When we wrote the annual outlook last November, the data was mixed. Some metrics hinted at emerging cracks in the economy while others suggested the growth trajectory in capital markets and the economy had legs. So, the variety of the data produced the narrative that business activity in the new year would grow on an annual basis but experience some bumps in the first half of the year. Now, enter the revisions.

Strong Job Momentum Has Surprised

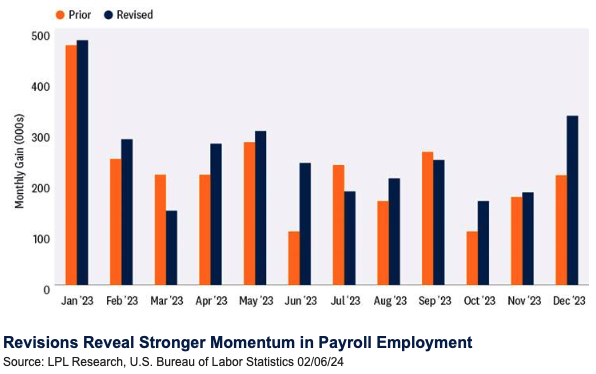

In the latest employment report, the Bureau of Labor Statistics (BLS) issued revisions to the prior 12 months, and it turns out that firms added more jobs in 2023 than originally reported. As last year ended, investors thought businesses added 2.7 million jobs, but after revisions, businesses added roughly 3.1 million.

Job Growth Healthier Than Originally Reported

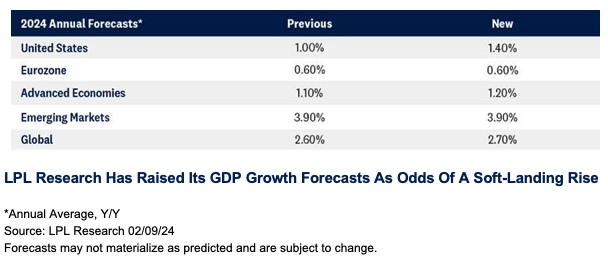

The stronger employment figures tell us that businesses and households have stronger momentum going into 2024, and therefore, we believe it is prudent to increase our forecasts for economic growth. Headwinds remain but on an annual basis, we believe the U.S. and global economy is poised for a bit stronger growth this year than originally forecasted last year.

It’s More Than Just Jobs

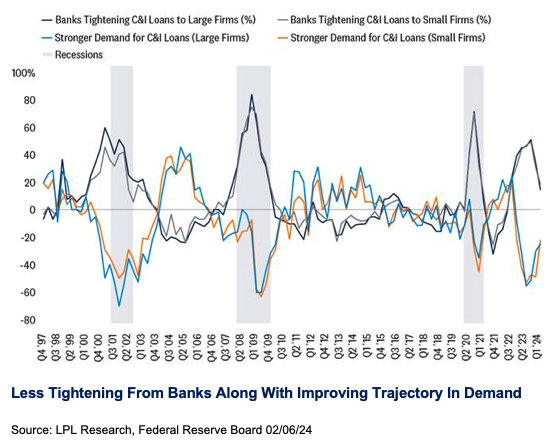

Another factor that suggests the economy could move through this year with fewer headaches is the improving credit conditions. The latest Senior Loan Officer Survey tells us credit supply and credit demand are getting into better balance. Financial conditions improved in recent months as fewer banks tightened credit conditions in Q4 because fewer firms were pessimistic about demand. As investors digest the experience of loan officers, historically we experienced recessions when credit was this restricted. Improving credit conditions suggest the economy had good momentum as the New Year got underway and markets are responding accordingly.

Consumers Have More Room To Run

Tight labor markets and improving credit conditions create a favorable environment for both consumers and businesses. But let’s focus on the consumer here. Since the pandemic, consumer spending on durable goods, such as cars and household furnishings, plus demand for nondurable goods, have been strong and above trend. We think some of that spending was pulled forward from future demand, and we should expect a tapering of spending on goods.

