Markets continued to rise in June, as efforts to reopen state economies across the country continued throughout the month. Investors reacted to the continued reopening with optimism, driving the S&P 500 up 1.99% in June following a 4.76% increase in May. These positive results came despite some midmonth volatility created by concerns of rising national coronavirus case numbers. While the continued market rebound during the month was certainly welcome for investors, very real risks to markets still remain—and there are several key factors that matter when determining the overall risk level.

Recession Risk

Recessions are strongly associated with market drawdowns. Indeed, eight of 10 bear markets have occurred during recessions. As we discussed in this month’s Economic Risk Factor Update, the National Bureau of Economic Research (NBER) declared that a recession started in February. On top of that, most of the major economic indicators that we cover monthly remain at a red light, despite some better-than-expected results during the month. As such, we have kept the economic factors at a red light for July.

Economic Shock Risk

There are two major systemic factors—the price of oil and the price of money (better known as interest rates)—that drive the economy and the financial markets, and they have a proven ability to derail them. Both have been causal factors in previous bear markets and warrant close attention.

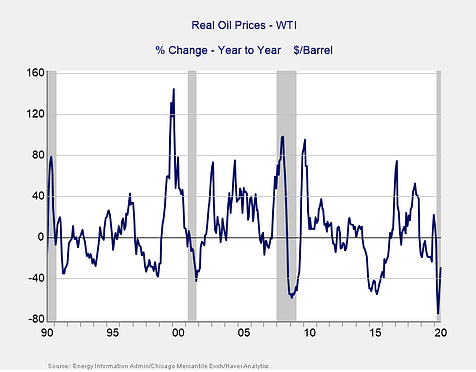

The price of oil. Typically, oil prices cause disruption when they spike. This is a warning sign of both a recession and a bear market. In this case, however, the sudden drop is also a warning of significant disruption.

The price of oil continued to decline notably on a year-over-year basis in June, falling by 29.9% compared with last June. On a month-to-month basis, however, prices increased from an average of $28.55 per barrel in May to $38.32 per barrel in June. This increase brought the average price of oil to its highest monthly level since February, indicating that the sharp drop in prices in April was likely the low-water mark for oil prices in the short term.

Going forward, sustained oil prices at these levels continue to signal a risk, with the energy industry being massively disrupted, as we saw back in 2015. With that being said, the continued recovery in prices in June is a positive development for energy companies, and prices still remain low enough to be a boon for consumers. With reopening efforts taking hold in June, gasoline demand rose notably during the month; however, demand still sits below historically normal levels.

Despite the positive tailwind that low prices create for consumers, we’ve left this indicator at a red light for now given the disruption to the energy sector caused by the large year-over-year decline in prices. A potential upgrade to yellow is possible if we continue to see modest price recovery in July.

Signal: Red light

The price of money. We cover interest rates in the economic update, but they warrant a look here as well.