A second potential advantage is that the closed-end structure allows these funds to trade at discounts to the value of their assets. Open-end funds, because they must offer redemptions and issue new shares for buyers every trading day, trade at precisely the value of their underlying assets. Closed-end fund investors, by contrast, trade among each other instead of with the funds themselves, so fund share prices can vary widely from the underlying value of the assets.

The advantage, of course, is that a fund purchased at a discount can potentially deliver the returns of the underlying assets (including the additional assets purchased with leverage), and then an extra return if the gap between the price and net asset value (NAV) closes. There are no guarantees that this will happen; in fact, funds can trade for years at meaningful discounts to NAV.

Patrick Galley, chief investment officer at RiverNorth, oversees all of the firm’s funds, including the River North Core Opportunity Fund (RNCOX), a mutual fund that owns closed-end funds and ETFs. He indicated that the firm started buying some closed-end funds dedicated to MLPs recently. The discounts to NAV were large enough, and the underlying MLP assets had dropped enough in price, to provide a margin of safety in his opinion.

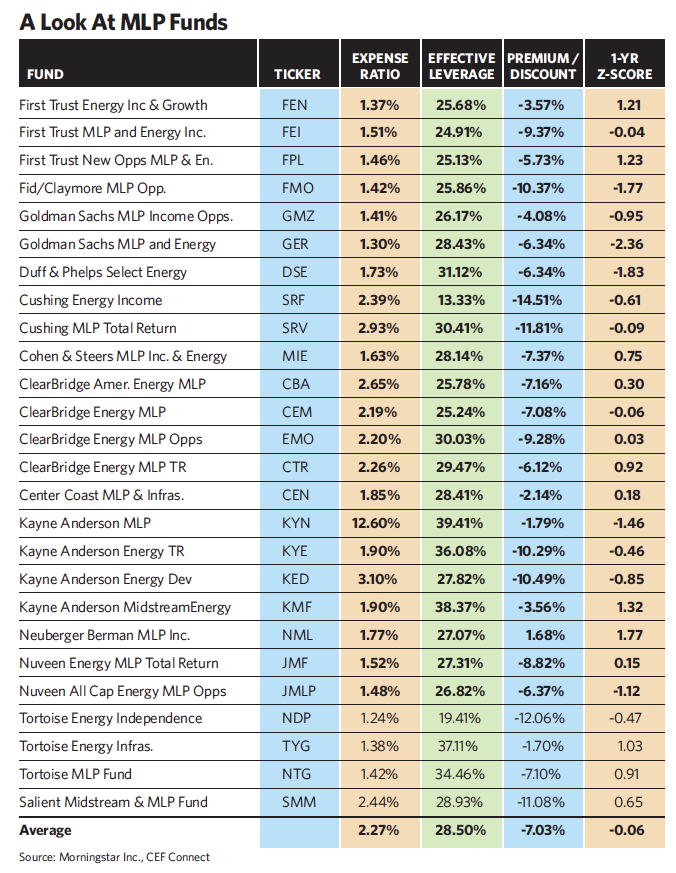

There are 26 closed-end funds currently listed as specializing in MLPs. On average, they are trading at a 7% discount to net asset value, but some trade at double-digit discounts. Their expense ratios average 2.27% (according to data from Morningstar.com and CEF Connect).

Mind The Z-Score

One other metric fund analysts look at (besides expense ratios, leverage, discounts to NAV, etc.) is called a “z-score” or “z-statistic.” The z-score measures the difference between a fund’s current discount and its historical average discount relative to its volatility. It can be applied over different time periods.

For example, a fund with a current discount to NAV of 15% with a 10% one-year average discount and a standard deviation (a measure of volatility) of 2.5 has a one-year z-score of minus 2. Some analysts consider that score or lower an indication of statistical undervaluation, while a score of 2 or greater is an indication of statistical overvaluation.

Like other analysts, Ron Mass, a closed-end fund specialist and founder of Almitas Capital in Los Angeles, prefers to examine z-scores over different time periods. A one-year score of minus 2 or below, for example, may only indicate that a fund has dropped recently, but is still not necessarily cheap.