In recent decades, China's real estate market grew to around 25% of the entire economy:

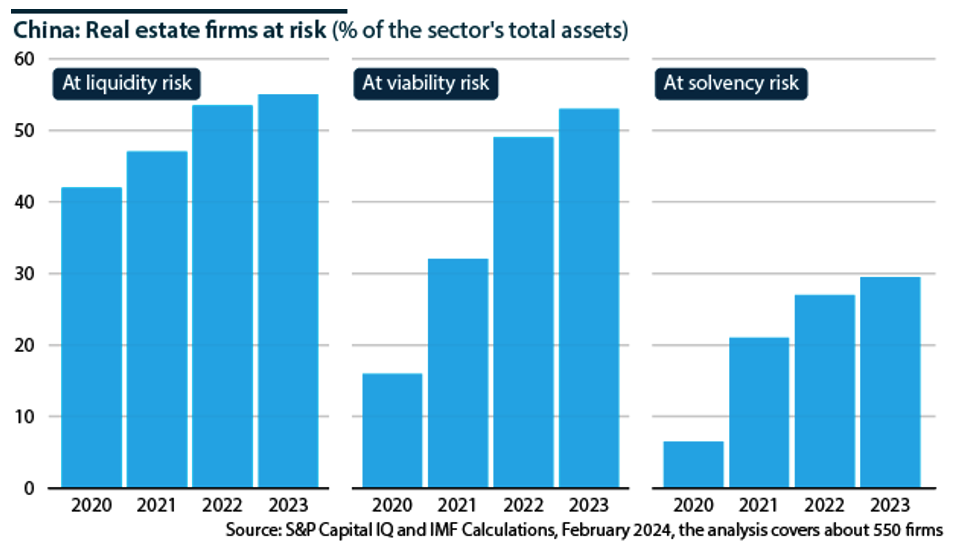

• Developers took on large debts to fund construction, which became a risk to financial stability.

• Local governments became reliant on land sales and taxes; land-related revenues rose to more than 40% of local government revenue in 2021 from closer to 20% in 2012.

• Readily available financing and investor speculation caused construction to outpace demand, leaving behind unoccupied housing; around an estimated one in five properties are unoccupied.

• In larger cities, population inflows and a lack of alternative investments intensified demand, making prices increasingly unaffordable relative to incomes.

The government took action to limit real estate-related financial risks in 2020, introducing debt ceilings (the “three red lines”) for developers.

In 2021, one of the country's largest developers, Evergrande, defaulted. Hong Kong courts have ordered it to liquidate.

Many other developers faced similar cash crunches and stopped construction on projects. Buyers lost confidence in the ability of developers to deliver contracted homes. Housing sales declined, reducing developers' pre-sale income.

Policy Support

The government's goal is a controlled real estate market correction to reduce financial risks and bring supply and demand into a more sustainable equilibrium.

Policy support remains targeted. A priority is to ensure the completion of pre-sold housing to mitigate risks to social stability. The authorities have created supportive measures developers can access to complete projects.

Local governments have provided demand-side policy support, including relaxing purchase limits, mortgage rates and down-payment requirements. However, this has yet to improve demand in the face of low buyer confidence.

The government has relaxed some developer financing restrictions. Banks have been permitted to delay the recognition of developers' non-performing loans, roll over existing loans, and adjust repayment arrangements to the end of 2024. This minimizes the impact on bank balance sheets and gives time to finish unfinished pre-sold homes.

The authorities have avoided the large-scale bailout of developers.

This year, the government's focus will be building more rental and affordable housing and upgrading old urban neighborhoods. This will translate into more government-led spending on these housing types.

Unresolved Market Pressures

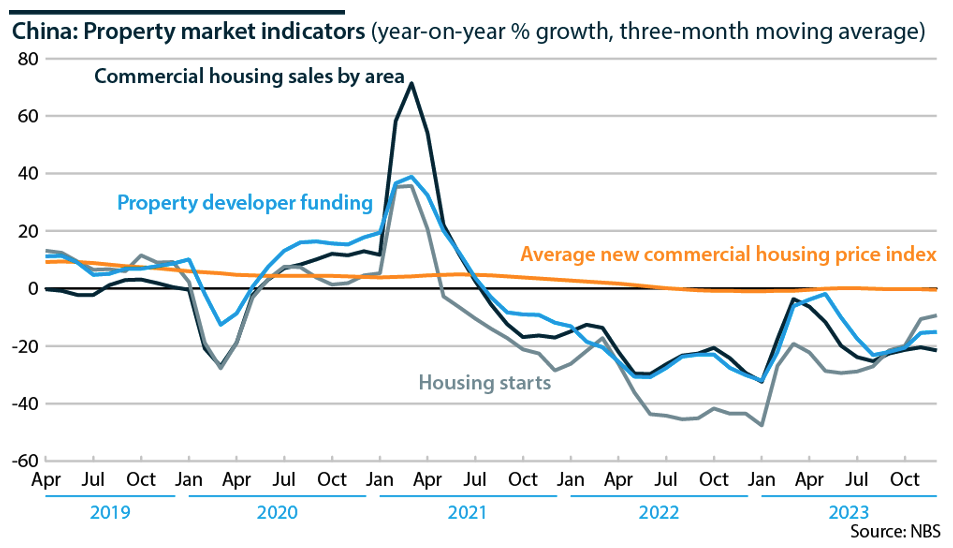

While housing starts and sales have been volatile amid deep contractions, house prices have fallen steadily.

