They will do so by either 1) using a rationalized form of tactical asset allocation to restructure from stocks to bonds; also note that tactical asset allocation is meaningful when it is tied more to business up and down cycles. Important also is to remember that in contractionary cycles, portfolios would then be automatically bond heavy and safer; or, 2) using derivative strategies such as collars and spreads. These excess returns now can be realized once the economy starts contracting. In money management parlance, such tactics are known as income smoothing strategies.

Continuing on this exemplary path, if five such good and well-managed years are followed by five more such years, then at the end of ten years, the whole retirement income plan can be locked up and planners can move over into beneficiary estate planning. Now consider the other extreme at the bottom of the tree of five bad years. After about three such bad years, the natural instinct of the client will be to suggest (often so forcefully that the planner will succumb rather than stick to her/his guns) to sell off the equity holdings (sell low) and place the money in some low-yielding, CD-like securities. Of course, those who do so set themselves back about five to ten years since they lose the advantage of the benefits of a buy-and-hold strategy.

Astute advisors should necessarily point such possibilities out way before such events (documenting the counsel if needed) happen and thoroughly educate their clients both about the long-term nature of the retirement plan and that business cycles imply turnarounds. Any other counsel or action would neither be client friendly nor fiduciary-like. However, if five bad years are followed by five more, then it is a moot issue. Pretty much all people would sink together and nothing much can be done about such situations.

Fortunately, the two extreme paths are also the least likely paths while the paths in between are much more likely. Fortunately too, the strategies outlined earlier, income smoothing (upside) or buy and hold (downside), will work for all the interim paths. Finally, note that the management of retirement funds becomes much easier if clients have saved enough such that a fairly large portion of the portfolio is invested in bonds. The impact of bonds in portfolios is such that the greater the proportion of bonds to stocks, the greater the likelihood of expected outcomes converging toward actual outcomes.

Needs And Age-Based Bucket Plans

Consistent with a mental accounting format, rather than approaching the retirement income distribution issue from the portfolio-income generation side, it is worthwhile to examine the actual expense outlays also in more detail and in this case, three separate buckets of needs and wants. The most basic questions in terms of saving for retirement are: 1) How much income must you help generate to cover the basic necessities of life and allow your clients to live in good health and with dignity, knowing that they took good financial care of themselves and their spouse until the last days of their lives, and, 2) How many conveniences do they want to add on to that foundation?

If they're living beyond their means and need to cut off some of the fat, what fat do they need to get rid of first, and so on? These are really behavioral issues, a trade-off between current consumption and postponing consumption, keeping in mind that the rewards of postponing current consumption are extremely difficult for most midcareer and younger people to conceptualize. The last layer on top of that is how many luxuries they would like to enjoy in retirement.

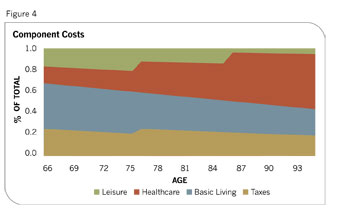

On the age bucket side, the first step for pre-retirees and their advisors should be to calculate the amount that should be set aside for future necessities for the decades in retirement. This entails estimating the level of income needed to meet three of the four general categories of expenses-basic living costs, taxes and health care-which will all vary during the various decades of retirement. The fourth category is of leisure spending that would include expenses for conveniences as well.

For example, most retirees tend to be very active in the first ten years of retirement, so their leisure costs are highest then. As we know, many people delay leisure until this stage of life. Then in the next ten years they start slowing down, spending more time with family.

As leisure expenses slow down, health-care expenses start picking up. In the final ten years, health-care expenses are likely to be at their highest. Figure 3 shows a sample breakdown of expenses for our hypothetical client. For the last two age buckets, final years, it's important to consider other impacts on cost, such as long-term care insurance plans, home ownership and longevity of life issues. When the advisors and their clients model what the clients want to do in retirement, they will have a more holistic picture of their income-distribution needs. (See Figure 4.)