When Donald Trump was elected president, Ray Dalio, the founder of the hedge fund Bridgewater Associates, was optimistic about the new administration’s economic agenda. Since then, his notes have turned increasingly pessimistic. He recently said his firm is reducing risk over worries that the U.S. is becoming politically more divided. Dalio recently compared today’s environment to the situation in the late 1930s:

It seems to me that we are now economically and socially divided and burdened in ways that are broadly analogous to 1937. During such times conflicts (both internal and external) increase, populism emerges, democracies are threatened, and wars can occur. I can't say how bad this time around will get. I'm watching how conflict is being handled as a guide, and I'm not encouraged.

Dalio has made the 1937 analogy before. Yet it’s impossible to quantitatively compare two different eras in these terms. We can, however, make an economic and stock-market comparison to those times to get a better sense of how things played out in the first recession following the Great Depression. There are a few similarities between that period and today. Interest rates were low for a long time in the 1930s. The 10-year Treasury yield began 1937 at 2.7 percent. It currently stands at around 2.2 percent. In both cases, the Federal Reserve was tightening monetary policy, as well. And both periods saw a huge stock market rally following a previous crash and deep recession.

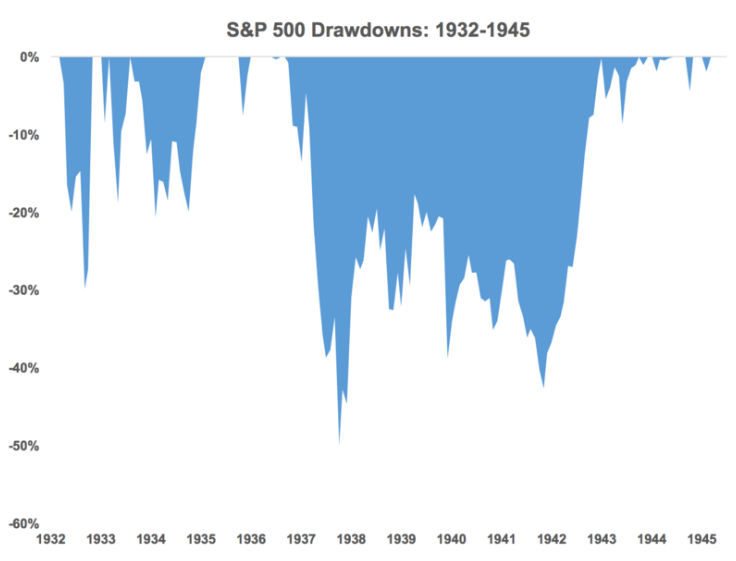

But that’s really where the similarities end. Everything that happened in the 1930s was magnified compared with what we’re experiencing today. After falling in excess of 80 percent during the Great Depression, stocks finally found a bottom in the summer of 1932. The rebound was so pronounced that equities were up more than 90 percent in the months of July and August of 1932 alone. From the bottom in 1932 through early 1937, stocks had an enormous rally, gaining about 415 percent in less than five years. This was good enough for an annual gain of more than 40 percent a year.

Unfortunately, the good times didn’t last. After peaking in February 1937, stocks fell 50 percent over the next year, culminating in a 25 percent loss in March of 1938. It’s no wonder that no one wanted anything to do with stocks for many decades following this period. After witnessing the greatest stock market crash in history from 1929-1932, investors watched stocks get chopped in half a few years later.