After 12 years of trying, Ray Dalio is finally letting go.

The billionaire founder of Bridgewater Associates has given up control of the firm he built into the world’s largest hedge fund, entrusting its future and $150 billion in assets to a younger generation of leaders with their own ideas about investing. On Sept. 30, he transferred all of his voting rights to the board of directors and stepped down as one of Bridgewater’s three co-chief investment officers.

“Ray no longer has the final word,” co-Chief Executive Officer Nir Bar Dea said in an interview. “That’s a big change.”

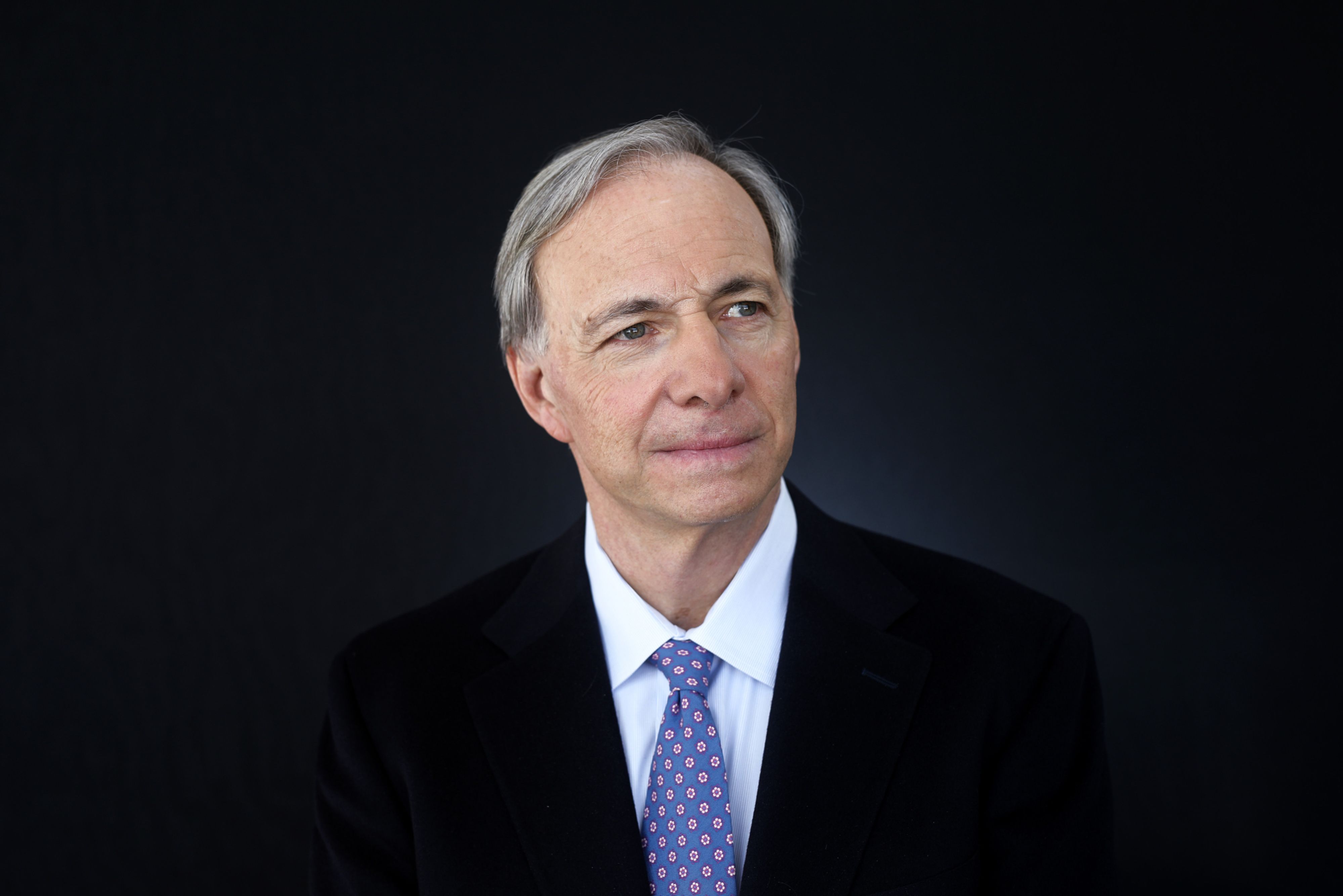

Ray Dalio (Bloomberg)

It’s also a milestone. While some of his peers converted the firms they founded into family offices or closed shop, Dalio was determined to create something that outlasted him.

He initiated a transition plan as far back as 2010, figuring it might take as little as two years. But Dalio struggled in his search for successors. Now that those people are in place, handing over control is the final and irreversible step.

“This was the natural progression of events; as soon as we were ready, we went ahead,” said Dalio, 73, who will keep his seat on the board with a new title: founder and CIO mentor. “I didn’t want to hold on until I died.”

The timing is favorable, too. Bridgewater, after misreading the markets during the early months of the pandemic, has been putting up some better numbers.

Its flagship Pure Alpha strategy has advanced 34.6% in this year through Sept. 30. All Weather, an approach designed to deliver more stable returns, has lost 27.2%.

‘Idea Meritocracy’

Dalio was a former commodities trader and broker when he founded Bridgewater from his two-bedroom New York City apartment in 1975. Thanks to standout performance in the 2000s, the firm amassed tens of billions of dollars in assets and landed many of the biggest institutions as clients.

Westport, Connecticut-based Bridgewater also became so notorious for secrecy and iconoclasm that it drew comparisons to a cult.