The pandemic years transformed wealth in the US, sowing the seeds of a new form of inequality.

The divide is clear when describing the state of family finances in 2024. Household balance sheets, in aggregate, are arguably in the best shape ever. At the same time, borrowers are getting squeezed as high interest rates make servicing new debt more challenging. This sets up a difficult balancing act for the Federal Reserve as it contemplates policy changes.

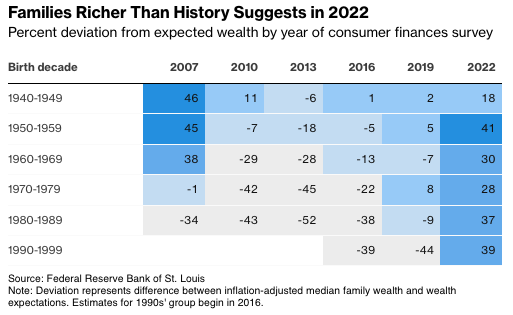

A blog post published last week by the St. Louis Fed provides some important context. The authors looked at the median household wealth of people based on the decade in which they were born and compared it with where history suggests they should be. For example, how are older millennials born in the 1980s doing compared with past generations when they were the same age.

In 2019, those older millennials along with cohorts born in the 1950s, 1960s and 1970s had roughly the net worth one would expect for their age, based on historical averages.

By 2022, the picture had shifted dramatically. Median family wealth for the 1980s cohort was 37% higher than expectations, a touch below the gains seen by baby boomers born in the 1950s. Millennials, on average, are now pretty rich for their age.

But averages miss the nuances when there’s a lot of variability within a group. The blog post notes that the vast majority of the increase in wealth for older millennials during those years came from nonfinancial assets—predominantly home equity. And while the home ownership rate for that generation has risen a lot since 2019, tens of millions of millennials still don't own homes. This latter group didn’t benefit from the rise in home-equity wealth and was instead hurt by it.

For a homeowner, the surge in property values and inflation during the pandemic meant rising wealth after locking in low monthly mortgage payments. For a renter, it meant an increase in housing costs and dwindling affordability.

The subsequent policy response from the Fed pushed interest rates to the highest levels since the mid-2000s, making new borrowing and debt servicing more challenging. Higher rates don't go into official inflation measures, but they represent a meaningful rise in the cost of living for many households and help explain why consumer sentiment remains lower than the unemployment rate or official measures of inflation would suggest.

This widening wedge of inequality is different from what we saw in the early 2010s. Back then, it seemed like the only people getting ahead were billionaires and those lucky enough to have good jobs in technology or finance. In general, the middle class was struggling, most workers were under-employed, and household wealth levels were below historical expectations due to the decline in home and stock values in the wake of the Great Recession.

In that environment, “just stimulate the economy” was a policy response that broadly worked by boosting the labor market and repairing home values and household balance sheets. Low inflation created room for the economy and asset values to grow before policymakers had to be concerned about tradeoffs.

But in 2024, striking a policy balance between property-rich homeowners and interest rate-burdened borrowers and renters isn’t so straightforward.

The Fed’s pivot to signaling rate cuts rather than increases in the future has led to a surge in asset values, speculation, and consumer and business confidence. Moving ahead with rate reductions would likely increase home equity-related wealth and give homeowners a greater ability to tap it via cash-out refinancing or other means. That could put the kind of upward pressure on inflation that the Fed wants to avoid.

But keeping interest rates high strains consumers with floating-rate debt on credit cards or those who need to finance the purchase of a home or automobile.

In an ideal world, Fed officials probably wish they could push debt-service costs modestly higher for homeowners with pandemic-era mortgages, creating a cushion so they can lower rates for those with other kinds of debt or those who need to borrow now. Of course, policymakers can't do that.

Instead, we get the kind of message Fed Chair Jerome Powell delivered to Congress on Wednesday—they're not ready to cut rates yet, but they believe “it will likely be appropriate to begin dialing back policy restraint at some point this year.”

It's an effort to keep rich homeowners from getting too excited while signaling to borrowers that help is hopefully on the way. Making home-equity wealth expensive to tap while signaling that lower mortgage rates are in our future is the best of a bad set of policy options for the time being.

Conor Sen is a Bloomberg Opinion columnist. He is founder of Peachtree Creek Investments.