Family offices, a once shrouded and sleepy corner of the investment world, have emerged as formidable participants in global capital markets. The number of family offices globally grew by 38% from 2017 to 2019 and today they collectively control $6tn in assets. In 2021, family office backed deals accounted for 10% of the entire deals market—an unprecedented level.

That said, the term “family office” describes a very heterogeneous set of organizations—ranging from an overworked accountant and a harried assistant booking private jets, to an eponymous venture fund, to a fully operational asset manager. Some of this dispersion is by design, but mostly it’s because family offices tend to be “built” around what already exists (teams, assets) rather than ”designed” from best practices as a conventional business would be.

Given the immense focus on privacy, the teams running these entities are often in the dark about the best practices used by peers, leaving them to create what they hope will work in a vacuum. This lack of shared learnings can lead to vastly different outcomes: from the multi-generational impact of the Rockefellers to the financial market-roiling downfall of Archegos Capital Management.

Family offices have a unique potential to earn returns and to affect positive change in society. Multi-generational time horizons and a concentrated set of stakeholders, alongside a powerful combination of financial and social capital from the owners, should enable these organizations to fund projects untenable by other institutions. For example, three of the most notable companies in the race to privatize space travel—SpaceX, Blue Origin, Virgin Galactic—were initially funded by family offices and Bill Gates’ “Breakthough Energy,” which aims to fund innovations that will lead to net zero emissions by 2050 was started by a select group of private investors.

Reducing the chaos and improving the efficiency in this space can clearly yield positive outcomes beyond solely investment returns. But where does this transformation start?

The key is to start treating family offices as businesses rather than extensions of an individual or family. The same care is required in setting the strategy, designing the operations, and measuring success as in the business that originally created the wealth. It is important that founders, families, and their teams take time to think through these factors both at the outset and at critical inflection points if the true potential of each individual family office and the industry is to be realized.

Creating The Scaffolding Of The Family Office

Set the mission, vision, and purpose. Too many family offices jump straight to deploying capital without a North Star. It’s important to start with the key “existential” questions: why does this business need to exist? Is the goal to maximize returns? To invest in industries where the family has strong connections and heritage? To drive societal change? Having a crystal-clear view of the goals is the cornerstone of success.

Don’t neglect family governance…Every family should have a constitution, employment policies, in-law policies, spending policies. This allows for clarity of expectations and a framework for conflict resolution. Collectively, these policies promote a stable foundation for day-to-day operations.

Importantly, the family needs to determine which family members will play a role in leadership, investing, giving or governing. It’s important to set guidelines for what each of these roles mean, assess who is capable of filling them, and describe how the founder and/or family members should interact with the business. Without a clear definition and behavior to match, family office teams can become paralyzed by owner meddling and unclear lines of authority.

…Or corporate governance. As with any business, having formal governance and clear decision making processes is important. An investment policy statement should clearly specify the areas where the team can make decisions autonomously, and where decisions need to be elevated to a “higher power.”

For more formal periodic reviews, or to make decisions on investments and opportunities “outside the norm,” families should strongly consider structuring a board or investment committee with qualified independent directors who bring perspective on outside best practices, help the family office to see around corners, and fill gaps in expertise that the family and their team don’t possess.

