In our recent media engagements, we have been asked if the Russian invasion of Ukraine is the cause of the carnage in the stock market this year. Many of the investors suffering stock market failure and financial media participants are looking for some comfort from the declines. They’d like to think that their portfolios have been hit by a Molotov cocktail and that the stock market will repair itself like it did when the pandemic crushed stocks two years ago. The facts appear to say the invasion is only a catalyst for what was already going on.

Fact No. 1

This stock market decline is the unwinding of what Charlie Munger says is the wildest euphoria episode he has seen in his career (75 years), because of what he calls “the totality of it all.” This euphoria episode wasn’t just high price-to-sales tech stocks (it was). It wasn’t just cryptocurrencies (it was). It wasn’t just SPACs and IPOs (it was). It wasn’t just FAANG devotion (it was). It isn’t just the most expensive S&P 500 Index in history (it was). It wasn’t just growth stock mania (it was).

Fact No. 2

As market participants for nearly 42 years, we’ve never seen more groupthink and widespread devotion to common stocks (think Reddit and Robinhood). Peter Lynch said he knew the end of a bull market was near when people he met were telling him what stocks they like. We wish we could show you a video of how many times that has happened to us in the last two years.

Fact No. 3

The bull market that ended last year, which started at the pandemic lows, was a function of two things. First, massive liquidity provided by the U.S. Federal government and an enormous accommodation by the Federal Reserve Board. This combined to create a surge in stocks that benefitted from being stuck at home (FAANGs, tech of all kinds, vaccine makers, DocuSign/Peloton/Shopify, etc.). Then when everyone had fled the companies hit the hardest by the quarantines, they rebounded as the evidence showed that people will always want to be around people. If you go back and look, you’ll see that the stuck-at-home stocks have been crushed in the last year. Even Amazon shares have gone sideways in the last year.

Fact No. 4

Commodities are booming and what we call “wolverine inflation” is now being spotted by others (like Jeff Gundlach). Our chart from April of 2020 showed that commodities were the cheapest versus common stocks as they have been for 250 years. We believe all investments will get repriced to represent the new reality over the next couple of years. It is very unusual to spot the “wolverine,” but it was spotted in Yellowstone Park and in oil prices recently.

Fact No. 5

The “carry trade” regime died (which Cole recently wrote about). The Fed will likely unwind their ownership of the long-term bonds they own, while also ratcheting up short-term interest rates to make a late attempt to stop the “wolverine inflation.” Like when all carry regimes end, the liquidity disappearing causes asset prices to decline and volatility to rise. Warren Buffett says, “Only when the tide goes out do you discover who was swimming naked!” It won’t just be “innovation investors,” it will also be S&P 500 Index investors, growth stock aficionados and everyone who placed their faith in assets tied to that confidence.

Fact No. 6

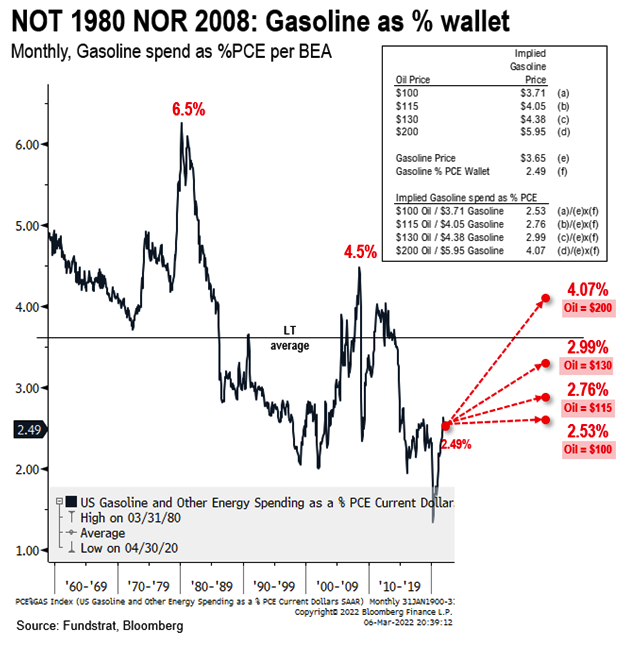

Anyone who thinks that the oil price increase would be the cause of a recession doesn’t realize how much gasoline has been deemphasized over the last twenty years.

To defend your assets and avoid stock market failure, you must take out the 1970s playbook. Oil stocks and their industry have suffered under-investment. This is due to a mistaken belief that we are close to getting away from using carbon energy. In our eyes, there is a mistaken devotion to green investments, which have some validity but are a “needle in a haystack” from a common stock probability standpoint.