We will use Amgen (AMGN) as a poster child for what is going on. Amgen is trading around $166 on April 3, 2018 on trailing earnings of $12.58. This makes a P/E ratio of 13.28x versus a trailing P/E of over 20x for the S&P 500 Index (source: Thomson Reuters). They have a long history of researching and creating successful medical remedies. The company has a stellar balance sheet with more cash than debt. Insiders have sold very little stock in the last 12 months. Amgen’s net profit margin was 40.4 percent and generated an unleveraged return on equity of 33.5 percent in 2017.

Amgen has one of the most exciting new biotech products called Repatha. Taken in tandem with a statin, this biologic reduces the bad cholesterol in a group of 27,000 high-risk patients by 70 percent on average. Repatha dramatically lowered the risk of heart attack and stroke in this large population of people whose high bad cholesterol threatens their life. They were in the study because statins by themselves had not solved the high bad cholesterol dilemma.

However, it has become politically attractive on both sides of the spectrum to take shots at companies developing these drugs and Repatha has been no exception. The list price for a year of Repatha is $14,000. To cater to the body politic, health insurance companies have balked at paying that price and have slowed the adoption of its use. Since its widespread use is being delayed, earnings estimates are expecting small growth in Amgen earnings to $13–$13.50 per share in 2018.

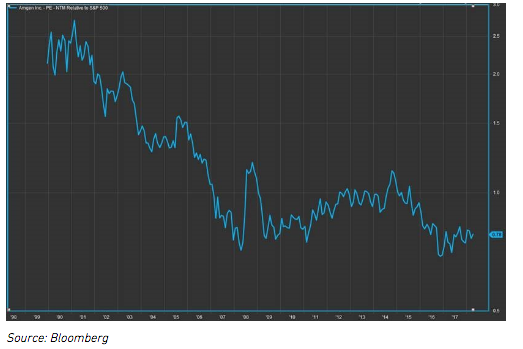

In effect, this slow adoption will prevent thousands of high cholesterol Americans from running around the bases at next year’s opening game or being honored as one of the “Hutch Heroes,” who have recovered from the disease in their body that is trying to put them in their grave. In the short run, just about anything can happen and the present cultural attitude could continue. In our observation, change is the only guarantee that exists in the investment business and attitudes tend to return to normal. Below is the chart of the P/E ratio of Amgen compared to the S&P 500 going back 20 years:

Peter Lynch argued that over long stretches of time, earnings and stock prices are highly correlated. We are very excited to collect the current annual dividends of $5.28 (3.2 percent yield) and wait for the investment markets to be as excited as we are about Amgen and other businesses that are creating life-saving medicines for people whose lives are being prolonged.

William Smead is CIO and CEO of Smead Capital Management.