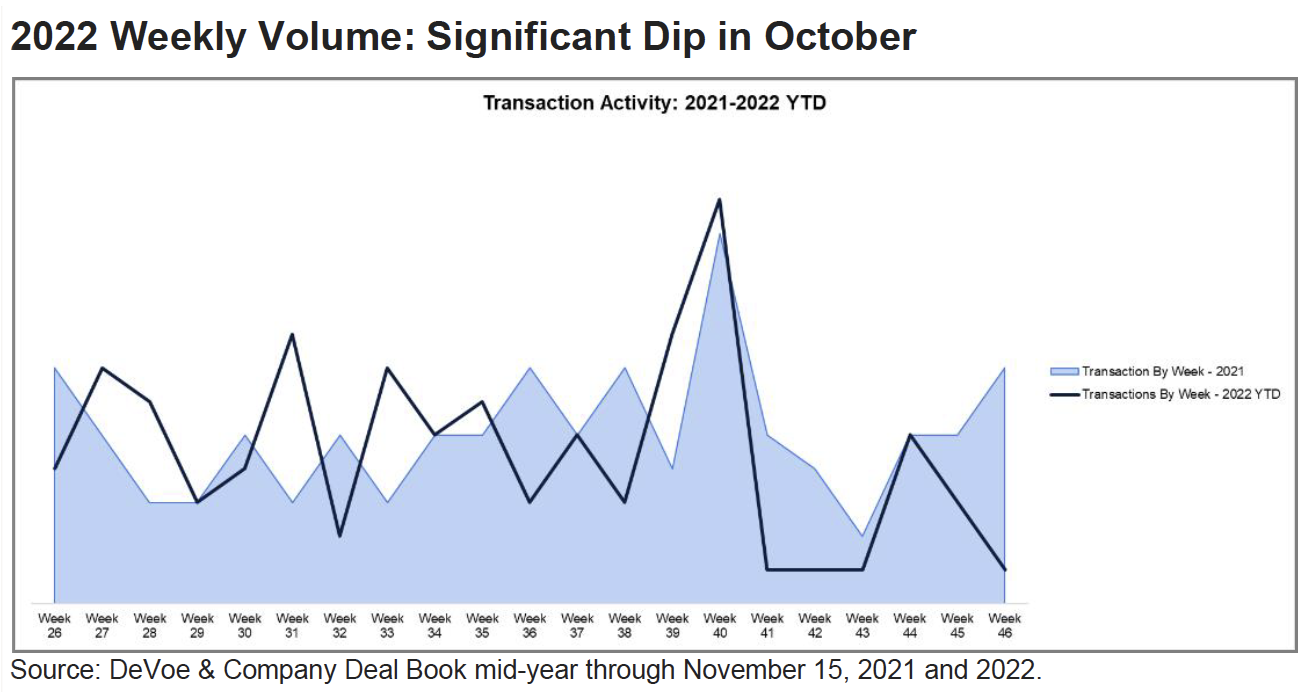

Financial industry mergers and acquisitions did not just tap the brakes in October, but hit them hard, dropping by a dramatic 81% from the trailing 12 month average, according to David DeVoe, founder and CEO of DeVoe & Company, a consulting firm and investment bank that supports wealth management companies.

After months of record-setting increases in the number of M&A transactions in the industry, October saw a dramatic dropoff to only one transaction per week for each of the last three weeks of the month.

“The wheels fell off the M&A train in early October,” DeVoe said in a statement. “2022 delivered three quarters of unexpectedly strong activity,” which was remarkable in part because of the poor market environment. “High interest rates, a declining stock market and a challenging economic environment typically drive down M&A. It remains to be seen if these pressure points are creating a short-term lumpiness of volume or a sustained downturn.”

DeVoe said in an interview that he does not believe valuation levels have created the downturn. “Instead, the do-it-yourselfers, who do not use an investment bank, may be burned out. With the challenges the world is facing, advisors may be using all of their time and resources to help their clients and may not want to deal with a sale or acquisition right now,” he said.

For several months already, DeVoe had predicted a slowdown in the growth of M&As, in part because the dramatic increase in transactions was unsustainable. “But this change has been more dramatic than expected—it came on pretty quickly and strong,” he said. “It will take time before it is known whether the increase will be sustained, but six weeks of declines was too much to ignore. The current situation is pretty rare. At the same time, we usually see an uptick in transactions in December each year.”

“To put the decrease in perspective for the year, the average monthly volume through September was 23 transactions. October and November are tracking at 15 transactions per month,” the firm said.

“The current dynamic will make the rest of the year interesting,” DeVoe said. “The pipelines of DeVoe & Company and many acquirers remain strong. The year is still expected to set a record, but it will not be a blockbuster increase over 2021’s 241 transactions.” For this year through Nov. 15, 227 transactions posted.