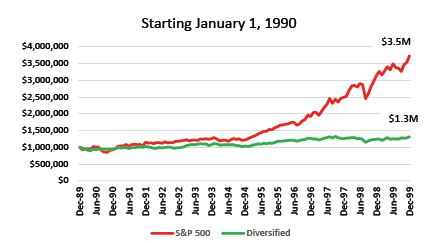

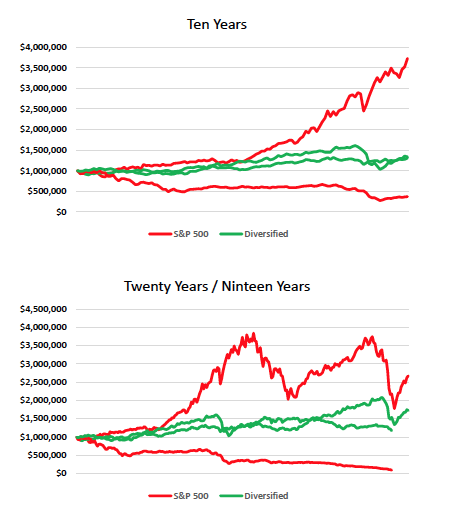

Consider two individuals. Both have $1,000,000 and want to draw $45,000 in each year of their retirement, adjusted for inflation. For each of them, this is a 4.5 percent withdrawal rate. One investor places his assets in the S&P 500. The other diversifies. They begin their story on January 1, 1990. Unbeknownst to the investors, they had embarked on their journey during a fantastic decade for U.S. stocks. Here is how they fared:

The S&P 500 investor experienced a great run, ending with $3,538,000. His ending draw of $60,000 represented 1.7 percent of his portfolio. He was in great shape.

The Diversified investor ended his run with $1,291,000, and his ending draw represented 4.7 percent of his portfolio. He was in fine shape, just not as well off as his counterpart.

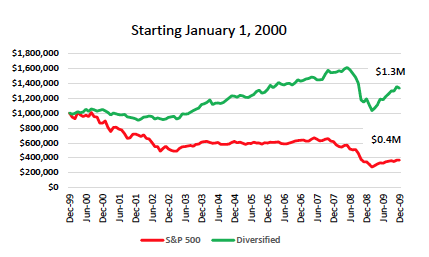

Both investors told their younger friends about their first decade as retirees. Their younger friends retired and followed suit, making similar investment choices, each beginning with $1,000,000 while needing to draw $45,000 per year. The friend of the S&P 500 investor placed his assets in the S&P 500, and the friend of the Diversified investor decided to diversify. Unfortunately, these two friends retired after the 1990s, on January 1, 2000. Unbeknownst to the investors, they had embarked on their journey during a terrible decade for U.S. stocks. Here is how they fared:

The S&P 500 investor experienced a poor run, ending with $369,000. His ending draw of $58,000 represented a daunting 15.6 percent of his portfolio. He was in very bad shape.

The Diversified investor ended his run with $1,334,000, and his ending draw represented 4.3 percent of his portfolio. He was in fine shape. Remember, both Diversified investors ended with similar $1.3M portfolios even though they retired during very different periods.

The investors were similar. The assets were the same. The portfolio draws were the same.

The investment decisions were different. The risk was different. The range of outcomes was different.

We just experienced the longest bull market for U.S. stocks, ever. We don’t claim to know what the future holds. But we do claim that proper diversification can lower our risks, decrease our range of outcomes, and increase our odds of remaining on pace for our goals.

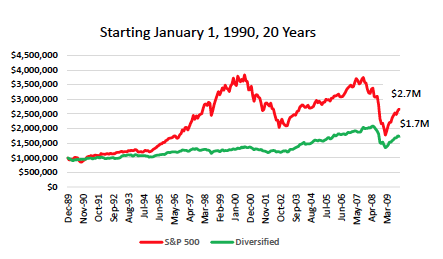

What happened to the original retirees over the 20-year period?

Over the first 20 years the S&P 500 investor ended up wealthier, with assets of $2.7M and an ending portfolio draw of 2.9 percent. The Diversified Investor ended with assets of $1.7M and a portfolio draw of 4.5 percent, right where he started.

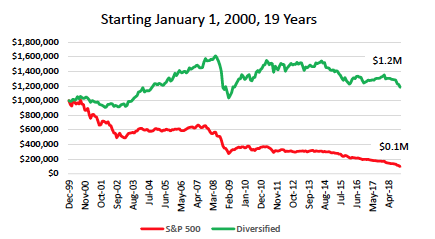

How did the second set of retirees fare over the 19-year period that ended after 2018?

The S&P 500 investor ended the 19-year period with just $95,000, and his annual withdrawal is now 68 percent of his portfolio. By the time you read this, he may be out of money. The Diversified investor ended the period with $1,180,000. His portfolio draw is 5.6 percent.

The sequence of returns matters. Will you experience positive or negative returns early on? Risk matters. Higher risk portfolios will likely have higher ups and lower downs. Range of returns matters. When we are on track to reach our goals, our aim is to reduce both our risk and our likely range of outcomes. That is what we are laser-focused on.

Lastly, to wrap up, let’s look at all of four of the 10-year periods in one chart, and all four of the two-decade periods in one chart.

Absent a crystal ball, we are aiming for the green lines. We believe that a slow and steady pace wins the race.

Randy Kurtz, CFP, is chief investment officer of DataDriven Advisor LLC.