Reviewing bond holdings doesn’t make most people’s list of New Year resolutions, but it should. Why? Investors often tell us that fixed income is confusing and that they have heard now is not a good time to buy bonds. The truth is a bond allocation is critical to your financial health, and a truly tactical approach to the asset class can address a lot of the confusion and misgivings about bonds that investors typically have.

Bond investing can be confusing, but it doesn’t have to be. The problem is that many start by making predictions about the direction of interest rates. For instance, at the start of 2019, nearly all of the soothsayers emphatically believed that the interest rate path trajectory was up (and the prices of bonds down). This turned out to be flat wrong.

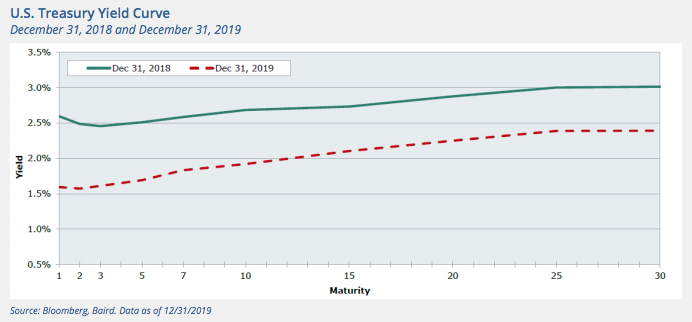

Take a look at the chart below. In 2019, yields dropped by more than 50 basis points (bps) across the curve. Here is something interesting: from early November 2018 until early September 2019, the 10-year U.S. Treasury yield collapsed from 3.24% to 1.47% yield, or 177 bps. Assuming a duration of 9 years, that drop in yields translated to a roughly 16% price gain. (If yields had jumped by 177 bps, investors would have lost 16%—in a bond holding!). Trying to predict the timing and direction of interest rates is a fool’s game and getting it wrong has serious financial consequences. It’s a big reason why investors find that bonds are confusing.

We also keep hearing that in addition to just being confusing, it’s not a great time to buy bonds. Here are a few justifications for avoiding bonds we commonly hear:

• The 1.75% yield on 10-year U.S. Treasury bonds is almost exactly the same as on the S&P 500 so bonds aren’t attractive relative to stocks.

• The credit quality of investment grade (IG) bonds skews more to Baa (the lowest level before junk) than it has ever been, making IG bonds riskier than ever.

• High yield corporate bond spreads are tight, so lower quality bonds are more expensive than historical averages.

All of these reasons make sense on some level, but at the same time, they are not (in our view) valid reasons to completely avoid all bond investments.

• The yield on the S&P 500 is similar to that of a 10 year Treasury bond, but the risk is much higher for the broad stock market than for Treasuries; a 10% drop in stocks over a few weeks can be common, but that’s unheard of for bonds.

• The credit quality of IG bonds has shifted, but in a lower rate environment more companies can safely borrow at higher levels.

• High-yield corporate bond spreads are lower than average. In fact, this has been the case for most of the past decade. Spreads have also been tighter than they are today so it’s also not a great reason to completely avoid this lucrative asset class.

Like the dead-wrong interest rate predictions above, no investment prognostication can be counted on to be 100% right, especially over the short term. The fact is that bonds play an important long-term defensive, volatility dampening and diversifying role in nearly any portfolio. While most investors believe that bonds are confusing and that it’s not a great time to buy, the reality is that they need to have bonds in their portfolios. Here is a solution: utilize a process that clears up the confusion with a set of rules that points out what to buy and when, and also when it is time to get out of the way.

A tactical, rules-based process for buying and selling every flavor of fixed income, from high-yield corporate to 10-year Treasury bonds may remove the confusion and help guide the way. A process takes the guesswork out of the dilemma as to whether it is good or bad timing. In fact, many fixed-income investments do well when interest rates rise. Many others do well when they fall.

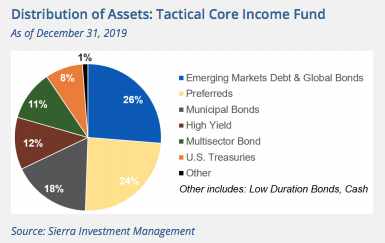

Our truly tactical rules-based process defines when to buy and when to sell based on valuation and momentum. The pie chart below is a general summary of where our clients made money in 2019 within the Sierra Tactical Core Income Fund. The results show our commitment to truly uncommon diversification, and profits were derived from a variety of areas: high-yield bonds, emerging markets debt, preferred stocks and Treasury bonds.