If the U.S. has a problem at present, it could be too much of a good thing. The economic rebound from last year’s seizure is proceeding with remarkable speed, and financial markets are cheerfully moving to price a continuing recovery as a reality.

As I wrote last week, the first quarter was the worst for bonds in four decades. Meanwhile, the S&P 500 ended April 1 above 4,000 for the first time in history, after a quarterly gain of just over 7%. And the dollar strengthened. So markets are plainly keeping up with this fast unfolding recovery.

Here are the highlights. Last week brought news that combined continuing and initial unemployment insurance claims were down again. They remain disconcertingly high, showing that economic pain persists; but the speed of the recovery is almost as exceptional as that of the crash that preceded it:

Friday’s unemployment data surprised to the upside. Looking back to the 1970s, the speed and severity of last year’s recession appear almost off the charts, but then the same is true of the recovery. At 6%, the unemployment rate as conventionally measured is still too high and policymakers doubtless want to reduce it further. But this has been an economic cycle like no other:

We can take consumer sentiment data as showing some degree of confirmation for the jobless numbers. Until now, consumer confidence had badly lagged behind other indicators, barely showing any recovery. The consumer remains much less confident than the average trader in financial markets; still, both the most closely watched surveys now show a clear improvement from the bottom. Whether driven by the vaccine rollout, or by tangible improvement in jobs, this must raise the chances that consumers will spend the large wads of cash they have in hand later this year:

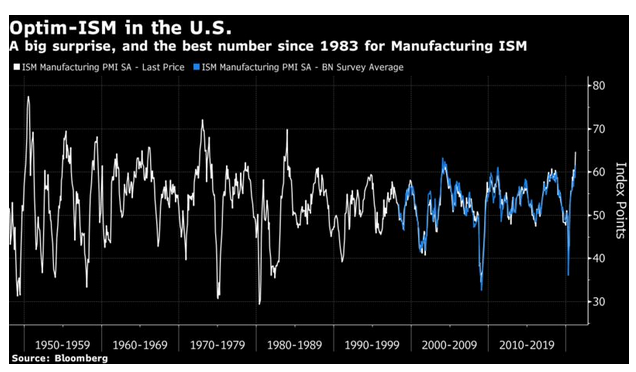

Manufacturing, meanwhile, hasn’t been as confident as this in almost four decades. The following chart shows ISM manufacturing data, where any measure above 50 indicates expansion while any number below suggests a recession, going back to 1950. Consensus forecasts compiled by Bloomberg are also included over the period for which we have them. This month’s survey was truly extraordinary; supply managers are very optimistic, and far more so than economists and analysts had expected. Looking back through history, numbers like this were common in the 1950s and 1960s, when economic cycles tended to be shorter and more pronounced. It is almost as though the pandemic suddenly returned us to the world that existed back then, when the dollar still had a tie to gold, and when steady demographic growth helped ensure economic expansion.

An environment like this is so different from anything that those active in markets today have personally experienced in their professional lives that there is a serious risk of errors. We’re just not used to sharp cycles like this anymore: