It is hard to believe we have passed the halfway point of 2021. After a 2020 that would never end, the first six months of 2021 flew by. With the second half underway, we have updated our views of the markets and economy in LPL Research’s "Midyear Outlook 2021: Picking up Speed." Below we provide a summary of those expectations covering the economy, policy, stocks and bonds.

Economy: Speeding Ahead

The U.S. economy has surprised nearly everyone to the upside as it speeds along thanks to vaccinations, reopening, and record stimulus. The growth rate of the U.S. economy may have peaked in the second quarter of 2021, but there is still plenty of momentum left to extend above-average growth into 2022. Despite the natural challenges of ramping back up, the recovery still seems capable of providing upside surprises.

We forecast 6.25–6.75% U.S. GDP growth in 2021, which would be the best year in decades. Last year’s 3.5% drop in GDP, the worst year since the Great Depression, may not be forgotten—but it has been left in the dust of 2020.

We continue to watch inflation closely but believe recent price pressures are transitory and will begin to work their way off gradually later in the year. As shown in Figure 1, the average U.S. expansion since World War II has lasted five years and much longer over the last few decades. There’s nothing on the horizon to indicate the current expansion can’t reach that mark.

Policy: Taking A Back Seat

The economy was supported through the pandemic by more than $5 trillion in fiscal stimulus measures and extraordinary support by the Federal Reserve. Policy was also in the foreground as safety restrictions created a heavy economic burden for many businesses and families. But policy will take a back seat in 2021 as reopening and private sector growth replaces stimulus checks.

The biggest policy risk may be around taxes, with businesses and wealthy households both facing the prospect of a higher tax burden to pay for proposed new spending and help manage the deficit. Historically higher personal tax rates have had only a modest impact on markets, but higher corporate taxes would have a direct impact on earnings growth, potentially limiting stock gains.

Stocks: Gaining Ground

The second year of a bull market is often more challenging than the first, but historically still usually sees stocks climb higher. We expect the strong economic recovery to continue to drive strong earnings growth and support further gains for stocks. However, after one of the strongest starts to a bull market in history—including a more than 90% gain off the March 23, 2020 lows through the first half of 2021—stock prices reflect a lot of good news. As inflationary pressures build and interest rates potentially rise further, the pace of stock market gains may slow.

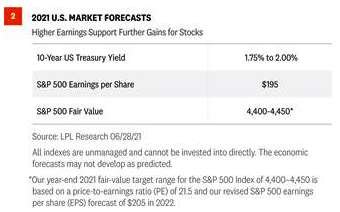

Economic improvement should continue to support S&P 500 Index earnings, which had a stunning first quarter. Reflecting the tremendous strength in corporate profits, our forecast for S&P 500 earnings per share (EPS) in 2021 is $195, a 36% increase from 2020 [Figure 2]. We believe our forecast is reasonable given the strong economic growth outlook and massive amount of fiscal stimulus. We expect corporate America to build on its strong earnings performance in 2022. Our 2021 year-end S&P 500 fair-value target range of 4,400–4,450 is based on a price-to-earnings ratio (PE) of 21.5 and our 2022 S&P 500 EPS forecast of $205.