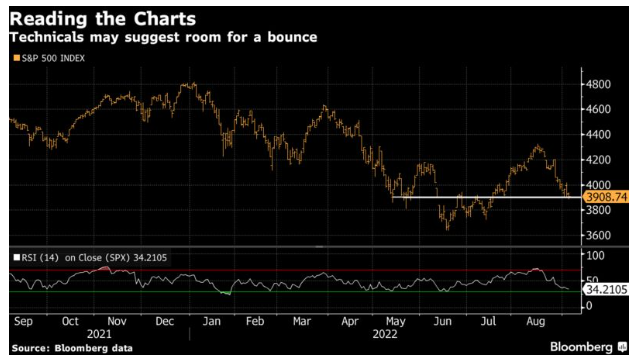

• The CBOE equity put/call ratio, a measure of the ratio of bearish option market bets to bullish ones, is back near the highest since June. Taken as a contrarian indicator, the ratio indicates to some people that the gloom is overdone and a reversal may be near.

You may choose to believe these signals or not, but plenty of market participants do, which makes them relevant to the odds of a near-term bounce. What’s more, there simply isn’t a lot of top-tier fundamental data to trade until the crucial Consumer Price Index release on Sept. 13. Analysts may continue to tweak their earnings outlooks—Morgan Stanley just slashed its 2023 base-case for S&P 500 earnings per share by 10% to $212—but there won’t be much in the way of concrete developments.

All told, much will come down to sentiment and a factor that’s even harder to predict: temerity. Certainly, a further moderation in inflation could help tip the scales in favor of a 50-basis-point rate increase, but there’s little sense in getting too excited about it beforehand. If the market really wants to see a measured Fed in September, it’s best to keep its bullishness in check.

Jonathan Levin has worked as a Bloomberg journalist in Latin America and the U.S., covering finance, markets and M&A. Most recently, he has served as the company's Miami bureau chief. He is a CFA charterholder.