Local governments have a mandate to maintain house price stability. They have maintained formal and informal price floors and ceilings, limiting the downturn's effects on banks' balance sheets, household finances, capital flight and social stability.

A side effect is that buyers are less likely to purchase real estate, believing prices will keep declining. The price controls have also prevented developers from making discounts to move housing stock, curtailing their fundraising ability, and banks' loan rollovers have put off debt restructuring among developers.

These issues are delaying but not stopping the market resizing.

Local Government Financing

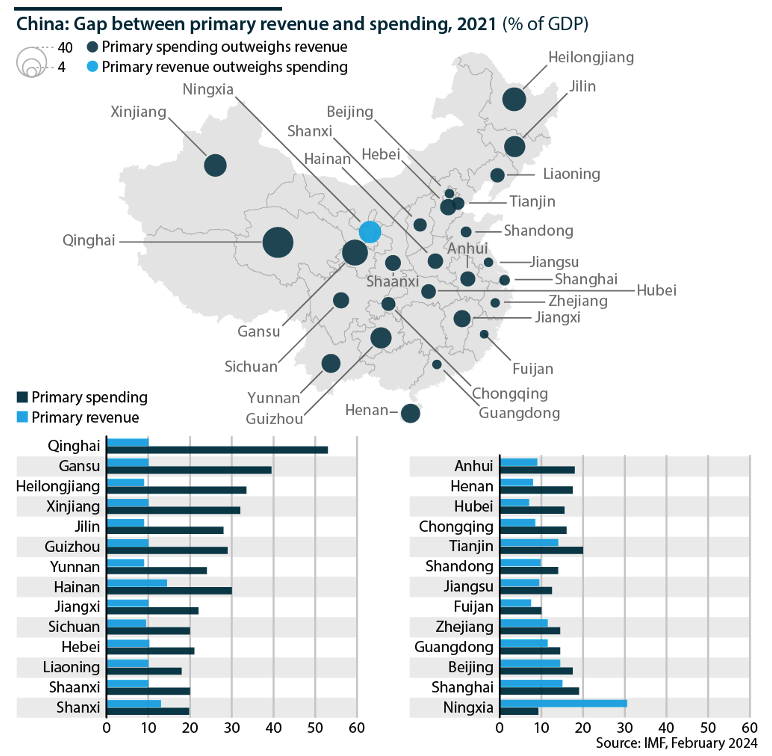

The housing downturn is exacerbating the fiscal difficulties of local governments, many of which have large debts.

According to the IMF, local government “augmented debt,” which includes reported government debt and other sources of debt financing, is more than 60% of GDP in most regions. Local government financing vehicles (LGFVs), which regional authorities rely on for off-budget spending, have large deficits between revenue and spending needs.

Many local authorities also have significant budget gaps that they rely on central government transfers to fill.

Financing these deficits has become increasingly challenging. Land revenue used to account for 42% of local government revenue in 2021, but this dropped below 30% in 2023, according to Chinese media outlet Caixin.

Bottom Line

Real estate investment and housing starts will contract as developers struggle with low liquidity. Their limited funds will be tied up completing unfinished pre-sale homes.

Government-led investment in rental and affordable housing will support some construction. The decline in housing starts has narrowed since the authorities announced this in December 2023.

Housing sales will be sluggish, given expectations of future price declines. More developer defaults are expected, but the government will help to delay firms' failure until they have finished pre-sold housing or until a larger company takes over their assets.

The central government is preparing a package to address local government debt risks, which will likely be published by mid-2024.

Officials said local governments are responsible for their debt and should use their resources, such as public asset sales, and negotiate with banks to restructure LGFV loans. The central government will likely increase transfers to local governments and control local government borrowing more stringently.

The real estate market downsizing will continue alongside the government's deleveraging of developers and reduced consumer home-buying confidence.

Structural factors will also dampen demand. These include aging, the declining birth rate and slower urbanization. Household formation will modestly offset the declines as more two-person and single-person households arise.

The IMF sees the sector stabilizing from around 2026 and gradually recovering, taking real estate investment to 40-70% of 2021 levels in the 2030s. The IMF bases its view on an analysis of comparable housing downturns in the United States, Denmark, Ireland, Japan, Spain and Sweden.

The Fund sees housing demand falling by 35-55% in the decade to 2033, depending on household size changes. It expects housing starts at roughly 55% of the 2019-21 average in the next ten years.

The downsizing will be steepest in areas with slower growth, larger excess stock, and greater population outflows, especially in the northeast. These regions will suffer more significant stress on local government, developer and bank finances, and greater house price declines.

However, demand will remain more robust in larger cities, mainly first- and second-tier cities with strong economic and population growth prospects.