EM washed out?

How Normal Is EM Volatility?

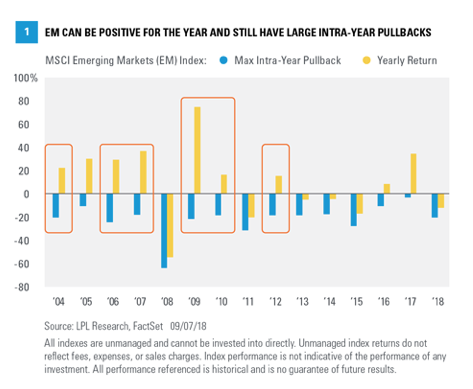

How common are big EM pullbacks? As Figure 1 shows, when it comes to EM, it can be quite normal. Going back 15 years, the MSCI Emerging Markets Index pulled back at least 15 percent (intra-year peak to trough) 11 times. In six of those years, the index finished the year higher. EM could not dig itself out of a big hole after heavy losses in 2014 and 2015, and ended those years in the red. However, those periods were marked earnings recessions—nothing like the solid fundamental backdrop we are seeing today.

A Positive Technical Signal?