[The current market demand for enhanced alpha-generating strategies, investment transparency and operating efficiency in today’s uncertain and volatile markets presents an opportunity for investment technology leaders to bring more solutions to the industry. This also positions forward-thinking investment managers to play a leading role in sparking the next wave of transformation in the asset management industry, including end-to-end automation of the investment process with the objective of delivering persistent alpha and reducing risk.

Reston, Virginia-based Valspresso—a financial technology and investment strategy development firm—has this mission at its core which motivated them to create and launch a suite of AI-driven, cloud-based applications that automate the entire investment process—from analysis to portfolio construction to trade execution—without human intervention. Their AI-driven sentiment and fundamental indicators analyze all publicly traded companies on the U.S. major exchanges with deep fundamental, as well as a patented price sentiment analysis. These indicators exhibit strong predictive power and help to manage the risk of investing by identifying those companies that are stable investments. Alpha is delivered through a combination of stock selection, dynamic tactical allocation, and automation.

The Institute decided to explore further by speaking with Valspresso’s management. The firm is led by founder and CEO, Reginald Nosegbe, the originator of the proprietary methodology described in this interview, along with Ty Seddon, a data science expert with 25 years artificial intelligence and algorithm development experience and Bob Caspe, with 50 years of experience in technology and entrepreneurship. Their most recent step has been to create VALDX—a data feed of their indicators that is licensed and distributed by FactSet—bringing to the market the core elements of their patented investment technology.]

Bill Hortz: Can you share with us the motivations and thought process you originally went through in creating your investment approach?

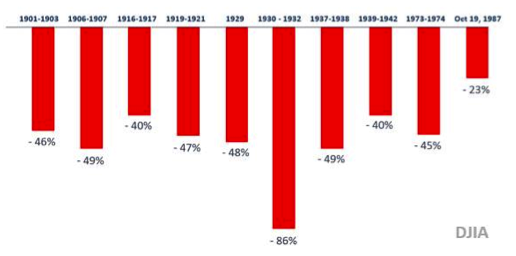

Reginald Nosegbe: As an undergraduate student at the University of Virginia in 1996, I studied the great crashes of the 20th century. I was concerned not so much because of the crashes in and of themselves; but, rather, because of the devastating financial and emotional impact they had on the lives of ordinary people. Then, I read the Federal Reserve Chairman Alan Greenspan’s statement, buried in the middle of a speech, that the market was driven by “irrational exuberance.” What he meant was that crashes had been the result of stock bubbles.

So, I started to ask myself then, if there is something called irrational exuberance how does one objectively quantify it? To answer this question, I designed an independent study course, outside of the normal curriculum at UVA, to create a mathematical model that would objectively quantify exuberance. I went on to get a master’s degree in systems and information engineering, giving me the technical rigor to support my mathematical model. I got a patent for it—a method for precisely measuring market sentiment.

Making a contribution to solving this seemingly intractable problem has been my life’s work. It is this experience: a quest to empower investors to reduce their risk of investing in the stock market, coupled with a dedicated team at Valspresso that shared my passion, that gave me the motivation to bring to market our innovation. In essence, a data-driven, easy to understand, transparent investment approach—undergirded by patented sentiment, proprietary fundamental indicators, and AI-driven systems—that empowers asset owners and asset managers to predictably reduce their risk of investing in the stock market while generating higher Alpha.

Bob Caspe: Let me also point out that often it is the coincidence of events that leads to great opportunities. About the time that Reggie was studying the question of irrational exuberance, the market-reporting environment changed radically. For example, under SEC Regulation FD, it would no longer be possible for companies to share critical information with a select group of analysts or brokers, now everything was open. Visibility to cash flow data and the balance sheet provided insights to trained CPAs with the ability to really measure a company’s true earnings and structure. While it may seem simple, the actual analysis to do this is based upon years of study and understanding. But we believed that we could apply that analysis in an automated way that leads to classifiers that have powerful and consistent predictive power—both for good and also poor performance.

Hortz: Why did you take the road you took in merging two seemingly different approaches into your patented “quantamental” investment methodology?