We think the U.S. midterm elections on November 6 will likely be a bigger media event than a market event. Current polls indicate the Democrats may take control of the House of Representatives, but the Republicans will hold control of the Senate. So a divided Congress will be in no better position to pass legislation than they are today — but the market hasn’t been expecting any major legislation to be forthcoming. Under a Republican Senate/Democratic House scenario, we envision a modestly positive impact on health-care stocks and a modestly negative outcome for the consumer sector.

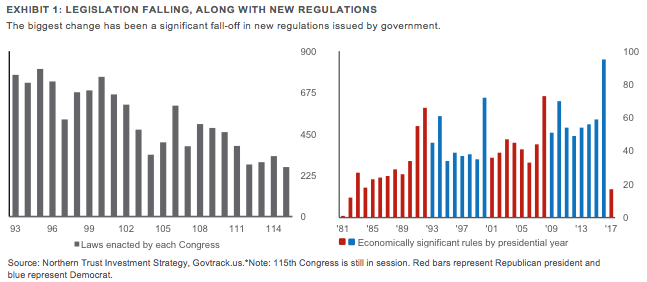

While polling data and history point to the likelihood of the Democrats taking control of the House, the recent poor predictive record of polls keeps us from being too confident in that outcome. The good news is that we don’t think the economic or investing outlook will be much different in that scenario. The markets aren’t counting on meaningful legislation being passed, and the tax cuts and deregulatory efforts of President Donald Trump’s administration will remain in place. Neither party is in a position to surpass the 60 votes required in the Senate to clear the filibuster, limiting the legislation that can be passed. In addition, neither party will be able to clear the higher hurdle of a two-thirds majority to override a presidential veto. As Exhibit 1 shows, there has been a slowdown in new legislation passed over the last year, but the real story is on the regulation front. The issuance of economically significant rules plummeted in the first year of the administration, which has boosted business confidence — and this won’t be upended by a change in Congress during the midterms.

Outlook For The House: Democrats Favored To Take Control

The House currently consists of 235 Republicans, 193 Democrats and seven vacancies. A party needs 218 for a majority and all 435 seats are up for election. Forecaster FiveThirtyEight estimates an 83 percent chance that the Democrats will take control of the House, up from a 71 percent chance in August. The Cook Political Report, based on race-by-race analysis, predicts the Democrats will pick up between 25 and 35 seats — with 25 seats just reaching the 218 majority figure. As shown in Exhibit 2, Republicans will need to win 76 seats that are currently considered competitive, while the Democrats will only need to win 36 of those seats. Looking at national polling data, Democrats currently hold a 7.7 percent advantage over Republicans in the generic ballot, a poll that has predicted the House popular vote correctly the past four midterm elections. We do note, however, that individual race polling appears closer than the national numbers, so the election could be closer than the national polls indicate. Historically, when the president’s approval rating has been under 50 percent, his party has lost an average of 40 seats in the House. The current Real Clear Politics average approval rating sits at 44 percent.

Outlook For The Senate: Republicans Favored To Retain Control

The Senate currently consists of 51 Republicans and 49 Democrats. A majority requires 51 seats; however Republicans more or less only need 50 seats as the vice president has the tie-breaking vote in the case of a 50-50 split. There are 35 seats up for election, 26 and nine of which are currently held by Democrats and Republicans, respectively. The Democrats will need to win 28 of the 35 seats in order to gain control, reflecting a gain of two seats. FiveThirtyEight’s model forecasts a 21 percent chance that this occurs, down from a 28 percent chance in August. Of the 35 seats up for election, 26 are considered likely Democrats (“likely Dem” or “leaning Dem”), eight are considered Republican (“likely GOP” or “leaning GOP”) and one is a toss-up. Over the past 21 midterm elections, the president’s party has lost an average of four seats in the Senate. This year’s election is not expected to follow that trend as Republicans are expected to hold their current number of seats.

The degree of ease in which Congress can pass legislation is, of course, of interest to the financial markets. In order for a bill to be enacted into law it needs both majority approval from the House and effective 60 percent approval from the Senate in cases where filibuster rules still apply. In every instance since 1946, the S&P 500 Index has been higher one year after midterm elections than it was the day of the elections. However, the past is not always an indicator of the future and the implications of the midterm elections extend beyond a one-year horizon. Possible election outcomes and their far-reaching likely impacts are outlined below:

Scenario 1: Democrats Take Control of the House and Republicans hold the Senate. This is the consensus expectation, and FiveThirtyEight pegs this as a 66 percent probability. Historically, the average U.S. equity return under a Republican president and split Congress is 7.7 percent, the lowest out of possible administration compositions (based on market returns from 1953-2017). While a split Congress makes it very difficult to pass major legislation, this does not mean there won’t be any fireworks. With control of the House, the Democrats will have subpoena power, leading to more investigations. Furthermore, it is likely that trade war activity with China will pick up after the elections. Trump has been careful to not raise tariffs too much ahead of the elections amid concerns from voters. However, it is important to note that many policy changes made during Trump’s tenure, including those related to trade, have been made through executive order.