Key Takeaways:

• We expect slightly positive earnings growth in the second quarter, with substantial drag from falling technology sector earnings.

• The big question for investors this quarter is how much tariff costs are reflected in analysts’ earnings estimates.

• We expect better-than-expected earnings may be a catalyst for stock market gains in the second half of this year.

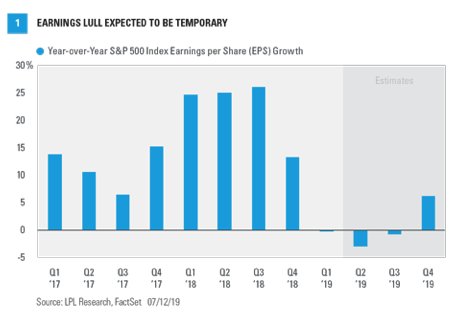

Second quarter earnings season gets rolling this week. Consensus estimates are calling for a modest year-over-year decline in S&P 500 Index earnings amid the downshift in U.S. and international economic growth, tariffs, and ongoing trade tensions. Quarterly earnings almost always beat quarter-end consensus estimates—this quarter will likely be the 41st in a row to do that—so we expect a slight year-over-year that would continue the stretch of consecutive quarterly earnings gains since the 2016 earnings recession [Figure 1]. Nearly 60 companies will report this week (July 15–19). Here we preview second-quarter earnings season and share our outlook for profits in the second half of 2019.

Low Bar Again

Seventy-seven percent of companies issuing guidance for the second quarter have lowered estimates, which is above the 5-year average of 70 percent, according to FactSet data, lowering the bar so to speak. However, the overall consensus S&P 500 earnings estimate has fallen only by a below-average 2.6 percentage points over the past three months, much less than the 7 percentage point reduction in first-quarter 2019 S&P 500 earnings expectations ahead of the first-quarter reporting season. We think earnings stand a good chance of beating estimates by the typical 3–4 percent when factoring in the lower bar, a generally steady U.S. economy, the results already in for May 31 for quarter-end companies, and the latest trade developments (more on that below).

The Big Question

The big question for investors this quarter is how much tariff costs are reflected in analysts’ earnings estimates. China tariffs remained in place after President Trump’s meeting with China President Xi at the G20 Summit in Japan last month. We suspect those tariffs are mostly reflected in second-quarter estimates (and probably third quarter as well). Estimates were reduced significantly earlier in the year, and companies have already taken steps to mitigate impacts by altering supply chains. Tariffs have also received a lot of attention on earnings conference calls this year, giving analysts a fair amount of information to react to.