And even if the market rebalances and moves into a small deficit, it could take several quarters for the enormous overhang of crude and product stocks to fall to more normal levels.

So there are plenty of reasons to be cautious about the sustainability of the current rally and worry that it will run out of steam.

Fundamentals are clearly improving on the supply and demand sides of the market and it is now possible to identify a trajectory that will bring production and consumption back to balance.

Supply And Demand

Gasoline consumption in the United States is apparently on track for another year of exceptionally strong growth in 2016.

Consumption has been steadily revised up from a predicted increase of just 10,000 barrels per day (0.1 percent) in December to 130,000 bpd (1.4 percent) in April ("Short-Term Energy Outlook," U.S. Energy Information Administration (EIA)).

Vehicle buyers are increasingly choosing larger and more fuel-hungry sport-utility vehicles and especially crossover-utility vehicles rather than smaller, more energy-efficient cars.

Car sales as a proportion of all new-vehicle purchases have dropped from 52 percent in 2009 to 44 percent in 2015 and are forecast to slide to just 41 percent in 2016, according to industry analytics firm Wards Auto.

The balance is made up of sport-utility vehicles, pick-ups, light vans and especially crossover-utility vehicles, which are the fastest-growing segment of new vehicle sales.

Similar trends are evident in India and China. Traffic is growing strongly and car buyers are opting for larger and more fuel-hungry vehicles, leading to rapid growth in gasoline consumption.

But it would be wrong to assume the run-up in prices was being driven entirely by trend-chasing and macro-focused hedge funds.

.png)

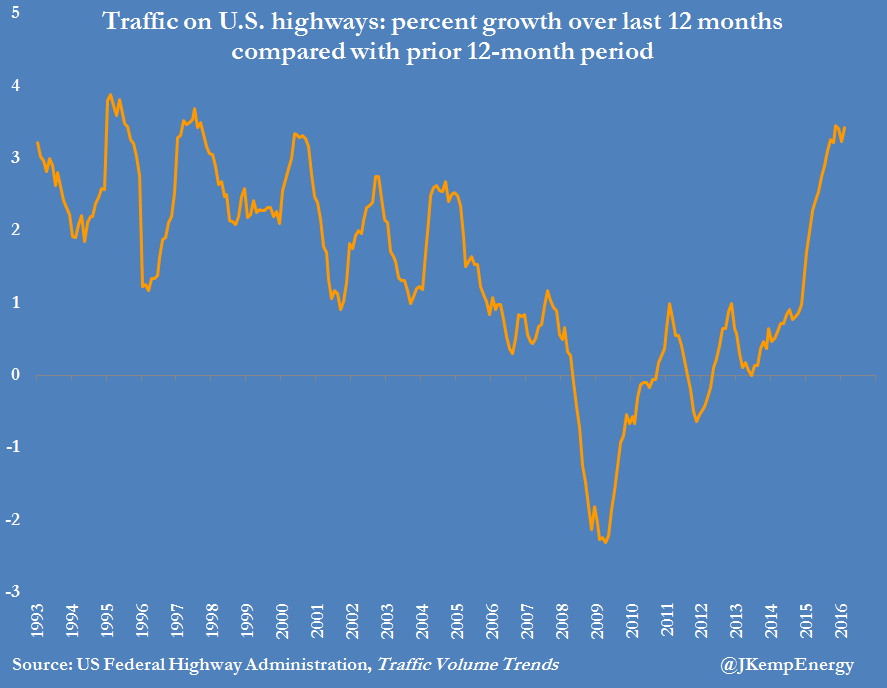

Road traffic is growing strongly and shows no sign of leveling off. Volumes were up 5 percent in February compared with a year earlier and have shown consistent growth averaging around 3.5 percent in recent months.

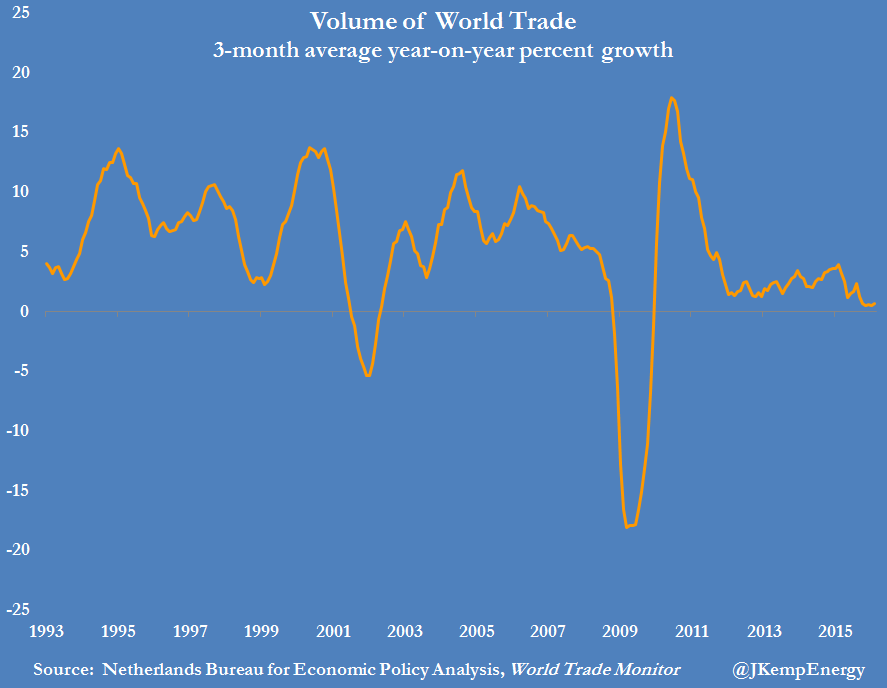

In contrast to gasoline, consumption of middle distillates used as diesel and heating oil has stagnated thanks to a warmer-than-normal winter and the worldwide slowdown in freight growth.