U.S. asset managers are pulling back even further from an already abysmal record of implementing procedures to meet climate change goals, according to InfluenceMap.org., a London-based research organization.

The largest asset managers in the U.S., who have traditionally lagged behind their European counterparts in investing to fight climate change, “are far off track to meet their own 2050 net zero commitments,” according to a study released by the organization today.

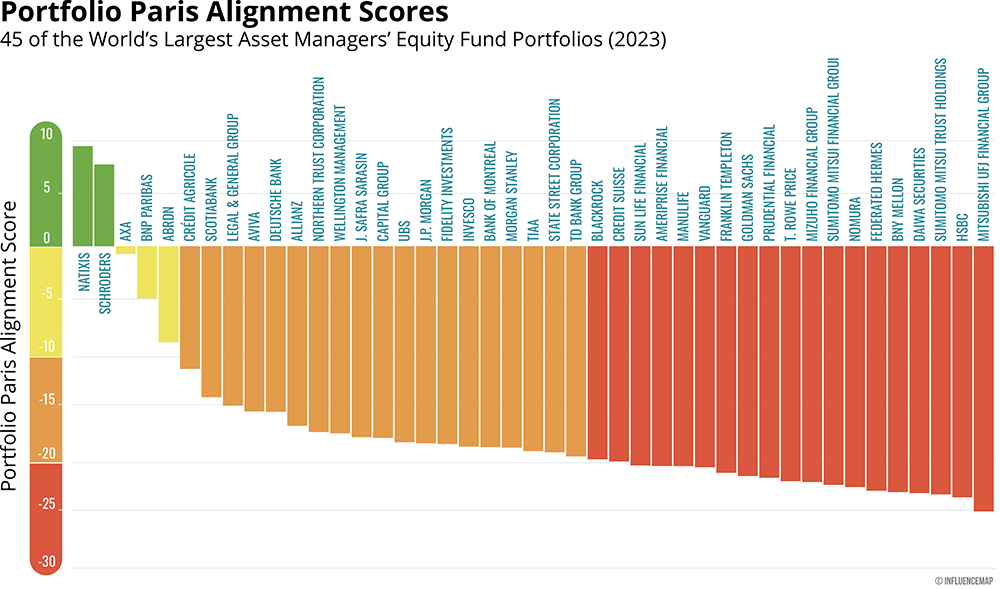

The study, Asset Managers and Climate Change 2023, produced by FinanceMap, is a program created by InfluenceMap to rate the largest asset managers. On the asset managers included in the comparison, 19 were U.S.-based and 26 European-based.

The analysis found that the largest U.S. asset managers have not improved their climate performance over the past two years and in some cases have reversed positive trends, backed by state legislatures that are passing laws restricting ESG investing, InfluenceMap said. InfluenceMap is a non-profit think tank that provides evidence-based analysys of how companes and financial institutions are impacting the climate and biodiversity crisis.

The study rated the 45 largest asset management companies based on three criteria: equity portfolio analysis, stewardship of investee companies, and sustainable finance policy engagement. The accompanying graphic shows each asset manager tht was include in the analysis and how they swcored on climate change fighting initiatives.

For example, BlackRock scaled back its calls to transition business models, while Fidelity Investments continued to be the least active manager in stewarding companies in the entire assessment, the report said. The report also found that support for climate-positive shareholder resolutions declined notably in 2022, with the average asset manager supported just 50% of such resolutions, compared to 61% in 2021, InfluenceMap said.

U.S.-based asset managers displayed a trend of voting against a large portion of climate-related resolutions last year, with the average U.S. manager supporting just 36% of climate resolutions, compared to 50% in 2021, the report said.

“We are seeing growing calls from asset owners, including large institutions,” that net zero should be a real goal, FinanceMap Program Manager Daan Van Acker said in an interview. “It is difficult for asset owners to know what managers are doing to meet their own goals. That’s why we put out this report. Until 2021 we were seeing some improvement, but that has reversed itself.”

“The portfolios of the world’s 45 largest asset managers, which collectively hold $72 trillion in assets under management, continue to be highly misaligned with Paris Agreement goals. Collectively, asset managers hold 2.8 times more equity value in fossil fuel production companies than in green investments in the assessed sample,” the report said.

“Eighty-six percent of the asset managers assessed in this report are members of at least one industry group opposing sustainable finance policy required to enable decarbonization pathways,” it continued.

“The data shows that while they may talk the talk, most asset managers are not walking the walk when it comes to using their influence to drive real change in investee companies and sustainable finance policy,” Van Acker, said in a statement that accompanied the report. “Since our last study in 2021, asset managers’ portfolios are still misaligned with net zero targets, environmental stewardship efforts have stagnated, and asset managers are not supporting effective sustainable finance policy.

“Asset managers obviously have a great deal of influence over the investment of their clients’ assets” and whether they are used to fight climate change,” Van Acker said in the interview. “They say fighting climate change is important, but they are acting counter-productively.