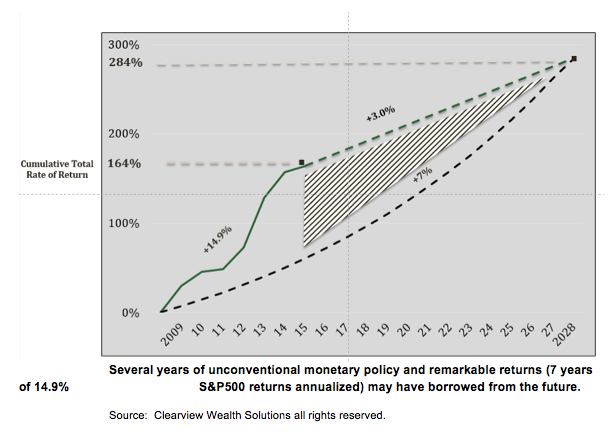

Many experts believe annual stock returns will be lower over the next several years. Rob Arnott (of Research Affiliates) anticipates less than 2 percent annually, while McKinsey (the consulting firm) expects 4 to 6 percent real stock returns and Vanguard’s Chief Economist, Joseph Davis, looks for less than 6 percent over the next 50 years. Disappointingly low returns could upset advisory assumptions for the majority now dependent upon defined contribution programs and lead to widespread difficulty among the retired.

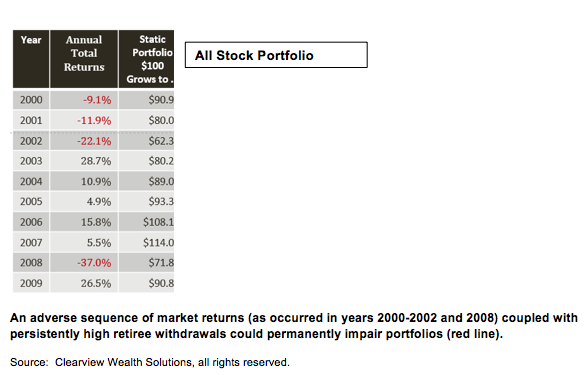

There are two distinct potential issues for consideration; inferior portfolio returns and adverse return sequencing.

Inferior Portfolio Returns

This chart displays S&P 500 returns over the past seven years (2009 thru 2015) and the projected future returns that would ultimately provide at a 7 percent average annualized return over a 20-year period. As returns over the past 7 years have been more than twice our assumed trend, it could be argued we have borrowed from the future. Mediocre projected future market returns of around 3 percent could now be expected. Slower growth of investment portfolios will require larger contributions to meet funding objectives. And smaller retirement portfolios will result in reduced withdrawal potential and a more frugal lifestyle for retirees.