3. Widen the circle. How has the situation impacted your clients’ family members? How has it impacted their career or business? How has it impacted their future plans?

4. Bring some perspective. We don’t want any permanent answers for temporary situations, and there may be clients inclined to self-sabotage. If that’s the case, you may have to bring up the old charts showing how markets have survived through all the historic events of the last 50 to 100 years. Markets will survive this reality as well.

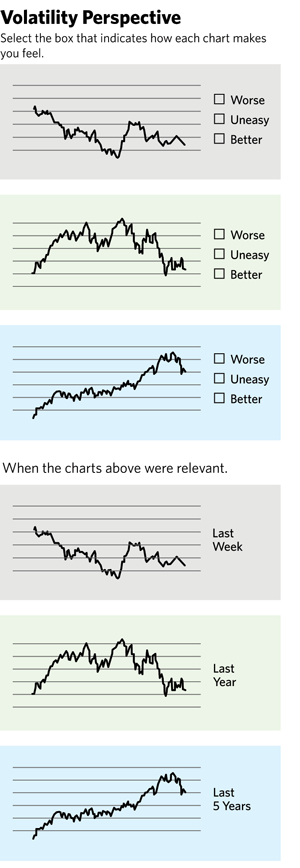

The graphic on the left is one I created back in 2009 to help clients gain some perspective. In the first illustration, they are asked to mark how the chart would make them feel if it was their money being discussed: worse, uneasy, or better. Typically, clients label the first chart “worse,” the second “uneasy” and the third “better.”

The graphic on the left is one I created back in 2009 to help clients gain some perspective. In the first illustration, they are asked to mark how the chart would make them feel if it was their money being discussed: worse, uneasy, or better. Typically, clients label the first chart “worse,” the second “uneasy” and the third “better.”

When they look at the next chart, they see the punch line: They are looking at the same stock (or fund), and it’s simply the time perspective they have chosen that has caused them to feel worse, uneasy, or better.

5. Find a way forward. Perhaps some of your clients’ plans have changed. Perhaps their attitude toward investing, insurance, retirement, debt, spending or some other financial issue has changed. This is a time to take their temperature and be proactive and discuss any shifts they are making in their thinking or life plan. Here you can talk about what is “fixable” and what we must accept, as well as asking “What do we know, and what do we not know?”

I’ve been getting a lot of calls these days from firms seeking advice about how advisors can bring out their best in the worst of times. I understand the concern. This is a time to discover the type of relationships you have been building and the basis for those relationships. If they are centered primarily on clients’ portfolios, then the stress level in your dialogue is going to be higher.

If, on the other hand, your relationships have been centered on the life of your clients and helping them make progress, then you’re most likely seeing them ascend to a higher level, because the dialogue has always been about life first.

If there ever was a time to make a difference in the lives of our clients, that time is now. Now more than ever, financial professionals can demonstrate the power and impact of placing life at the center of the financial advice conversation.

Portfolios fluctuate, but lifestyles veer and sometimes swerve. And it’s lives that we must tune into at this moment in history. The portfolios will find their way back over time, as we’ve seen time and again. But lives may never be the same.

Those who expect to return to the status quo may find that the “quo” has been decidedly altered. It’s our job to show up in the now and sort out each client’s present reality … and there’s no time like the present.

Mitch Anthony is the creator of Life-Centered Planning, the author of 12 books for advisors, and the co-founder of ROLadvisor.com and LifeCenteredPlanners.com.