As Noble Group Ltd. investors head for the door, the embattled commodity trader has turned to a man whose resume is a roll-call of Asia’s highest-profile corporate collapses.

Paul Brough, a British-born former KPMG LLP executive, was appointed chairman of Noble last week as the company’s stock and bonds plummeted. The Hong Kong restructuring veteran’s most recent jobs include liquidating Lehman Brothers’s assets in Asia, running what emerged from the bankruptcy of plantation developer Sino-Forest Corp., and restructuring failed fishmeal supplier China Fishery Group Ltd.

Reviving Noble Group will be no easy trick after two turbulent years marked by falling commodities prices, losses, mounting debt and accusations of improper accounting. Its stock market value has shrunk to less than $600 million from more than $10 billion in 2010. The latest collapse came after Noble reported another loss for the first quarter.

"The situation of Noble is precarious: trading struggles, liquidity shrinks, liquidity costs are sky rocketing,” said Jean-Francois Lambert, a consultant and former head of global commodity trade finance at HSBC Holdings Plc. “This is clearly untenable."

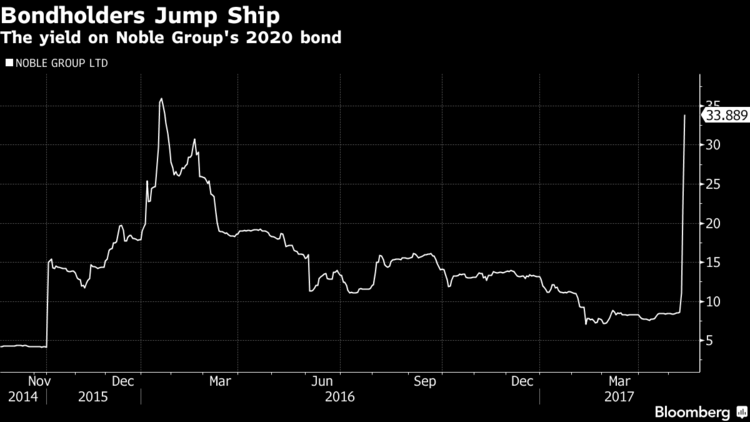

The company’s shares have fallen more than half since the start of last week to their lowest in more than 15 years, while its bonds due in 2020 have lost about 50 percent of their face value. The stock rebounded to trade 5.9 percent higher on Tuesday following a three-day, 54 percent slump.

Moody’s Investors Service downgraded Noble further into junk on Monday, cutting it to Caa1 -- two notches about the level associated with a default -- from B2 and warned it may not have enough money to cover its debts.

The rating agency said that Noble’s liquidity headroom has narrowed to about $1.2 billion, becoming "insufficient to cover the $2.1 billion in debt due" later this year and in the first half of 2018.

Noble Group told investors that Brough’s first job after taking over from founder Richard Elman would be to conduct a "strategic review of the business.” Noble also said he will also "explore strategic alternatives,” often corporate-speak for finding a buyer for the business.

Noble isn’t in as desperate a situation today as some of the other companies Brough has worked for. The commodities trader survived a near-death experience a year ago, when its bonds briefly traded at less than 50 cents on the dollar. At the end of the first quarter, it was sitting on roughly $1.5 billion in cash, which the company told investors on a conference call last week would be sufficient to cover its debts maturing next month.

Brough, 60, has been a non-executive director at Noble since 2015 and knows the company.