Governor Phil Murphy’s progressive agenda, outlined in his first New Jersey budget, depends on approval of $1.5 billion in new riches from Democratic lawmakers reluctant to increase residents’ financial burden in one of the highest-taxed U.S. states.

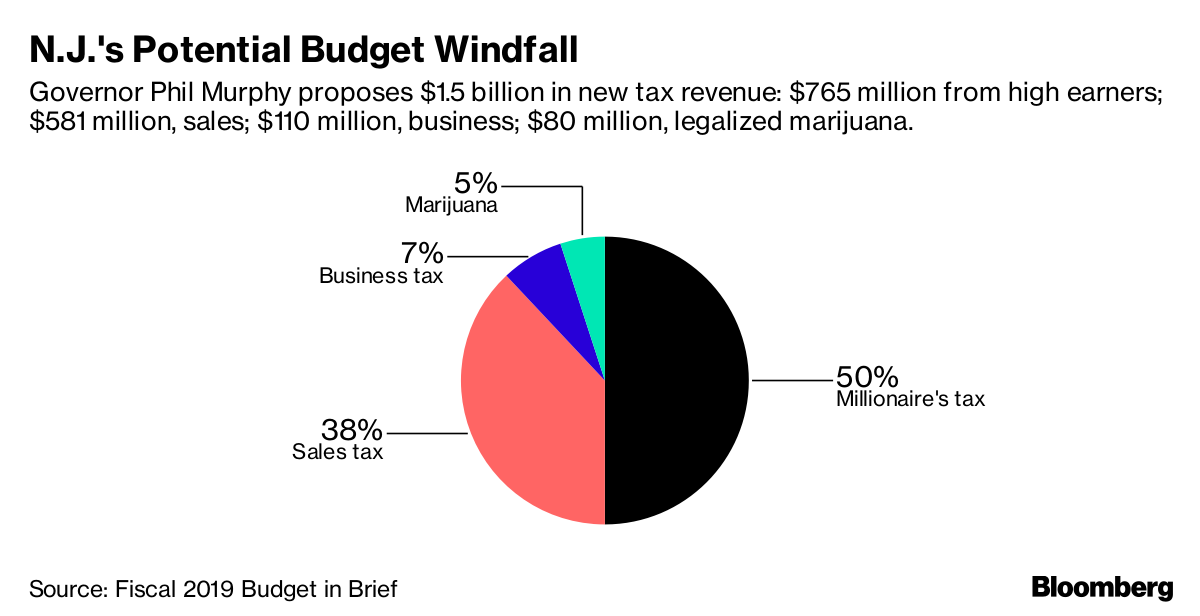

A newcomer to elective office, Murphy has proposed a record $37.4 billion spending plan that presumes lawmakers will approve new taxes on millionaires, retail sales, legalized marijuana, electronic cigarettes, corporations and such services as Uber and Airbnb. That’s the greatest revenue risk for a budget since 2009, the last time a governor tried to tap New Jerseyans for more than $1 billion in general-fund tax increases.

If Murphy’s fellow Democrats who control the legislature don’t cooperate, they’ll potentially derail a record $3.2 billion pension payment and more school funding. Should they sign on, they may antagonize voters and drive wealth from a state more burdened than most by President Donald Trump’s new $10,000 limit on state and local tax deductions.

“New Jersey was very hard hit by the cap on the SALT deduction and as a result there’s a sentiment that there’s less disposable income, less wealth available to New Jersey taxpayers,” Baye Larsen, a Moody’s Investors Service senior analyst, said in an interview. “Therefore, this is a particularly difficult time to raise taxes."

Tapped Out

Cash-poor New Jersey cultivates annual budget drama, and the last episode played out nationally, with Republican Governor Chris Christie scorned for relaxing with his family on a beach that was closed to the public amid a budget impasse and government shutdown. This year, Democratic lawmakers were lukewarm after Murphy’s budget address on March 13.

After eight years of Christie, Democratic lawmakers should be natural allies with Murphy, a retired Goldman Sachs Group Inc. senior director and U.S. ambassador to Germany. With his victory in November over Christie’s lieutenant governor, Kim Guadagno, his party controls the legislative and executive branches. The path was smooth, it seemed, to Democratic goals that Christie had blocked: legalized recreational marijuana, a $15 minimum wage and turnaround for neglected mass transit.

Instead, the relationship appears to be chilly as the budget heads to its first legislative committee hearing on March 28.

Though New Jersey’s governor is the nation’s most powerful -- with authority to appoint the attorney general, hand-pick appointees for heavy-spending commissions and veto budget line items -- Murphy needs legislative approval for the new revenue he’s seeking.

“The budget shortfall, school funding, higher education, New Jersey Transit falling apart -- we have all these problems and there’s only one way to deal with them,” former Governor Jim Florio, a Democrat ousted after one term on a tax-increase backlash, said in an interview. “It’s not a spending problem so much as a revenue problem.”

Murphy’s drive for a cannabis law within his first 100 days has been slowed by public hearings and concerns about its effect on cities from Senator Ronald Rice of Newark, chairman of the Legislative Black Caucus. On a millionaire’s tax, Murphy lost a champion in Senate President Steve Sweeney from West Deptford, sponsor of a tax on the rich that Christie vetoed five times. Sweeney last month told reporters that the measure “should be the absolute last resort” in light of the federal tax changes signed by Trump in December.