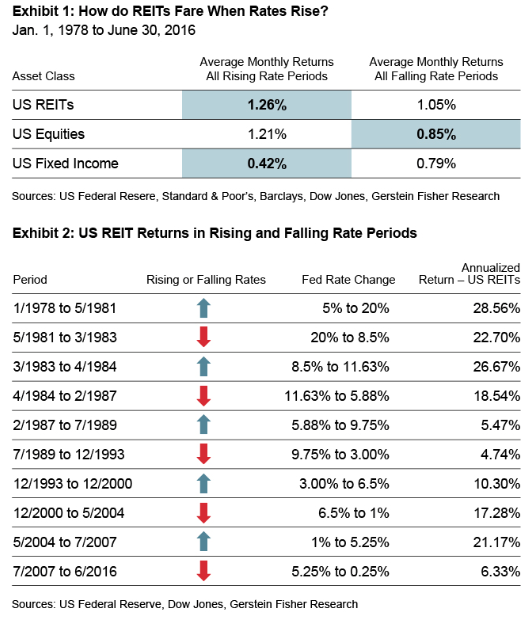

I am often asked whether rising interest rate cycles (which is bound to occur one of these days) negatively impact REIT prices. Though each scenario is somewhat different, our research shows that REITs have in fact historically performed relatively well in environments of steadily rising rates—outperforming equities and fixed income. Remember that rising rates usually coincide with periods of a strengthening economy and rising inflation, which are generally positive factors for REITs. Exhibit 1 reports the returns of the three asset classes in periods of both rising and falling interest rates from January 1, 1978 to June 30, 2016. Exhibit 2 details how US REITs performed during 10 specific cycles of rising and falling rates during the same 38 ½-year time frame.

While real estate becoming a sector unto its own may generate increased investor interest, at Gerstein Fisher we’ve always felt it has a place in most diversified portfolios, for the reasons outlined above. Real estate securities such as REITs are an effective and diversified way to access global real estate, allowing individual investors to participate in a growing and important segment of the global economy.

Gregg S. Fisher is chief investment officer of Gerstein Fisher.