Investing is about opportunism, as much as it is about hard work, discipline and patience. That is the founding creed of value investing. As laid out by Benjamin Graham almost 90 years ago, Mr. Market is a manic-depressive who will occasionally give you the opportunity to buy stocks for less than they are worth. Doing so is more easily said than done. But is it just about possible that Mr. Market is giving us a second chance to buy into value stocks at ridiculously cheap valuations?

That is the argument made by Rob Arnott, the quantitative guru who founded Research Affiliates LLC, in a new research paper called “Did I Miss The Value Turn?” It’s worth 20 minutes of your time, if you’re an opportunistic investor. And it’s just possible that Arnott is right.

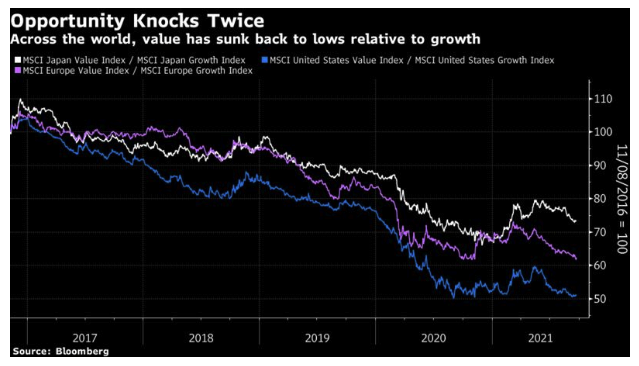

Let’s take the argument in steps. In recent years value, using the classic simplified definition of just taking the stocks with the lowest price-to-book multiples, has badly underperformed growth, where companies are chosen based on how fast their earnings are increasing. After a rally at the end of last year, which was sparked by the successful results of initial Covid-19 vaccine tests, value has sagged once more. This is true in the U.S., and also in Europe and Japan:

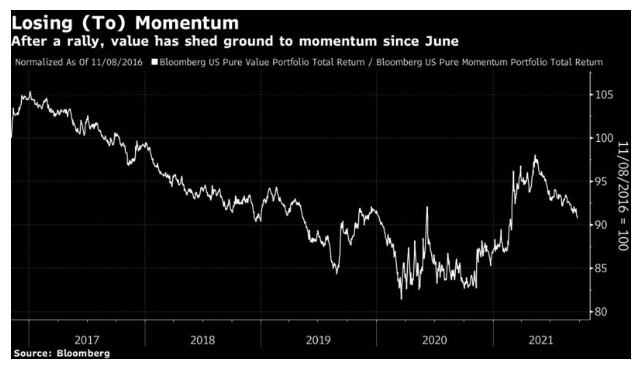

We get a similar result if we look at the performance of value compared to momentum (a factor beloved of professional investors, which involves piling into winners while selling or shorting losers). Momentum suffered a particularly savage reversal with the vaccine tests, and a further reversal as the incoming Biden administration started by splashing around a lot of money. The following chart uses the pure factor returns for value and momentum as calculated for U.S. stocks by the Bloomberg FTW, or Factors To Watch, function:

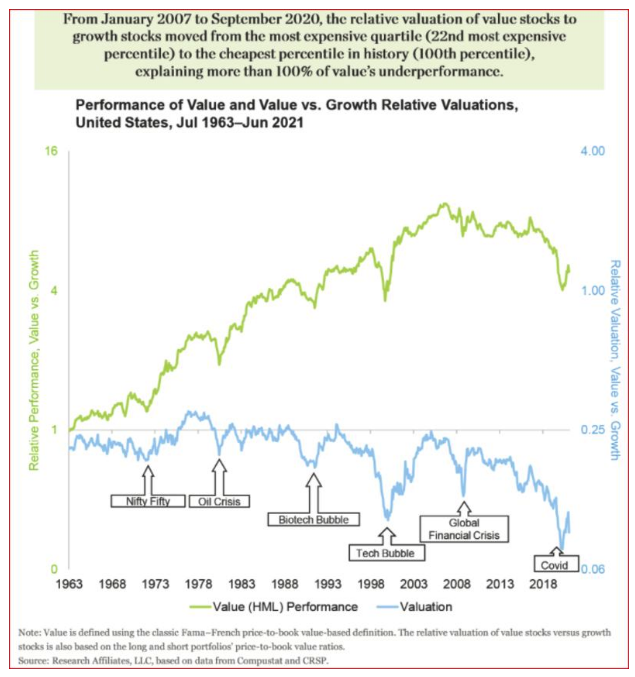

Value had a terrible run, then, rallied for a while, and then relapsed. Why should we believe that this is a good time to buy? Arnott’s theory is that we should look at valuation. By definition, value will always look cheap relative to growth. The point is to look at how much cheaper value is, and how this compares with history. That calculation is shown in the blue line, going back almost six decades. Over that time, value has typically outperformed growth (the green line), with occasional sharp drawdowns driven by major crises, after which it tends to bounce back quickly. But since the global financial crisis, value hasn’t enjoyed a big rebound, and its relative valuation has become extraordinarily cheap:

The deeper the discount at which you can buy value stocks, the greater the opportunity to profit as they return to normal. And Arnott shows that the excess return (compared to the market) over the two years of a recovery from a major shock sees great performance for value. This is particularly true when the crisis has itself been driven by a bubble, or misvaluation (as was true of the bursting of the dot-com bubble in 2000 or the fall of the Nifty Fifty stocks three decades):