By building off AIM’s benchmark we are setting the bar relatively high for contrarian investing. First, we rebalance monthly, which tends to skew the performance toward strategies such as momentum rather than value. Second, the investment decision used in our portfolio test ignores the actual yield on cash, the other investment opportunity. Indeed, on several past occasions, stocks, even though expensive, still provided a more attractive expected return than cash, whose return is controlled by the Federal Reserve. We believe, however, that by setting a high bar for our portfolio test, we can offer more transparent and compelling evidence.

Over the last two decades, US equity market price increases have pushed yields to remarkably low levels, leading investors to wonder, what is fair value? Our analysis suggests that macroeconomic volatility can provide meaningful guidance to investors in recognizing fair value. Currently, we find that US equity market prices are still higher than their implied value, which is based on recent low levels of macroeconomic volatility. We believe the trend toward lower macro-vol and the higher valuations it justifies is waning. Therefore, long-term investors can benefit by considering the future trajectory of economic management, both in the US and abroad, and successfully advance their progress in the quest for the Holy Grail of fair value.

The authors are members of the investment team at Research Affiliates LLC:

Omid Shakernia, Ph.D., is senior vice president of asset allocation.

Michael Aked, CFA, is a director and head of asset allocation.

The equity allocations that result for both historical contrarian and macro-vol contrarian strategies are nearly identical in the early years of our analysis. After the early 1950s, however, as the level of macroeconomic volatility starts to fall, the holdings of the macro-vol contrarian strategy begin to deviate from those of the historical contrarian strategy. We observe that significant changes in macroeconomic volatility are reflected in the allocations of the risk-conditional strategy as it gradually reacts to the changing environment, resulting in larger relative allocations to equities.

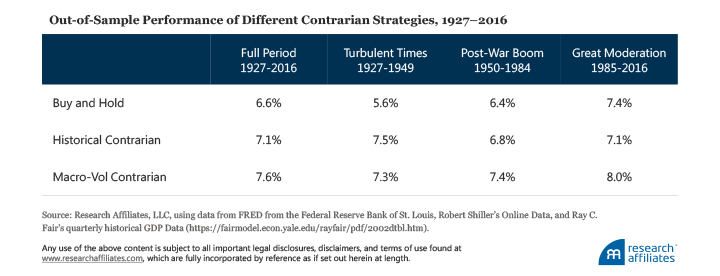

We compare the out-of-sample performance of the two contrarian strategies relative to a buy-and-hold portfolio, which is fully invested in equities (i.e., no cash). For the period 1927–2016, we observe that the macro-vol contrarian strategy outperforms the historical contrarian strategy in years after major changes occur in the macroeconomic environment. The explanation for the performance difference is that the anchor for the historical contrarian strategy is backward looking and suffers from the “poison” of secular changes. At the same time, because the macro-vol contrarian strategy is responsive to macroeconomic conditions, it is better able to adapt to a changing macro risk environment.

Over the full period, conditioning on macroeconomic volatility is indeed valuable; the insight provides an average 50 basis points (bps) more a year compared to the historical contrarian strategy. Consistent with the path of macro-vol, the additional return relative to the historical contrarian strategy is not evenly distributed over time, but is additive in recent years. For example, since the start of the Great Moderation in 1985, the macro-vol contrarian strategy has outperformed a buy-and-hold strategy by 60 bps a year, while the historical contrarian strategy underperformed the same by 30 bps a year.

If we apply the allocation rules of the historical contrarian and macro-vol contrarian strategies based on year-end 2016 market prices and macroeconomic risk conditions, we observe that stocks are currently overvalued but not as much as suggested by the historical averages. The current low level of macro volatility implies lower expected returns (and higher current prices). As of December 2016, a macro-vol contrarian investor would allocate a full 8% more to equities than a historical contrarian investor (92% vs. 84%).

Conclusion

Michele Mazzoleni, Ph.D., is vice president and head of macro research.

Quest For The Holy Grail: The Fair Value Of The Equity Market

March 27, 2017

« Previous Article

| Next Article »

Login in order to post a comment