U.S. equity markets continued to rally in August, with all three major indices setting new record highs during the month. We did see some midmonth volatility, but the Dow Jones Industrial Average gained 1.50%, while the S&P 500 experienced a 3.04% gain. The Nasdaq Composite led the way with a 4.08% return during the month. Despite the continued rally for equity markets in August, there are real risks to the markets that should be monitored going forward.

Recession Risk

Recessions are strongly associated with market drawdowns. In fact, eight of 10 bear markets have occurred during recessions. The National Bureau of Economic Research declared that a recession started last February, as markets plunged, but it also recently announced that the recession ended shortly thereafter. Despite that and the ongoing expansion, economic risks remain. The primary ones are the economic damage from the growth in Covid cases last month, as highlighted by declining business and consumer confidence, and the slowdown in hiring in August.

On the whole, the economic recovery continues, But given these risks, we have kept the economic risk level at a yellow light for now. While the most likely path forward is continued recovery, the slowdown in economic activity in August signals that risks are rising on the economic front.

Economic Shock Risk

One major systemic factor is the price of money, otherwise known as interest rates. This drives the economy and financial markets and has historically had the ability to derail them. Rates have been causal factors in previous bear markets and deserve close attention.

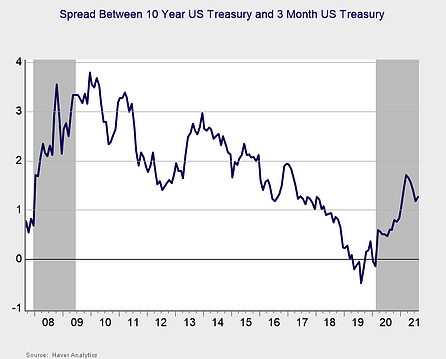

Risk factor #1: The yield curve (10-year minus 3-month Treasury rates). We cover interest rates in the economic update, but they warrant a look here as well.

The yield curve steepened slightly during the month, breaking a four-month streak of flattening. This result was primarily due to rising long-term interest rates, as the 10-year Treasury yield increased from 1.24% at the end of July to 1.30% at the end of August. The three-month Treasury yield declined modestly from 0.06% at the end of July to 0.04% at the end of June. While short-term rates are expected to remain low until at least 2023, longer-term rates had previously recovered back to pre-pandemic levels before declining from April through July.

Given the fact that long-term yields remain above the 2020 lows and we saw a modest increase in long-term yields during the month, we have kept this signal at a green light for now.

Signal: Green light

Market Risk

Beyond the economy, we can also learn quite a bit by examining the market itself. For our purposes, two things are important:

1. To recognize what factors signal high risk

2. To try to determine when those factors signal that risk has become an immediate, rather than theoretical, concern

Risk factor #1: Valuation levels. When it comes to assessing valuations, we find longer-term metrics—particularly the cyclically adjusted Shiller P/E or price-to-earnings ratio, which looks at average earnings over the past 10 years—to be the most useful in determining overall risk.