KEY TAKEAWAYS

• In May, market participants will be paying close attention to the Fed, employment data, French elections, and the start of an important seasonal cycle for stocks.

• The final round of French presidential election will provide an important measure of Eurozone unity and may upset global markets should the far right candidate pull off an upset.

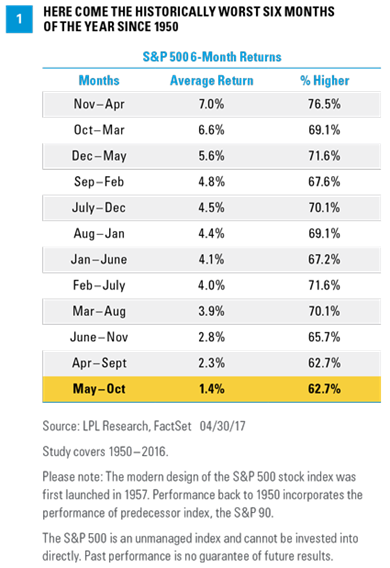

• May also kicks off what has historically been the worst six months of the year for equities.

May 2017 opens the door to summer here in the United States, and it is also a month with multiple potential market-moving events to monitor. While European and emerging markets (EM) have finally started to outperform their U.S. counterparts, markets have historically become more sensitive to risk as temperatures warm. As we turn the page to May, it is important to stay on top of the significant happenings ahead. To help, we’ve created this guide to the May 2017 market calendar, providing an overview of key events.

MAY 2–3:

FOMC MEETING

On May 2 – 3, the Federal Open Market Committee (FOMC), the policy arm of the Federal Reserve (Fed), will hold its third of eight regular meetings scheduled in 2017. After raising rates in March for the second time in a little over three months, expectations for a rate hike in May are near zero. This meeting may provide little for markets to respond to. The policy statement will not be accompanied by updated economic projections or rate expectations, and market participants will have to parse the brief policy statement itself, released at 2 p.m. ET on May 3, to gain any further insight on the Fed’s intentions. During the month the real action may come from comments by Fed speakers in the weeks following the meeting and the release of the meeting minutes on May 24. As for the statement itself, markets will be looking for any signs of wavering resolve after a prior meeting that saw a carefully worded but meaningful upgrade in the Fed’s assessment of inflation. The most effective statement the Fed can make may be largely staying the course after a month of somewhat soft economic data, including the advance estimate of gross domestic product (GDP) growth for the first quarter and the Employment Situation report for March.

MAY 5

APRIL EMPLOYMENT REPORT

The U.S. economy created only 98,000 jobs in March, decelerating from February’s downwardly revised 219,000 and missing consensus expectations of 175,000 jobs created by a wide margin. Wage growth also disappointed slightly at +0.2% month-over-month. With last week’s disappointing first-quarter GDP report (+0.7% real growth) fresh on investors’ minds, many will be watching the jobs data closely for any further weakness. Expectations are for a bounce back, with consensus estimates at 185,000 jobs created in April. It is worth noting the last time jobs growth was weaker than March’s 98,000 was May 2016, when only 43,000 jobs were created. The next month 297,000 jobs were added, so a big bounce back is possible.

Although weather may have played a role in weaker-than-expected job creation last month, slowing job growth is normal at this point in the cycle. Remember, jobs have been positive for a record 78 consecutive months, and job creation would likely need to slow to a sustained 25,000-50,000 per month to signal that a recession may be imminent. In fact, December 2010 and January 2011 were the last time there were back-to-back months with less than 100,000 jobs created. A report in line with estimates would keep the Fed on track to raise rates two more times in 2017, but a potential slowdown in job creation and lack of acceleration in wages would likely lower expectations.

MAY 7

FRENCH ELECTION

The second round of French elections takes place on Sunday, May 7. On the ballot will be Marine Le Pen, the leader of the right wing and populist National Front (although technically Le Pen has resigned as the head of her party), and Emmanuel Macron of the En Marche! Party. What is really on the ballot is the concept of Europe as a unified political entity, with a common currency and shared national policies on important issues like immigration.

After the first round of elections, the market took solace that neither Le Pen herself nor a left-wing, anti-European party received an outsized number of votes. Immediately after the first round, polling data for the second round suggested that Macron was headed for an overwhelming victory on May 7. Recent polls show the election tightening, though Macron still holds a formidable lead of 15 – 20% depending on the poll in question.

Yet there is plenty of room for volatility to creep into the markets this week. We tend to focus on the euro and related trading vehicles to gauge risk in the markets. So far, these markets have remained placid. But skeptics note that in the first ballot, some 43% of the voters rejected the current European status quo in favor of more radical change. Most of that support appears to be in Macron’s camp for the second round. But his support among many voters seems to be tepid.

It remains unlikely that Le Pen can take the presidency on May 7. But if she does, or even if she places significantly above her 22% first round showing, it would demonstrate increased wariness in France of the current European system. We would expect a potential sell-off, in both currency and equity markets, should this come to pass.

SELL IN MAY AND GO AWAY?

May to October has historically been the worst six months of the year [Figure 1], up only 1.4% on average, versus the November to April period, up 7.0% on average. This well-known seasonal cycle has given rise to the oft quoted maxim, “Sell in May, and go away.” The thinking is if you simply avoid stocks during the worst six months and come back for the best six months, the ride to gains will be smoother.

Unfortunately, it isn’t quite that simple, as during four of the past five years the worst six months of the year have been positive. Additionally, the recent November-to-April period was up more than 10%; when that has happened, the next six months of the year have been up 2.3% on average [Figure 2]. Not to be outdone, looking at the four-year presidential cycle, the May-to-October period has been strongest during a post-election year (which we happen to be in now), up 2.0% on average. Last, when the year has been off to a good start and up more than 5% at the end of April (as in 2017), the next six months have been up 3.6% on average, more than twice the average May-to-October period.