Services spending experienced something drastically different. The pandemic took a toll on services demand and after several years, consumers are finally back on trend for services. We think consumer spending will revert to the mean this year, but the strong momentum we have from jobs and credit suggest the reversion to the mean will be pushed out later—just like the timing of the first Federal Reserve (Fed) rate cut, which may not come until June.

Services Spending Back To Pre-Pandemic Trend

More Fiscal Stimulus May Be On The Way

President Biden lined up spending on infrastructure (Infrastructure Investment & Jobs Act of 2021), clean energy (Inflation Reduction Act of 2022, or IRA), and semiconductor manufacturing (CHIPs Act of 2022) to ramp up this year to help cushion his re-election campaign. The White House knows no U.S. president has been re-elected during or soon after a recession. This new investment spending will partially offset the consumer stimulus from previous years rolling off. This year will see the first big wave of IRA spending that is expected to mostly come by 2026 (though a GOP victory in 2024 will curb some of that in 2025 to pay for extending the Trump tax cuts).

In other fiscal news, a tax bill cleared the House on January 31 and is now being considered by the Senate. Provisions in the bill have been scored by the Joint Committee on taxation at roughly $120 billion in 2024. Strategas policy strategist Dan Clifton estimates $136 billion in fiscal stimulus from the bill, though passage is far from assured, especially considering these dollars could influence voters in swing states which may cause Republicans to balk. The same can be said for the defense (Ukraine, Israel, Taiwan, and Red Sea) and southern border deals that came out of the Senate and face uncertain futures. Should these bills get through Congress, the odds that 2024 GDP growth has a 2-handle—though not our base case—will increase. We have raised our GDP growth forecast for this year from 1% to 1.4% and marginally increased growth forecasts for developed international economies due to some positive spillover.

Importance Of Energy Costs Cannot Be Overstated

The Biden Administration needs to do everything it can to avoid a spike in energy prices. A spike in oil prices may be the biggest risk facing Biden at the polls this fall. Some of the best predictors of elections historically have been inflation-adjusted, after tax income and the misery index (unemployment plus inflation), which could both jump if energy prices rise.

What can they do? First, while the Strategic Petroleum Reserve has not been refilled, more could still be released to curb potential price increases. The Biden Administration has tried to protect oil shipments in the Middle East, which may also help. And they can stay out of the way from a regulatory perspective, which to an extent they have done because U.S. oil production is at a record high. (Note that the recent decision by the Administration to pause approvals of LNG exports is unlikely to affect exports in 2024 and is probably mostly a nod to climate activists at this point.)

More broadly, prices are elevated after several years of high inflation, so even though the pace of price increases has slowed, consumers are paying a lot more at the grocery store than they did when the pandemic began. Simply put, there’s little margin for error here with the situation in the Middle East largely out of the White House’s control.

Conclusion

The S&P 500 has eclipsed a key milestone in closing above 5,000. These big round number breakthroughs have historically preceded solid gains over the subsequent six and 12 months, averaging 9% and 10.4%, respectively, going back to when the S&P 500 cleared 100 in 1968. The strong gains this year have left valuations elevated, but with improved prospects for a soft landing and earnings growth, these gains appear mostly justified. Geopolitics and rates remain the key risks and, along with valuations, point to modest gains for stocks over the balance of 2024. Our year-end fair value target for the S&P 500 at 4,950 is under review.

Asset Allocation Insights

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its neutral equities stance despite the strength of the latest stock market rally that has carried the S&P 500 over the 5,000 milestone. The improved outlook for economic growth and earnings, along with relative stability in interest rates as inflation is poised to continue to move lower, keeps the risk-reward trade-off for stocks and bonds fairly well balanced, though upside over the balance of the year is likely to be fairly modest.

Within equities, the STAAC continues to favor a tilt toward domestic over international, with a preference for Japan among developed markets, and an underweight position in emerging markets (EM). The Committee also recommends a slight tilt toward large caps and growth stocks. Finally, the STAAC continues to recommend a modest overweight to fixed income, funded from cash.

Jeffrey Roach, PhD, is chief economist for LPL Financial. Jeffrey Buchbinder, CFA, is chief equity strategist LPL Financial.