As though this cocktail isn’t good enough between the retail and professional investors, let’s look at what the real wealth creators are doing: the insiders.

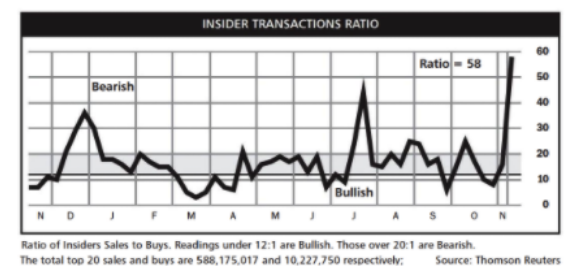

Insiders are dumping their holdings in large proportion to buyers. As you can see in the footnote below the chart, a greater than 20-to-1 ratio is not good for stocks.

As an example in our portfolio, to see the CEO of Pfizer (PFE) selling a large block of stock when the value of medicine has never been greater and the prospects of their reorganization look compelling, we must raise an eyebrow and think deeply about what is going on around us.

As Buffett said, this looks like “one helluva party” with the individual investors, professional investors and insiders all joining in the fun. As a former fraternity member in college, the best parties were always when you couldn’t find anyone missing. It wreaks of that today in the stock market. Much like college parties, things are beginning to not make sense. The BAML fund manager survey noted how bullish investors were on the stock market, and they also noted they were bullish on the economy. Yet, they wanted to be long tech and short financials. The strong economy helps the banks and not the stock market or technology. Things are getting late in the evening and the dangerous part is that investors are “dancing in a room in which the clocks have no hands.” For an older generation, Free Bird (Lynyrd Skynyrd), the last song of the night, may begin playing shortly and all the air-guitar band members will show their faces. Beware of stock market failure my friends!

Cole Smead, CFA, is president of Smead Capital Management.