Economics has trouble predicting the effects of big changes. Most of the events economists can observe and study are limited, incremental changes — a modest increase in the minimum wage, or a small decrease in immigration. This is as it should be, because governments are (rightfully) cautious about undertaking huge economic experiments. But when people are contemplating truly transformative changes — reparations for the descendants of slaves, for example, or wealth taxation — economists have fewer recent examples to look at. That’s one reason economic history is important — by looking at times of great upheaval, economic historians can shed light on the likely consequences of dramatic policy changes in the present day.

One such enlightening study is a recent paper by economists Philipp Ager, Leah Platt Boustan and Katherine Eriksson, entitled “The Intergenerational Effects of a Large Wealth Shock: White Southerners After the Civil War.” Using detailed Census records, Ager et al. measure the effect of the war on the wealth of slaveholders and their sons. This is an interesting question, because it asks: When the government takes away some of your wealth, how quickly can you bounce back?

The answer: Very.

Ager et al. used a combination of surnames, position in the wealth distribution and the amount of wealth held in “personal property” (which included slaves before the Civil War) to identify likely slaveholders among Southern families. Using these measures, they found that the Civil War and the abolition of slavery reduced slaveholders’ wealth by about 15 percent relative to Southerners who had had similar amounts of wealth before the war. This makes sense: When slaves were freed that represented a direct loss of wealth for slave holders, and their inability to compel former slaves to work their land reduced the value of that land as well.

But when they matched fathers to sons — estimating the sons’ wealth by their occupations and locations — they found that the sons of likely slaveholders closed the gap, rebounding to an approximately equal level of wealth relative to their Southern peers by 1880, and outstripping them by 1900. Although the South as a whole fell behind the North in wealth after the war, due to the accelerating importance of manufacturing and to temporarily reduced agricultural productivity, the relative wealth changes resulting from emancipation were temporary.

One reason for this might be that after the failure of Reconstruction to leave deep lasting changes on Southern society, the South implemented a system of sharecropping that was often only slightly better than slavery for black farm workers. To test this possibility, Ager et al. looked specifically at areas where land was redistributed or infrastructure destroyed by General William T. Sherman. Wealthy slaveholding families in these areas lost even more than Southerners elsewhere, often by large margins, due to the seizure or devaluation of their land. But again, within one generation, their sons tended to bounce back and equal or surpass those who escaped the devastation.

How did the sons bounce back? One way was by marrying into wealthy families, which they tended to do. The authors see this as evidence that former slaveowners retained social status and connections that gave them advantages in postbellum Southern society. Those connections could have allowed them to get good jobs or raise money to start businesses.

Whether that explanation is right, the finding that families bounced back from having their wealth expropriated has important implications for modern-day wealth inequality. Suppose the U.S. government were to enact a big one-time redistribution of wealth, for example to pay for reparations for African-Americans. If the history of the postbellum South is any guide, the descendants of the rich people who took the hit would make up the difference before too long, thanks to the survival of the human networks that determine who has the opportunity to get rich. Even an annual wealth tax would likely have only a limited effect in flattening the distribution.

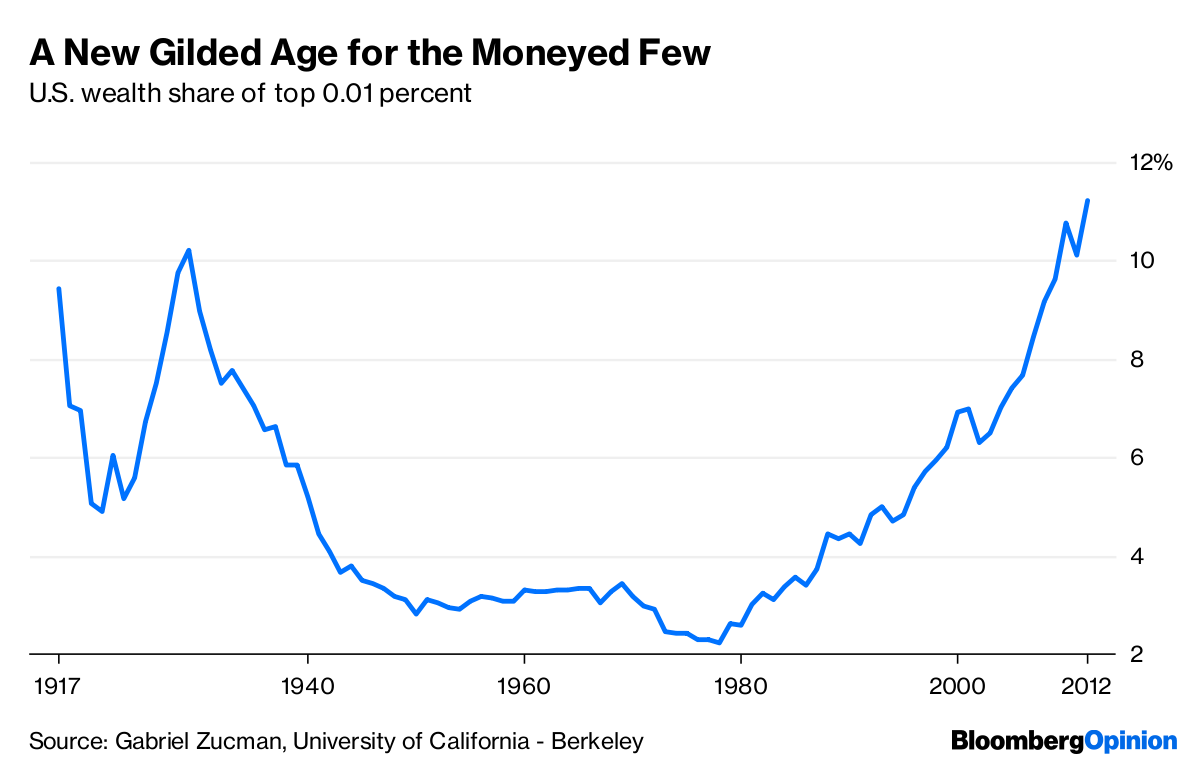

Right now, many economists and policy makers are looking for a way to reduce wealth inequality:

But Ager et al.’s research suggests that in order to make the U.S. wealth distribution more equal in a meaningful and lasting way, the government will have to do more than simply reallocate resources. It will have to address the mechanisms by which people actually get rich. And if Ager et al. are correct, social ties and human networks are an incredibly important mechanism. Although racial segregation has fallen since 1970, black and white Americans still tend to live in different neighborhoods and attend different schools. And poor Americans are at a big disadvantage when it comes to college: