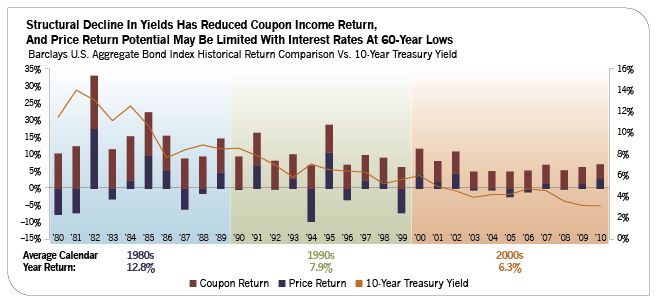

With interest ates at 60-year lows, epic monetary stimulus poised for a global withdrawal and the specter of inflation a bigger risk than it has been for decades, bond investing is more complicated than ever. Furthermore, after a decade of tremendous returns, anyone who subscribes to the theory of mean reversion has some legitimate concerns about the future potential of the asset class.

The days of bonds being a "no-brainer" allocation that one could largely set and forget have gone to the wayside, especially in a world where the sanctity of credit ratings, the security of monoline bond insurance and the seeming simplicity of structured and securitized investments have been called into question. Fixed-income investing, for better or worse, has changed, and will likely be subject to an unwelcome combination of high risk and low return for the foreseeable future, much to the frustration of financial advisors and clients alike.

Before one hits the sell button, though, it is important to remember that markets are unpredictable, and bonds have and will continue to play a vital role in a portfolio for the "return of principal" insurance that is just too important to dismiss in these volatile times. Rather than simply write off the allocation as a lost cause, consider for a moment the broad opportunity set that now exists within the asset class and the ways a dynamic approach to managing fixed-income assets may boost returns and deliver effective interest rate and inflation risk management.

This is not your grandmother's bond portfolio. (And it won't be again unless Treasury bond yields approach 15% or more. If they do, of course, follow Grandma's lead, buy them all up and never look back.)

To be clear, within every client's fixed-income allocation, a core bond base of 50% to 80% should be maintained that will serve as a foundation and act as a stabilizing force for this segment of the portfolio. The greater the risk tolerance, the lower this core bond exposure should be, and vice versa. Whether delivered through a mutual fund vehicle, through an ETF or via a portfolio of professionally managed individual bonds, this exposure should deliver benchmark returns, which at this time will be low considering the current interest-rate environment. Generally speaking, and especially now, we believe it is best for this exposure to be positioned on the short-to-intermediate end of the yield curve. That will allow investors flexibility and minimize any principal declines in a long-term bond portfolio if rates rise appreciably.

To complement this core base, financial advisors should consider a broad and deep array of fixed-income strategies that offer both a bigger potential return and more defense against upward movements in interest rates. Such a portfolio could include high-yield bonds, bank loans, inflation-protected securities, international bonds, emerging market debt and the newer strategic-income category.

High-yield bonds, for example, offer a much higher income level than core bonds. Though the valuations in this space are not cheap right now, the bigger coupons typically offset the negative price returns when interest rates rise. Meanwhile, bank loans, with their floating-rate coupon structure, will actually benefit from an increase in interest rates and offer better coupon income.

At the moment, high-yield securities may be the better bet, given their fixed-rate coupons and higher structural yields, especially if interest rates remain stable or only slowly rise. Either way, bear in mind that these asset classes tend to have a fairly high positive correlation to the equity markets and should only represent a measured portion of the fixed-income pie.

Another satellite allocation to consider in this environment is Treasury inflation-protected securities (TIPS), which have an incredibly low correlation to the equity markets and could provide a hedge against a worst-case scenario of spiking inflation. However, these securities are pricey at the moment, and will be affected by rising real interest rates just like any other bond. But as a modest complement to the core bonds, they would limit the downside of rising interest rates amid accelerating inflation.

International and emerging-market debt are two other categories worth considering for a satellite fixed-income allocation, offering diversification of credit, interest rate and currency risk, as well as a less correlated exposure to a core fixed-income allocation. Emerging debt markets have gained particular notoriety over the last few years as the health of developed markets has deteriorated and investors have sought out sovereign credits with strong fundamentals and without massive structural deficits. Aiding this demand for emerging markets debt has been the increased issuance and liquidity within the global fixed-income markets.

However, against a backdrop of sovereign debt crises and rampant emerging market inflation, a manager's ability to pick strong issuers while minimizing interest rate risk is paramount. The biggest benefit of including international and emerging debt as a satellite allocation is currency diversification, which could offer some measure of protection and excess returns over U.S.-denominated bonds if the secular trend of U.S. dollar devaluation continues.

Additionally, it is worth considering a satellite investment in so-called "strategic income" funds, which typically have a flexible, "go anywhere" mandate that allows allocation of assets across various sectors, credit qualities, geographies, interest rates and currencies. These funds have burst onto the scene as a byproduct of the 2008 credit crisis, allowing portfolio managers to tactically shift their portfolios to take advantage of opportunities and hedge against risks that traditional bond fund mandates may not allow. In many cases, hedging risks includes shorting segments of the fixed-income markets. If well-managed, these strategies can deliver strong risk-adjusted returns over time in different market environments.

While not all of these strategies are appropriate or advisable in every circumstance, it is worthwhile for financial advisors to consider them in a core-satellite approach to a client's bond portfolio, just as we have all come to accept the benefits of a globally and market-cap diversified equity portfolio.

Michelle Knight is chief economist and managing director of fixed income at Silver Bridge (www.silverbridgeadvisors.com), an independent wealth management boutique. All investment advisory services are provided by Silver Bridge Capital Management, LLC, a registered investment advisor affiliated with Silver Bridge.