Hortz: Why do you feel this Journal and its editorial goals are important at this juncture of the evolution of this investment arena?

Bruce: I have seen the field change from SRI to ESG and recently expand to include the concepts behind sustainable and impact investing. A recent paper from Boston Consulting Group claims that investing has moved from stocks and bonds to private equity, passive investing and ESG. I have not been able to find any of the 30 largest institutional money managers in the US who do not have ESG capabilities. With this growth in the field, it is clearly time for a journal dedicated to it. Misconceptions and confusion about the field still exist and we need a journal to thoroughly examine all the issues.

Hortz: Do you see a discrepancy between what social investment topics are trending in general versus topics and discussions most needed at this time?

Bruce: The topics that are currently trending are the topics we will be covering. We have a diverse advisory board that will continue to seek out important topics. One of the current hot topics is the DOL efforts in curbing ESG in retirement plans. We are organizing a round table to discuss this topic for the Journal.

Hortz: Any last points or recommendations you would like to share with advisors and industry leaders about social investing and its place in client portfolios?

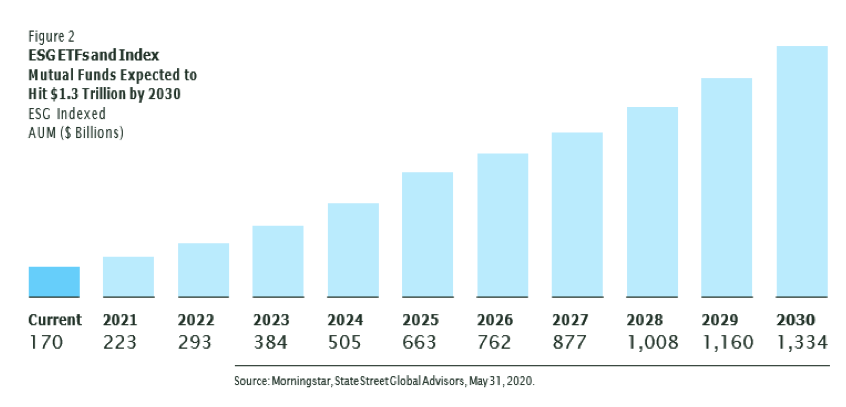

Bruce: The concept of “responsible” investing is becoming more important to many investors. The growth in the field will be tremendous over the rest of the decade as a July 2020 SSgA ESG White Paper expects assets under management to grow from $170 billion to over $1.3 trillion. If clients are not asking for responsible products now, they will be. The Journal will be here to support efforts to enhance investment and risk management strategies, as well as help substantially address client’s questions on key social investment issues.

The Institute for Innovation Development is an educational and business development catalyst for growth-oriented financial advisors and financial services firms determined to lead their businesses in an operating environment of accelerating business and cultural change. We position our members with the necessary ongoing innovation resources and best practices to drive and facilitate their next-generation growth, differentiation, and unique community engagement strategies. The institute was launched with the support and foresight of our founding sponsors—Pershing, Voya Financial, Ultimus Fund Solutions, Fidelity and Charter Financial Publishing (publisher of Financial Advisor magazine).