The municipal market continues to be a relative bright spot for core fixed income investors. While most of the other “safe” parts of the core fixed income universe have generated negative returns this year, the national muni market is up for the year (through September 24). With state and local governments flush with cash due to better-than-expected tax receipts along with generous amounts of federal aid, many municipalities are in good shape. Moreover, a combination of increased demand due to an expectation of higher individual tax rates and a dearth of new issuance over the summer months have kept muni bond prices largely range bound. Now, there is a question of whether the upcoming infrastructure legislation can provide additional support to the investment-grade municipal market.

“If passed, the infrastructure bill will likely help muni credit fundamentals,” noted LPL Financial Fixed Income Strategist Lawrence Gillum. “But current valuations likely reflect the slimmed down proposal. As such, we don’t think the legislation, when passed, will be market moving”

In August, the Senate passed a $1 trillion, bipartisan infrastructure proposal that would increase new spending towards transportation and “other infrastructure” initiatives by $550 billion, spread out over five years. Roughly $340 billion would flow to municipal issuers. Importantly, the deal calls for investing $110 billion in roads, bridges and major infrastructure projects and $40 billion for bridge repair, replacement, and rehabilitation. Additionally, the bill would invest $65 billion to rebuild the electric grid and $55 billion to upgrade water infrastructure. The House of Representatives is set to consider the plan this week, with a vote scheduled for Thursday. If passed, the Infrastructure Investment and Jobs Act would mark the largest federal investment in more than 10 years.

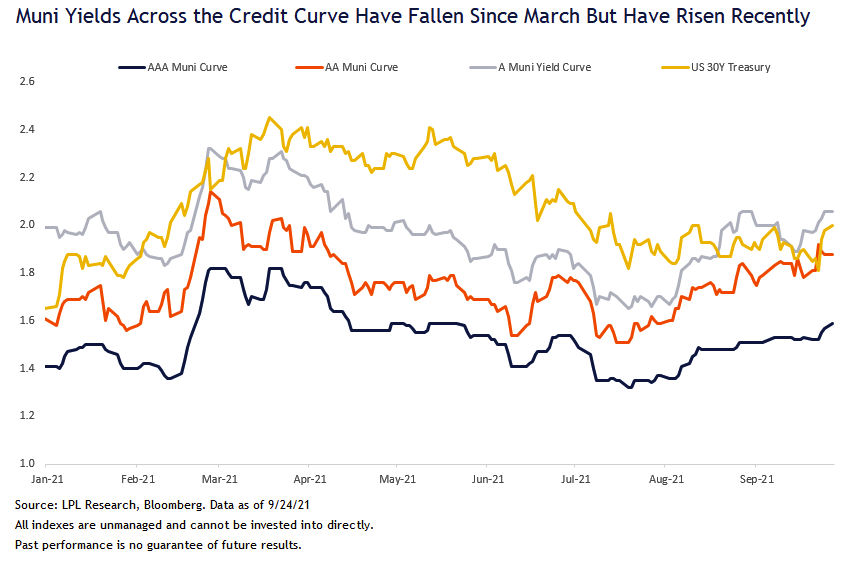

Additional federal dollars allocated to transportation, electric utility, and water municipal sectors should be supportive of municipal valuations. However, the significantly slimmed down bill won’t be nearly as supportive to the municipal market as was expected earlier in the year. As such, we’ve seen a slight repricing in muni credit over the past few months. As seen in the LPL Research Chart of the Day, yields on municipal credit bonds, across the credit quality spectrum, have fallen this year but have recently risen. The back-up in yields since August likely represents the significant reduction in infrastructure spending as well as the uncertainty surrounding the timing of the legislation passing. President Biden’s original proposal was for $2.3 trillion so the additional $550 billion in new infrastructure spending has likely already been priced in.

Additionally, complicating the House’s ability to vote on the smaller bipartisan infrastructure plan is the larger $3.5 trillion reconciliation bill that some Democrats want to pass before the infrastructure plan is considered and vice versa. Progressive House Democrats have said they won’t vote on the infrastructure bill until the reconciliation bill passes, and moderate Democrats have said they won’t vote on a reconciliation bill unless the infrastructure bill passes. While we think the infrastructure bill ultimately passes, it’s unlikely going to be a catalyst for lower yields/higher prices but it could be another reason yields remain range bound. Moreover, with the economy continuing to recover and the prospects for higher tax rates, muni investment-grade credit should continue to perform well.

Lawrence Gillum is a fixed income strategist for LPL Financial.