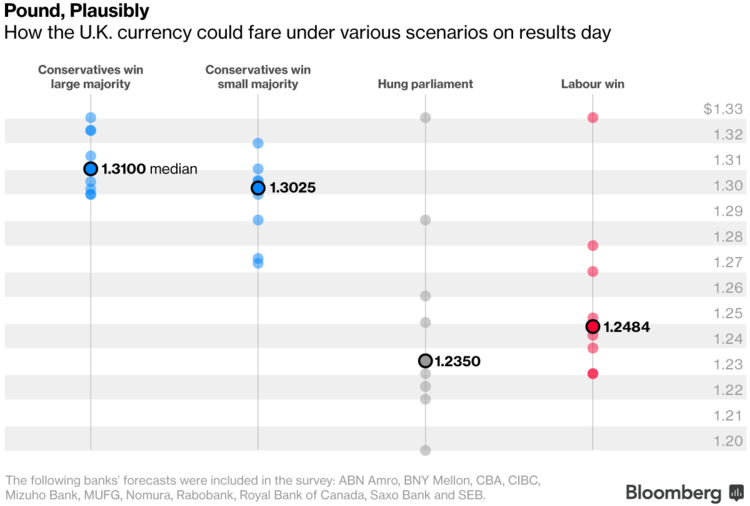

The pound could plunge to as low as $1.20 on Friday, a level last seen in January, should the U.K. snap election lead to a hung parliament, according to a Bloomberg poll of analysts.

Such an outcome, though seen as unlikely, would be marginally more negative than even an electoral upset that sees the Labour Party defying odds to emerge the winner, according to the survey of 11 banks and brokerages. That suggests investors don’t share Prime Minister Theresa May’s view that when it comes to Brexit, not having a deal is better than a bad one. A victory for May’s Conservative Party would be supportive of the pound, and this outcome is more or less already priced in, the analysts say.

Analysts also highlighted that the shorter- and longer-term effects on the currency could be different. While a strong Tory win lends markets near-term certainty and helps sterling, over a longer period it could “increase the odds of a harder Brexit, which would probably be consistent with the pound being lower,” Andrew Sheets, chief cross-asset strategist, said at a press conference in London on Monday.

The pound was at $1.2948 as of 3:27 p.m. in London. The currency had earlier reached $1.2958, the highest in almost two weeks.

Below is a compilation of analyst views on the election outcomes and potential pound reactions in the spot market:

Conservative Win (Large Majority)

• As a Tory win seems already priced in, there’s limited scope for sterling to rally on the news; still, this outcome is seen as the most positive for the pound immediately after the vote.

• Sterling is seen reaching $1.3100, according to the median of analyst estimates, with one predicting it to reach $1.3300, a level last seen in September 2016.

• “In the markets there is a very simple rule of thumb: the larger the Conservative majority becomes, the more positive it is for sterling,” says Adam Cole, London-based head of global foreign-exchange strategy at RBC.

Conservative Win (Small Majority)

* This outcome, which was once seen as a tail risk, is now very much on the market’s radar as Labour is slowly chipping away at the Tory lead in polls.