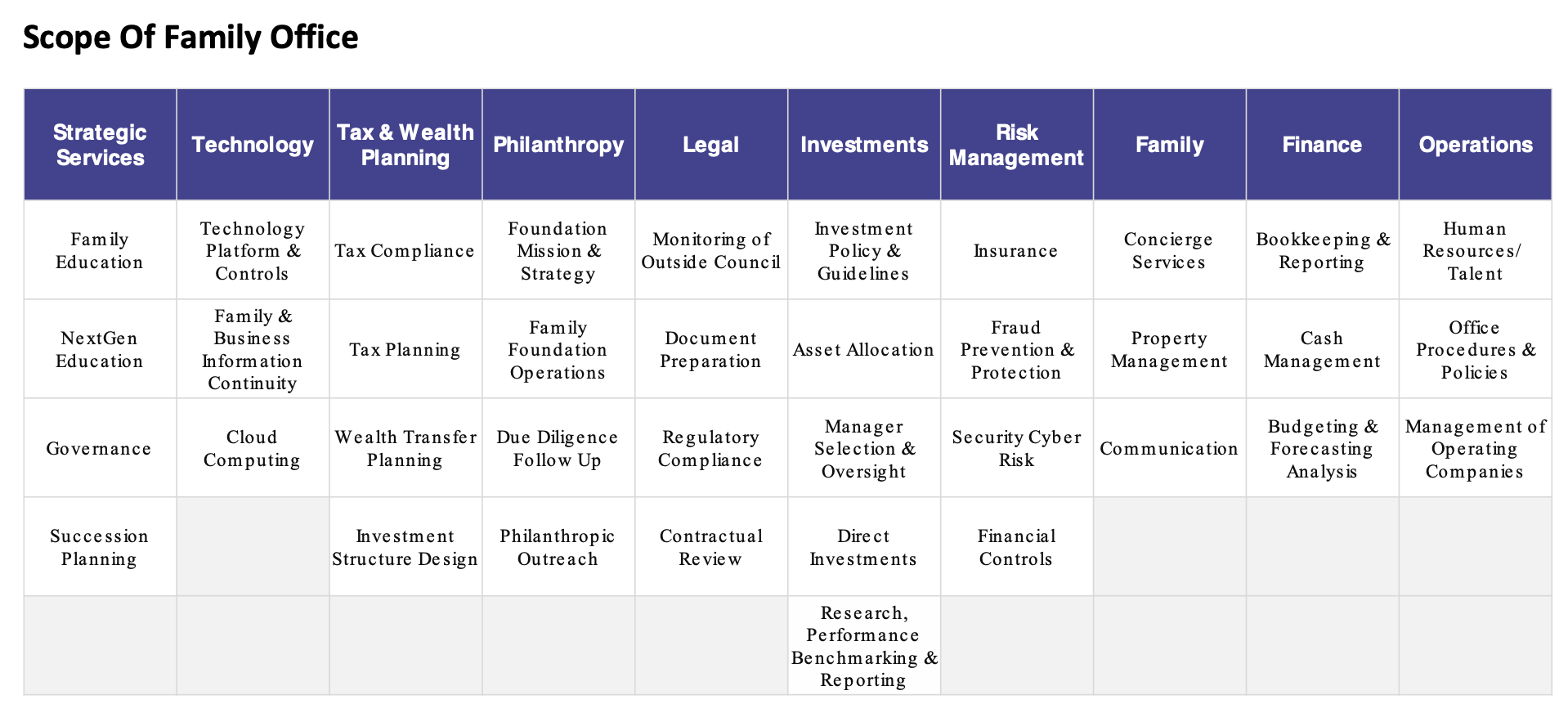

Be thoughtful about insourcing and outsourcing. Once there are clear goals and governance systems in place, the operating framework that dictates internal and external accountabilities can be determined. The remit of a family office is vast: no organization can have unique competitive advantages or cost efficiencies across all these capabilities, so the family and team must be deliberate about what should be insourced versus outsourced. There should be a focus on outsourcing commoditized functions and building unique capabilities to advance the mission in house.

Get the team and incentives right. Since trust and privacy are so critical and recruiting can be challenging, often families enlist “trusted stewards” (an accountant, friend, or long-time employee) to work in the family office. If these are not the right people to lead the team or pursue the mission, it only leads to issues down the road. It is important to have job titles with clear responsibilities and to hire people who are both trusted and qualified for those roles. Having a clear mission, defined decision-making parameters, and thoughtfully designed incentives will help families attract and retain talent that is extremely motivated, competent, and aligned to the family’s goals.

Measure what matters. Defining (and capturing) the metrics for success can be challenging. Frequently, incentives and governance are focused exclusively on investment returns. These are multifaceted organizations, and the metrics should reflect that. Risk, returns, liquidity, transparency, efficiency and progress against the mission should all be evaluated and measured. A balanced approach to business evaluation creates guardrails that enable the team to act more autonomously, while ensuring important facets don’t fall to the wayside.

While these steps simplify what is a uniquely complex industry, it’s shocking how many family offices don’t address these basic aspects of business management. The volume of family offices is poised to continue its dramatic expansion and regulatory scrutiny will only increase, so the industry must mature alongside its growth. Every family office should be thinking of themselves not only as an “office”, but as a “business”—and with that, there is a need for good business management. By leveraging best practices around strategy, governance and education, family offices will be poised to maximize their investment returns while affecting positive change in society.

Liza Truax is a partner at family business and family office advisory firm Wingspan Legacy Partners.