Trusts and estates lawyers are essential, as they are instrumental in enabling wealthy families to transfer their assets to future generations and do so tax effectively. Based on a survey of 148 elite trusts and estate lawyers throughout the world, certain key characteristics were identified.

Compensation Arrangements

According to Cliff Oberlin, chairman and CEO of Oberlin Wealth Partners and co-author of Family Fortunes: How Family Enterprises Thrive Across Generations, “Most elite trusts and estates lawyers, at this level, are not selling time. Instead, they are providing expertise. While they almost all use time-based compensation models, nearly 60% of them are often also inclined to charge significant project fees. Another 13.5% of them charge success fees.”

All the elite trusts and estates lawyers that work for project fees will also work on a time-based compensation arrangement. What is telling is that for more than nine out of 10 of these lawyers, project fees are commonly more profitable than time-based fees. For this to be the case, the elite trusts and estates lawyers must have a very solid financial understanding of their businesses.

Being talented and very good is usually not enough to generate the levels of compensation these elite trusts and estates lawyers earn. Being very good can be considered “table stakes.” It takes a lot more for them to rise so high above their competitors. One way this can happen is when they are thought leaders.

Thought Leaders

Elite trusts and estates lawyers being thought leaders entails freely sharing their expertise with others including competitors. The consequence of such sharing is being a known expert among a select, important cohort of the wealthy and other professionals. Almost nine out of 10 of the elite trusts and estates lawyers surveyed believe themselves to be relatively well-recognized authorities in their field.

According to Brett Van Bortel, director of consulting services with Invesco Global Consulting, “Being a thought leader can be very powerful in being better able to serve wealthy families as well as generate new business. This is the case no matter the type of professional whether the person is a lawyer, accountant, or wealth manager. Such stature becomes even more important when the desired clientele are single-family offices and very successful family businesses.”

Very telling is that—according to the research—almost all of the elite trusts and estates lawyers who identify themselves as thought leaders are actively taking steps to build and strengthen their professional brands. This takes several forms but is all based on their willingness to share. Operationally, it often involves distributing written high-value content and speaking engagements.

Making Referrals

Not only are elite trusts and estates lawyers regularly receiving referrals to wealthy clients from other professionals, they are often referring their ultra-wealthy clients to other professionals.

Making Referrals To Other Professionals

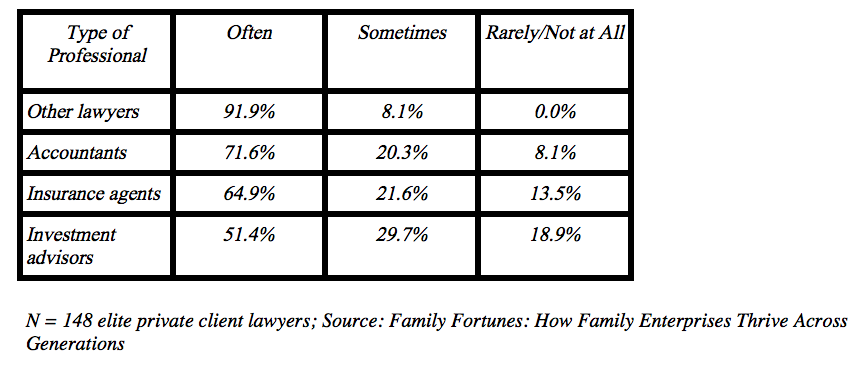

Almost all the elite trusts and estates lawyers will refer their ultra-wealthy clients to peers for legal expertise they cannot provide. This can be within or outside their law firms. About 70% of them will often direct business to accountants, while a fifth will do so sometimes. Nearly 10% will do so rarely or never.

Almost 65% of elite trusts and estates lawyers will regularly refer ultra-wealthy clients to insurance agents and slightly more than a fifth of them will do so sometimes. Only a sixth of them said they do so rarely or not at all. About half the elite trusts and estates lawyers said they regularly refer their ultra-wealthy clients to investment advisors. Thirty percent said they refer sometimes and almost a fifth said they refer rarely or not at all.

“We know we don’t have all the answers,” says Jeb Burton, the managing principal of The Burton Law Firm, “Because we often provide customized legal solutions to extremely wealthy families many of those solutions involve the expertise of other professionals. For example, there are times when PPLI (private placement life insurance) makes a lot of sense for a wealthy family. While we are involved in integrating the policy into the family’s estate plan, we’re not in the life insurance or investment business. We, therefore, need to bring in the best people to make sure the wealthy family gets the results they’re looking for.”

Request a complimentary PDF copy of Elite Wealth Planning: Lessons from the Super Rich from [email protected].