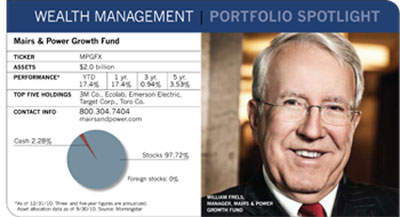

When Judy Garland closes her eyes and chants "There's no place like home," she could well be talking about the investment philosophy behind the Mairs & Power Growth Fund. Launched in 1958 by St. Paul, Minn., native George Mairs Jr. as a way for smaller investors to access the stock market, the fund zeros in on companies of all sizes, many of them in its own backyard.

"The upper Midwest is home to a surprising number of attractive growth companies, and many of them are in the Fortune 500," says fund manager and longtime Minnesota resident William Frels. "We couldn't implement this kind of geographic strategy in Detroit or Cleveland." About 60% of assets are attributable to companies in the Minneapolis-St. Paul area and the upper Midwest, with the rest spread in companies throughout the country.

To Frels, nothing is quite as effective as being in the thick of things, especially in the small- and mid-cap space. "When you're working outside of a region, you don't have any expertise beyond what you see in financial reports," he says. "Because we're neighbors with the companies we invest in, we talk to management all the time and see firsthand what's going on."

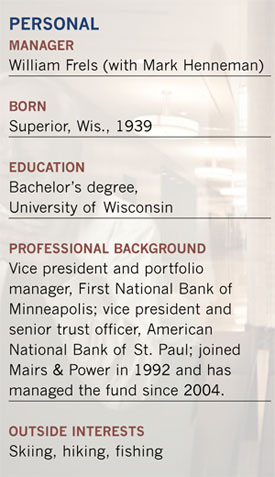

Born in Wisconsin in 1939 and a 1962 graduate of that state's university campus in Madison, the 72-year-old manager has schmoozed and badgered local company managers for almost half a century. After working at two Twin Cities area banks as an investment officer, he joined Mairs & Power in 1992. He became the fund's co-manager in 1999 and succeeded longtime manager George Mairs III in 2004.

Frels describes Minnesotans as people who are "conservative, stable and don't tend to move too much." The same could be said for the fund's stocks, some of which have been in the portfolio since before Garrison Keillor's tales of Lake Wobegon lured nostalgia-starved listeners. Over the last three years, the fund's annual turnover rate of less than 5% has been one of the lowest in the industry.

While such loyalty may seem dated in an era of rampant market volatility and computerized trading programs, Frels has no plans to change his strategy. "I refute the argument that buy-and-hold investing is dead," he says. "Traders compete for short-term gains in the stock market against powerful competition and work in an imperfect market environment. Their odds of success are low."

One of the first companies he recommended for investment after he joined Mairs & Power was Donaldson Co., a firm whose managers he became familiar with during the 1960s before it went public. Based in Bloomington, Minn., Donaldson was a growing presence in the air filtration business in the early 1990s. Today, it's one of the leading providers of filtration systems in the world and one of the fund's largest holdings. Even though Donaldson is an industrial company, its business has seen strong secular growth over the years and should continue to do so, says Frels.

An even longer-term holding, Target, was born in the 1960s as Dayton's, a now defunct chain of department stores based in Minneapolis. Dayton Corporation opened the first Target store in 1962 to compete with Kmart in the discount arena, and the new brand grew rapidly. The parent, which later became Dayton-Hudson, changed its name to Target in 2000.