IRA Updates

SECURE Act (original SECURE)

We are still waiting for the IRS to issue long-awaited SECURE Act Final Regulations. The one area that is of most interest is if the IRS will change its position on the 10-year payment rule. In Proposed Regulations issued last year, the IRS stated that certain IRA beneficiaries who were subject to the 10-year rule would also have to take annual RMDs for years 1-9 of that 10-year term. This would apply to beneficiaries who inherited from someone who died after beginning RMDs.

Right now, it looks as if this position will not change. In putting together SECURE 2.0 Act, Congress had an opportunity to clarify this item and eliminate annual RMDs for these beneficiaries. However, Congress chose not to, providing the IRS with a green light to stick to its position on annual RMDs. Advisors should remind affected beneficiaries of these annual RMDs. They will begin in the year after the IRA is inherited.

Adding to the RMD confusion, some beneficiaries who were originally subject to annual RMDs under the 10-year payout rule were relieved of those by the IRS in Notice 2022-53 on October 7, 2022. The IRS waived the excise tax (the 50% RMD penalty) for missed 2021 and 2022 inherited retirement account RMDs for beneficiaries subject to the 10-year rule. But these RMDs will need to resume in 2023.

SECURE 2.0 Act

401(k) Catch-Up Contributions

The IRS still must issue clarifications on many open questions here, and Congress must fix certain obvious errors. Some of the problem areas involve mandatory Roth catch-up contributions for employer plans for those age 50 or over. Because of a drafting error, technically there are no catch-up contributions allowed beginning in 2024. That error likely will be corrected either by Congress or by the IRS.

SECURE 2.0 provides that company plan catch-up contributions must be made on a Roth basis if an employee’s wage income from the company exceeds a dollar amount in the prior year (e.g., for 2024, 2023 wages exceeded $145,000). But the law is unclear on what happens if a company does not already offer a Roth plan option. Would that mean that these employees, or possibly all employees, cannot make any catch-up contributions? Of course, the plan could choose to begin offering the Roth option, and that would resolve the issue.

529-To-Roth IRA Rollovers

Another area gaining attention is the provision allowing 529-to-Roth IRA rollovers. Among other conditions, the 529 plan must have been open for at least 15 years, but the law is unclear as to what happens if the 529 beneficiary is changed. Does this trigger a new 15-year term? Unknown. Also unclear is whether the $35,000 overall limit on this rollover is per each 529 owner or per each beneficiary. If it’s per beneficiary, that could make these rollovers very lucrative for a 529 owner with multiple beneficiaries.

These are just some samples of guidance we are waiting for on the SECURE 2.0 Act.

RMD Error Notices From Financial Institutions

On March 7, 2023, the IRS released IRS Notice 2023-23 providing relief to financial institutions who sent out RMD notices to IRA owners that turned out to be incorrect due to SECURE 2.0. Those notices informed certain IRA owners that their first RMD was due for 2023 when, in fact, SECURE 2.0 delayed that first RMD until 2024. But the IRS relief was only for financial institutions, not for your proactive clients who may have already taken an unwanted RMD. If they did, and it is still within the 60-day window, your clients can convert those funds to a Roth IRA. Or, they may want to roll it back to their IRA to eliminate the tax bill. However, they cannot do that if they have already done an IRA-to-IRA or Roth IRA-to-Roth IRA rollover in the past 365 days before receiving the unwanted RMD. If neither of these options will work for your clients, then they’ll have to just pay tax on the IRA distribution.

NFTs And IRAs

Notice 2023-27.pdf (March 21, 2023)

The IRS says that nonfungible tokens (NFTs) in an IRA may be classified as “collectible.” In that case, the NFT would be considered a prohibited IRA investment, resulting in a deemed distribution based on the cost of the NFT. The cost would be taxable and subject to a 10% early distribution penalty if under age 59½. (If the investment was done in a Roth IRA, there would be no tax or penalty if the distribution is “qualified.”)

Advisors should warn clients about this. Hopefully, not many clients are investing in NFTs in their IRAs, but apparently enough are that the IRS felt it necessary to issue a warning on this.

Not all IRA NFTs will be considered a collectible. The rule would apply only to NFTs that link (or look through) to ownership or rights to a collectible such as a work of art, antiques, gems, certain coins, or other common collectibles. Warn clients to avoid investing IRA funds in NFTs. If the NFT values declined while in the IRA (which many did), the

client will still be taxed on the original cost, even though substantial value may have been lost.

