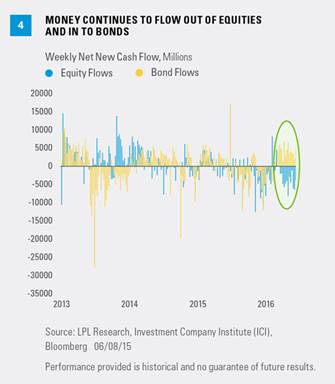

The inflows and outflows of stocks and bonds are just as fascinating. There have been 13 consecutive weeks of outflows from equity strategies, while bonds have seen inflows for 15 consecutive weeks [Figure 4]. That tells you what most investors are doing; with yields near record lows, they would still rather own bonds than invest in “risky” equities. All of this negative sentiment could provide future buying pressure on any good news in the second half of the year.

#3 Stabilized Crude Oil & U.S. Dollar As Tailwinds

Lower oil prices have been a major hindrance to corporate earnings growth; but now with the commodity back up near $50 per barrel, should it stay near current levels, it will show year-over-year growth by the third quarter of 2016 for the first time since the oil bear market took hold in mid-2014. With supply and demand coming more into balance, we do think there is a good chance that crude can hold current levels. Although a huge rally might not be in the cards, a big drop back to the February 2016 lows is not likely either, in our view. Should crude stay near current levels, the energy sector may reach double-digit earnings growth by year-end,[1] after posting a loss and registering a more than 100% decline during the first quarter 2016 earnings reporting season.

The strength in the U.S. dollar continues to ease and could potentially provide a significant boost to earnings in the second half of the year. With nearly half of the S&P 500’s sales coming from overseas, the strength in the U.S. dollar has been as much as a 20% drag on foreign earnings (since the second quarter of 2015). Should the dollar remain at current levels, it would act as a potential tailwind to earnings over the remaining quarters of the year, after providing a major headwind over the past year.

Conclusion

The worries out there are very real and could continue to hinder economic growth and stock market gains. The good news is there are some major positives that might not get the same amount of publicity as the bad news does, but that could very well help produce a strong second half of the year. We continue to anticipate mid- to high-single-digit total returns for the S&P 500 overall in 2016.[2] With the year-to-date return near 2.5% currently, we expect more gains before the year is done.

Burt White is chief investment officer for LPL Financial.

Thanks to Jason Hoody for his contributions to this commentary.