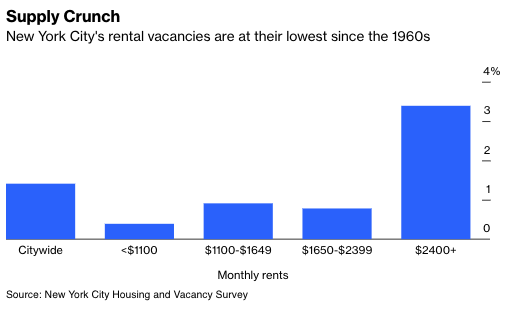

Something in New York’s rental market is fundamentally broken. This isn’t news to anyone struggling to find affordable shelter in a city where the vacancy rate has fallen to the lowest in more than five decades. It didn’t have to be like this.

The state of the rental market today is a report card on how responsive local economies were to changes during the pandemic. Surging rents and historically low borrowing costs in the first half of 2021 spurred apartment construction in much of the country, particularly rapidly growing metros including Austin, Phoenix and Nashville. Not so in New York.

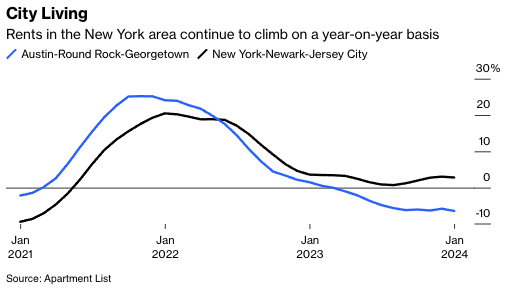

Fast forward to today and there’s a short-term glut of apartments putting downward pressure on rents in states such as Texas while costs continue to rise in New York. The divergence speaks to how market forces for residential construction don’t always work, and how fixing New York’s housing mess will need zoning reform, plus an assist from lower interest rates.

The worry is that the window of opportunity has closed—at least for the foreseeable future.

The conditions that led to an apartment boom in a place like Austin will probably never be repeated. A surge of migration from high-cost coastal markets (think New York and San Francisco) drove up demand and pushed rents higher during the pandemic. Financing costs were at rock bottom due to the Federal Reserve cutting interest rates to near zero to offset the economic damage of Covid-19. Valuations for apartments were soaring, with the stock prices of apartment REITs increasing by 50% or more in 2021, giving developers confidence to build. Of course, that’s going to lead to a ton of construction—assuming developers can get their hands on lots to build on.

New York didn’t experience the same boom. Part of it is the reality of renters leaving the city in the early days of the pandemic, which not only led to slumping rental demand for a while but also articles such as the infamous “New York is dead forever” one from August 2020. Even though rents were increasing again in 2021, the “vibes” might not have recovered as quickly, and developers and lenders need good vibes to embark on projects that won’t get done for two or more years.

So there was a lack of construction when rents were surging and interest rates were still low in late 2021 and into 2022, and there’s a lack of construction today when rents are high and vacancy rates are at multi-generational lows.

Relaxing zoning standards and streamlining permitting to make it easier and faster to build must be part of any solution. But it would likely not be enough to lead to an immediate surge in construction. Some of the same dynamics holding back building activity in Austin would hamper construction in New York, too. Financing and other costs have surged due to rising rates and more expensive labor and materials.

Apartment REITs have been some of the worst-performing financial assets over the past few years as higher rates have made them less attractive, and even in markets where rents aren’t falling, rising costs for things like insurance have squeezed profits. Liberalized zoning—an uphill battle—would make New York one of the more attractive markets to build in, but it will remain difficult for developers to overcome the pall that hangs over the whole asset class.

A necessary companion is lower borrowing costs. Not only would that help developers finance projects, it would also ease the pressure of high mortgage rates for renters who would like to buy homes. The rental market in a city such as New York works by taking in young people looking to start their careers and spitting out older people, who end up buying homes, whether in New York City or elsewhere. When the buying-homes part of the equation is difficult it jams up the rental market and prevents young people from moving in or forces out those who can’t afford to stay.

Without a decline in interest rates, one trend to watch this year is the opposite of a scenario I laid out in a column three years ago, when I argued young people should take advantage of the decline in rents during the early part of the pandemic to move to New York rather than Austin.

Today, given the relative state of the New York and Austin apartment markets, Austin makes more sense. In an earnings call this month, an executive from apartment REIT Camden Property Trust said Google searches for Texas apartments by people in New York were up 72% year-over-year in the fourth quarter, suggesting some renters are considering just that. Zoning reform and lower interest rates can, over time, ease the housing shortage in New York, but the pandemic was a missed opportunity for the city. And it probably means that New York will lose a fair number of residents this year to metros that did build when the conditions allowed.

Conor Sen is a Bloomberg Opinion columnist. He is founder of Peachtree Creek Investments.

This article was provided by Bloomberg News.