Post-Tax Season IRA PlanningTax season is over, but that’s where 2023 IRA planning begins. Financial advisors should begin connecting with clients, beneficiaries and their tax advisors on 2023 IRA and tax planning moves to make now.

Check The 2022 Tax Returns (If Already Filed)

This is the perfect time to review the 2022 tax returns if they have been filed. If the return is on extension, advisors can still get a good estimate of what the income and tax brackets were for the year.

Look For Problem Areas And Missed Opportunities

Contact clients to share some of these 2023 IRA planning ideas. You’ll find that clients will be more open, receptive, and interested right now after seeing their tax return, and likely anxious to have a better tax plan in place for next year.

Roth Conversions

See which clients did Roth conversions and if they maximized their tax brackets.

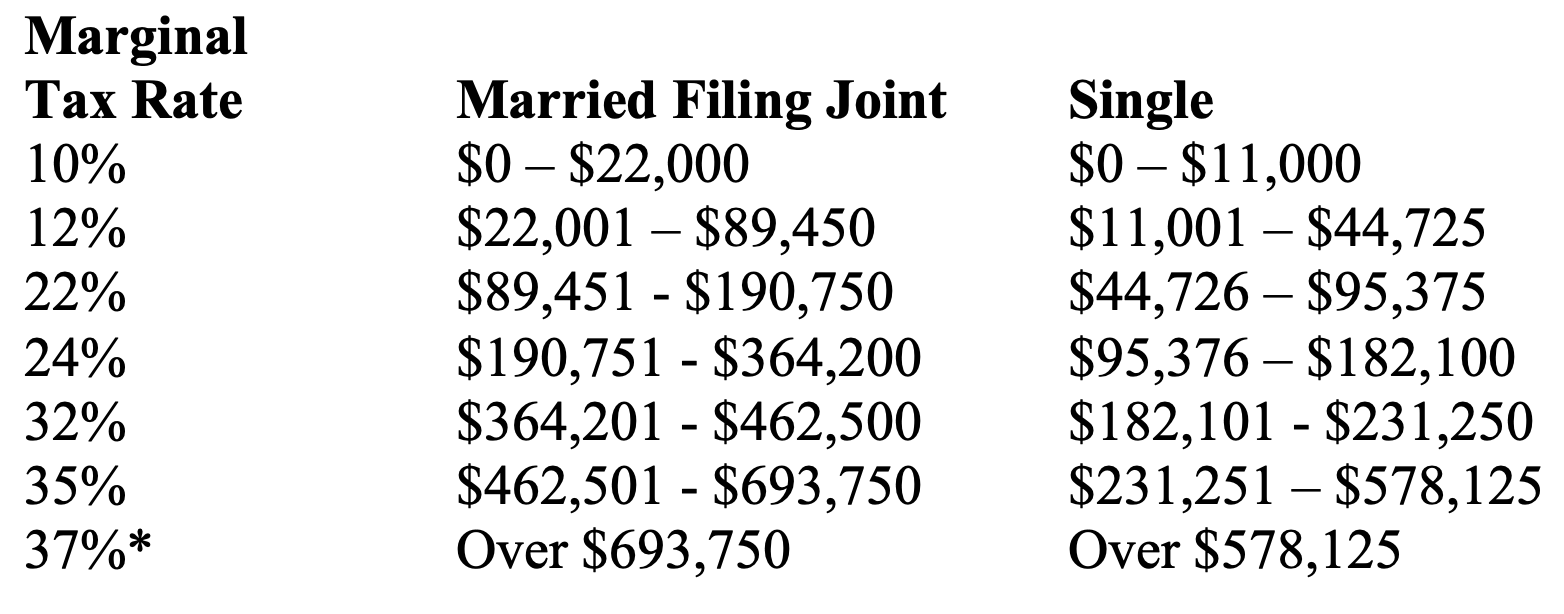

It may be that there was still room to use up more of the lower brackets and get more conversion income into these lower brackets. The 2023 tax brackets (see below) have been expanded greatly due to inflation increases, so check this now with clients in planning 2023 Roth conversions.

Taxable Income Brackets For 2023 Ordinary Income Tax Rates

* The top rate is effectively 40.8% for those subject to the 3.8% Medicare surtax on net investment income (those with MAGI over the thresholds of $250,000 joint filers/$200,000 single filers).

