One&Only Resorts is known for ultra-luxury hotels in outposts like Cape Town, the Maldives and Dubai, where it operates a beachfront retreat on an artificial island. Now it’s selling private homes in a $1 billion development near Puerto Vallarta, Mexico.

It’s the first time the resort operator, owned by Dubai-based Kerzner International Holdings Ltd., has stamped its brand on a residence. Late last year, partners RLH Properties and RSC Development pre-sold the first five One&Only-branded homes in the new development, Mandarina.

The initial phase of the project, designed by the architect Rick Joy to incorporate jungle vegetation and dramatic cliffside drops to the Pacific, includes 55 branded residences, priced between $4 million and $12 million, and a 108-room One&Only hotel. The development will eventually include a second hotel and another group of branded homes, to be operated by Rosewood Hotels & Resorts Inc., as well as a beachfront polo field and equestrian center.

“The community that these people are buying into, they realize this is the last large tract of land,” said Ricardo Santa Cruz, chief executive of RSC Development. “It’s very difficult to replicate, if you’re interested in this part of the country.”

Hotel developers have long cherished the idea of slapping luxury hotel brands on private homes, selling buyers on access to concierge services and the cachet of names like Four Seasons and Ritz-Carlton, and using the proceeds from early sales to fund hotel construction. Hospitality companies get a piece of the sales price and can add vacation rentals to their product mix, since many owners rent their homes when they’re not using them.

“In our ultra-luxury clientele, more and more people are traveling with their extended family,” said Philippe Zuber, president and chief operating officer of One&Only. He said the company is planning branded residences in Montenegro, Mauritius and Kea, an island in Greece.

The One&Only project is part of a parcel of land that Santa Cruz began putting together in 2008, assembling properties owned by 58 families with backing from a private-equity firm in which Goldman Sachs Group Inc. was an investor. The land was placed in a new company, RLH Properties SAPIB, which in 2015 sold shares to the public.

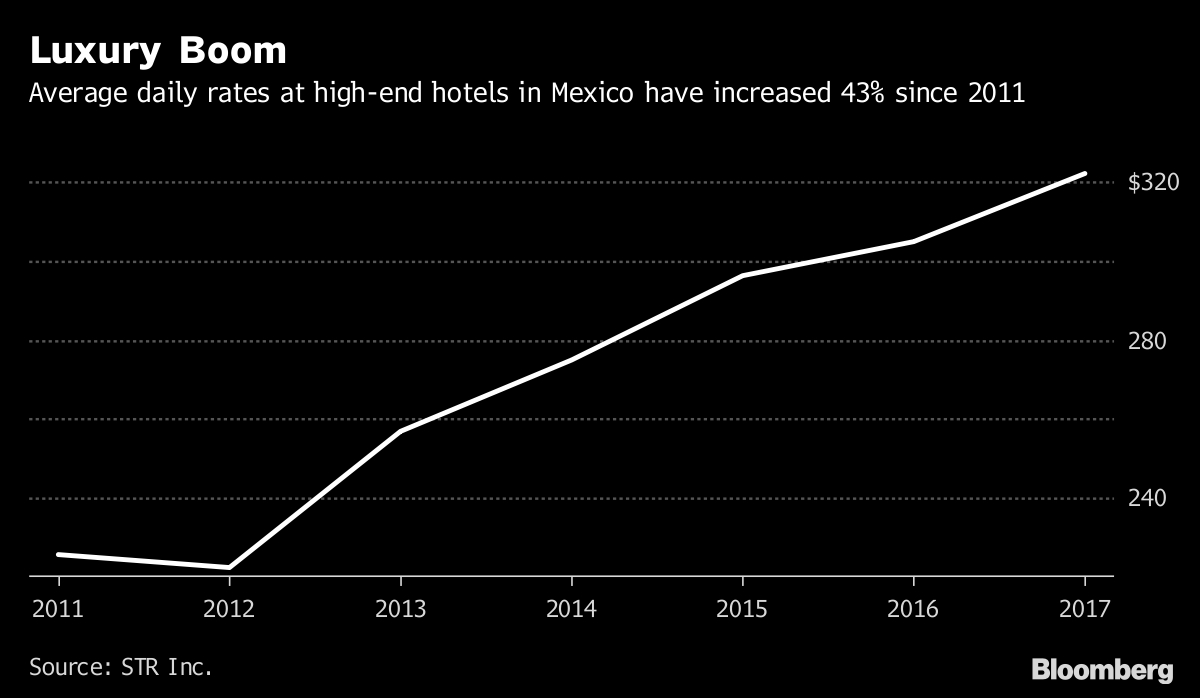

The new hotel comes amid a building boom that has increased the number of luxury rooms in Mexico by 33 percent since 2011, according to data from lodging industry provider STR Inc. Average daily rates increased 43 percent over the same period. Currency fluctuations may explain some of the rate growth, said Jan Freitag, senior vice president at STR.

It’s also possible, he said, that “the people who can afford Mexican luxury hotels are just not price-sensitive.”