Michael Kors Holdings Ltd. agreed to buy Jimmy Choo Plc for about 896 million pounds ($1.2 billion), as the maker of handbags popular with the commuter set seeks to restore lost luster by adding “Sex and the City” stilettos.

The purchase of Jimmy Choo, Michael Kors’ first deal to expand beyond its own brand name since its initial public offering in 2011, gives the New York fashion and accessories company a presence in higher-end luxury, in a move similar to Coach Inc.’s 2015 acquisition of shoemaker Stuart Weitzman.

London-based Jimmy Choo rose to prominence in the late 1990s, boosted by high-profile devotees including the late Princess Diana and the fictional Carrie Bradshaw in television series “Sex and the City.” The deal comes amid consolidation in the U.S. luxury industry, with Coach also agreeing to buy Kate Spade & Co. this year.

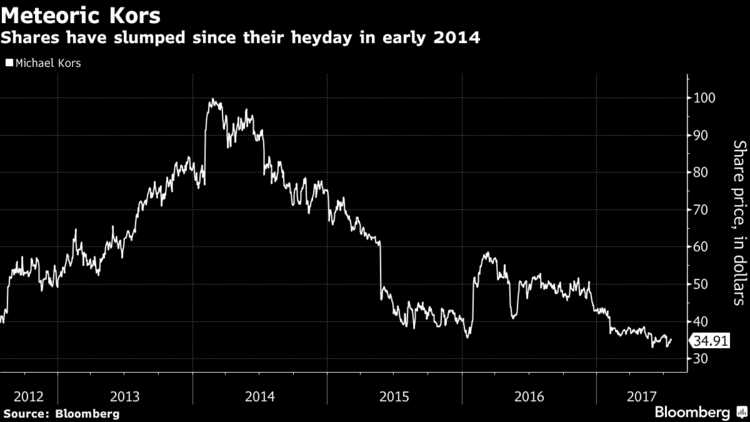

“Again, Michael Kors follows the path of Coach -- and again, on steroids,” wrote Luca Solca, an analyst at Exane BNP Paribas. “After a meteoric rise and spectacular crash, it is now the time to recycle cash into other brands.”

The company has been closing stores and reducing its exposure to department stores in an effort to boost its exclusivity. Alongside Ralph Lauren and Calvin Klein, Michael Kors has struggled to maintain its brand image after broadly distributing its products in discount stores and outlet malls. On the Macy’s website, for example, the brand’s signature $298 tote bags are currently sold for as low as $149.

Michael Kors shares dropped as much as 4.2 percent to $33.44 in New York trading Tuesday. The stock has fallen 19 percent in the year through Monday.

Chief Executive Officer John Idol said the company still plans to make more acquisitions of luxury brands and would consider M&As in the luxury footwear and accessories categories -- especially those like Jimmy Choo that are backed by a founder “who has a true vision for what their brand is.”

Idol said the goal is to create an “international luxury company” and added that Michael Kors would be less interested in brands that are “a little bit more broadly distributed” that rely on wholesale, he said on a conference call.

Jimmy Choo competes with the likes of Manolo Blahnik and Christian Louboutin for the attention of fans of high-heeled women’s shoes, selling models like the $800 Lance. The brand gets its name from its Malaysian-born co-founder, who created it in 1996 with British designer Tamara Mellon and opened its first store in London a year later.

JAB Holding Co., owned by the billionaire Reimann family, has committed to sell its 68 percent stake. The investment company bought Jimmy Choo for more than 500 million pounds in 2011 and later pared its holdings in a 2014 initial public offering. Before that, Jimmy Choo has been bought and sold by private-equity investors three times.