Back-Door Roth Conversions

Did clients who qualify do back-door Roth conversions? They should do that now for 2023, by making a nondeductible IRA contribution, and then converting those funds to a Roth IRA. Remember that under the SECURE Act, traditional IRA contributions can be made even beyond age 70½. This allows older clients to still benefit from a back-door Roth, assuming they have compensation (wages or self-employment income) to qualify for an IRA contribution. The back-door Roth process begins with a contribution to a traditional, nondeductible IRA, which can then be converted.

Tax will be owed on the back-door Roth conversion unless the client has any basis in the IRA balance. You’ll need to see if the client filed Form 8606 (nondeductible IRAs) to determine if there is any basis.

Roth IRA Contributions

Were Roth IRA contributions made for 2022? How would you know by looking at the tax return. Trick question. You won’t, because Roth IRA contributions are not reported on the tax return, but they should be entered in the tax data input to the 1040. The CPA or other tax preparer should know this. As an advisor, you would likely already know whether a client made a Roth contribution from the Roth IRA account statements or transactions.

Three Reasons To Report Roth IRA Contributions

1. To get the Retirement Savers Credit for lower income workers. If the Roth contribution is not inputted into the tax program, the tax credit will be lost because the program will not know that a Roth contribution was made.

2. To keep track of Roth IRA basis. Basis in a Roth is important to keep track of if Roth distributions are taken before the Roth becomes “qualified” by being held for five years and until age 59½. Roth IRA basis includes the original contributions and conversions, both of which can always be distributed tax free. Most tax programs will track and store Roth IRA basis, but only if Roth contributions are entered into the program.

3. To make sure you qualify for a Roth contribution. Roth conversions have no income limits, but Roth contributions do. By entering the Roth contribution into the tax program, most programs will automatically check to see if the taxpayer qualifies, and if not (because income was too high) the program will usually show a diagnostic warning or alert. If the Roth contribution is not entered, no alert will be triggered, resulting in a possible 6% excess IRA contribution penalty.

QCDs (Qualified Charitable Distributions)

Did clients who qualify do QCDs?

QCDs are only available to IRA owners and beneficiaries who are age 70½ older. (It doesn’t matter that the first RMD age is 72 or 73.) Identify clients who will turn age 70½ this year and let them know about the advantages of doing early QCDs.

One big advantage is that QCDs can offset RMDs. In the past, some taxpayers may not have received the RMD benefit because they took the RMD first before doing the QCD. This is a good time to start abiding by the timing rule.

In addition, some people did not receive a tax-free QCD because it was not reported correctly on the tax return as a QCD. Because of that, the distribution to the charity was shown as taxable when it should not have been. There is no code on the 1099-R to denote a QCD, so a tax preparer who did not know about the QCD may have entered it as a normal taxable IRA distribution, resulting in a taxable distribution.

RMDs (Required Minimum Distributions)

Were RMDs missed for 2022? The draconian 50% penalty for missing an RMD still applies for 2022. The SECURE 2.0 Act reduced this penalty to 25% and then down to 10% if the missed RMD is timely made up (within two years). But this penalty relief begins for 2023 missed RMDs, so the 50% penalty still applies for 2022.

Find out now if an RMD was missed so it can be timely made up. Once the missed RMD is made up, the client can request a penalty waiver from the IRS by filing

Form 5329. IRS confirmed (in an update to its RMD FAQs in March 2023) that the full RMD penalty (even the new 10% reduced penalty) can be waived by filing Form 5329 and providing an explanation of why the RMD was missed.

Check Beneficiary Forms

What is the client’s IRA estate plan? Do they know? The answer is in the beneficiary form which may not be up to date or cannot be found. This needs immediate attention. Even if there is a current beneficiary form, it still may need updating due to the major changes made by the SECURE Act, particularly, the elimination of the stretch IRA and the creation of the 10-year payout rule which applies to most non-spouse IRA beneficiaries, like children, grandchildren, and most IRA trusts.

Check to see who is named and when was the form last updated. Take special note if a trust is the beneficiary. The SECURE Act upended most IRA estate plans, and that was especially true for IRA trusts.

Even though tax season is over, there are plenty of tax saving opportunities still available!

Ed Slott, CPA, is a recognized retirement tax expert and author of many retirement-focused books. For more information on Ed Slott, Ed Slott’s 2-Day IRA Workshop and Ed Slott’s Elite IRA Advisor Group, please visit www.IRAhelp.com.