There’s good news from first-quarter earnings season. So far, expectations of a swift and impressive rebound from the pandemic have been amply fulfilled. With about a quarter of companies in the S&P 500 having reported, it looks as though the market didn’t get too far ahead of itself.

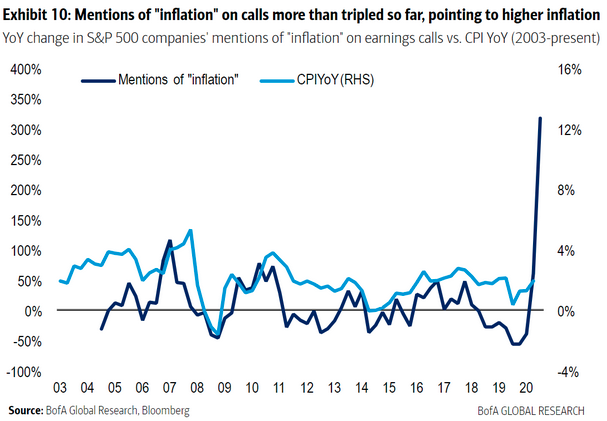

That said, the limited positive reaction shows investors really were expecting something massive. With a fantastic recovery already in the price, it will be difficult to go much further. And the comments of CEOs and CFOs on earnings calls so far suggest that the risk of inflation (a word I wanted to avoid mentioning) is rising. Stockbrokers now crunch transcripts to look for trends—and the overwhelming one so far is increasing concern about inflation. These numbers come from the quantitative team at BofA Securities Inc.:

Such a sharp increase cannot be ignored. The great inflation scare of 2021 may yet turn out to be a great head fake, but for the time being it’s a mighty real phenomenon that could yet have an impact on central bankers, and on the bond market.

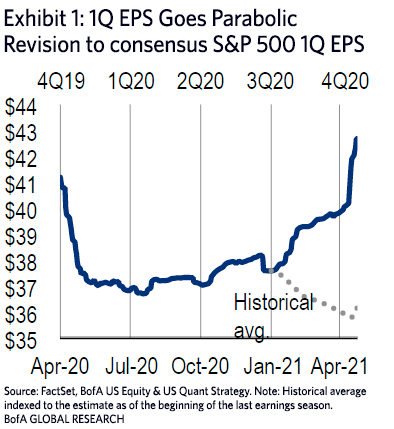

Anyone concerned about overheating will get plenty of support from the numbers coming out of corporate America. As BofA shows, expectations have shot up in the last few weeks. This is largely a reflection of the way the suddenness and extremity of last year’s shock has scrambled perceptions, but still it’s very uncommon to see estimates move like this. The corporate “game” of talking down expectations ahead of results is inoperative for the time being:

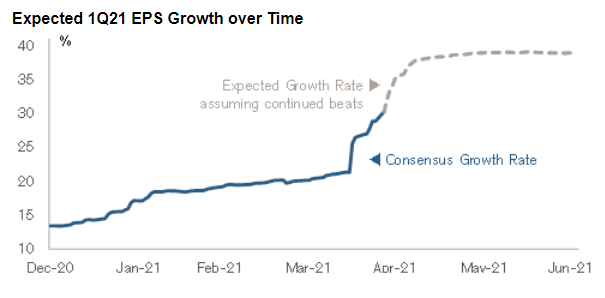

If companies keep beating forecasts at the same rate over the next couple of weeks, we could end up with growth for the quarter of as much as 40% from a year earlier. This would owe much to the low base set in the first three months of last year, but it’s still extraordinary:

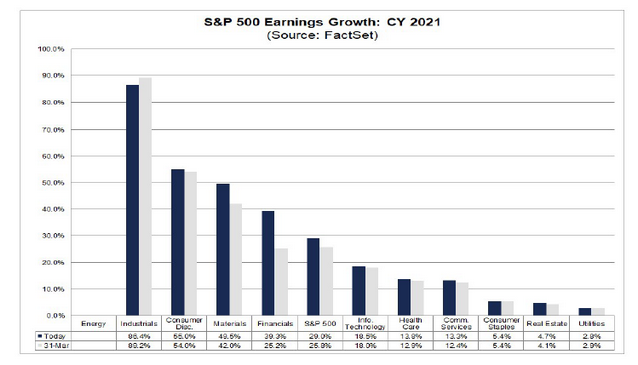

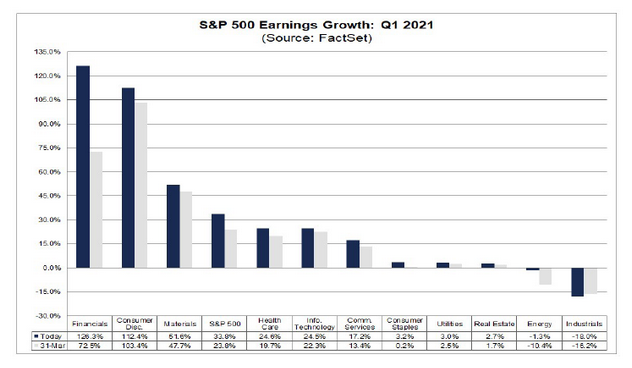

If the growth rate ends at Factset’s current projection of 33.8%, that would be the best of any quarter since the third period of 2010, when the post-Great Recession recovery was beginning to crank into gear. The numbers also show how much this quarter is being driven by cyclical companies that were prime victims of the pandemic, led by financials and consumer discretionary businesses. And if current forecasts are right, industrials still have a lot of growth ahead if they are to partake of this recovery:

By the end of the year, Wall Street seems confident that industrials will indeed have enjoyed a renaissance, with growth for the year of more than 80%—although that number has been trimmed back slightly in the early days of this reporting season: