We have lowered our projections for U.S. gross domestic product (GDP), the 10-year U.S. Treasury yield and operating earnings for the S&P 500 Index in 2019, as we noted in the August 19 Weekly Market Commentary: Tweaking Forecasts, and introduced our preliminary 2020 forecasts. Over the next three weeks, we will highlight our reasoning behind these changes. Delayed prospects for a trade agreement between the United States and China remain central to our projections for economic growth and financial market performance in the coming months and quarters.

Tariffs and threats of escalation weigh on business investment. As we emphasized in our Midyear Outlook 2019, business investment remains a critical component in determining the extent to which this record economic expansion can persist. As businesses invest in their futures, productivity growth often results, leading to increased efficiencies and improved output per hour worked. This can help elongate the expansion, as higher productivity limits inflation growth, and the absence of threatening wage gains helps sustain profit margins, supporting equity prices.

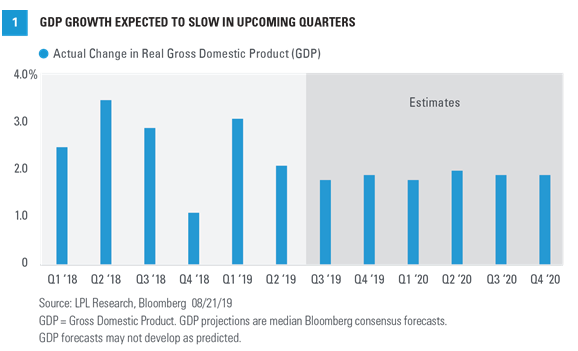

Unfortunately, the delayed trade negotiations and increased tariff threats between the United States and China have led businesses to hold back on their capital expenditures. After growing by approximately 7% in the first half of 2018, business investment has grown by only an average of 3.8% over the past year. This is troubling because after a decade of monetary policy support, the 2017 Tax Cuts and Jobs Act provided businesses with a package of fiscal policy incentives to increase investment. The combination of tax rates, repatriation of internationally sourced profits, and immediate expensing provisions were all tailwinds for capital expenditures. Yet it appears these tailwinds have been no match for the headwind of trade uncertainty. Consequently, we reduced our forecast for U.S. real GDP from a range of 2.25%–2.50% to 2% in 2019. Though the U.S. economy may be slowing from last year’s pace, it is still growing [Figure 1].

GDP=C+I+G+X

While some of you may cringe remembering this formula from Economics 101, we believe it still serves as a powerful reminder for the context and components of U.S. economic activity. Consumption (C), investment (I), government spending (G), and net exports (X), or trade, all factor into the calculation for economic output (GDP). While trade has gained all the headlines recently, it’s important to note that net exports account for only approximately 12% of U.S. GDP. The derivative, or add-on effects, of drops in business investment and trade can affect manufacturing, however, which has maintained growth but at a slower rate. Manufacturing may comprise only less than one-fifth of the overall economy, but we would argue that it is responsible for the majority of economic volatility.

Fortunately, the bulwark of the domestic and global economies has been the U.S. consumer. The combination of low unemployment and moderate wage growth has led to strong trends in personal spending, an area that comprises approximately 70% of the economy. Indeed, in the second quarter, personal consumption grew 4.3%, contributing 2.9 percentage points to the overall GDP increase of 2.1%.

Upcoming Challenges, But No Immediate Recession

The consumer can pull only so much weight, however. Even after the recent tariff reprieve, 25% levies remain in place on roughly $290 billion of Chinese goods, and 10% tariffs on an additional $110 billion in goods begin in September. Businesses are absorbing some of these costs while facing uncertainty about future trade actions, including currency. Slower international growth and geopolitical concerns also add to near-term pressure on U.S. output, potentially offsetting renewed monetary policy accommodation. We suspect these trends may persist in the coming quarters, factoring into our preliminary real GDP estimate of 1.75% for 2020.

Conclusion