In all, American households and nonprofits were worth $93 trillion at the end of last year, according the U.S. Federal Reserve. That’s almost $300,000 for every man, woman, and child in the country. Of that, Americans held $25.3 trillion as retirement assets, according to the Investment Company Institute. That includes $8.4 trillion in defined-benefit pensions and $14.9 trillion in individual retirement accounts and 401(k)-style plans.

If the bulk of that money never gets spent, that’s a big problem. Set aside that the U.S. economy could use the boost. Studies show that active retirees live longer, happier lives. There are cheap ways to get out of the house, of course, but a little spending money gives retirees far more options for exercising, socializing, and traveling.

The situation for wealthier older Americans couldn’t be more different than that facing younger generations. A study released by the National Bureau of Economic Research last month found the typical American man who entered the workforce in 1983 earned up to 19 percent less over his lifetime compared with one who started working in 1967. (Women’s incomes rose over that period, but that’s because earlier generations of women earned very little money.) Based on more recent data for younger people who are still in the workforce, the authors wrote, “the stagnation of median lifetime income seems likely to continue.”

The idea is “training people to spend.”

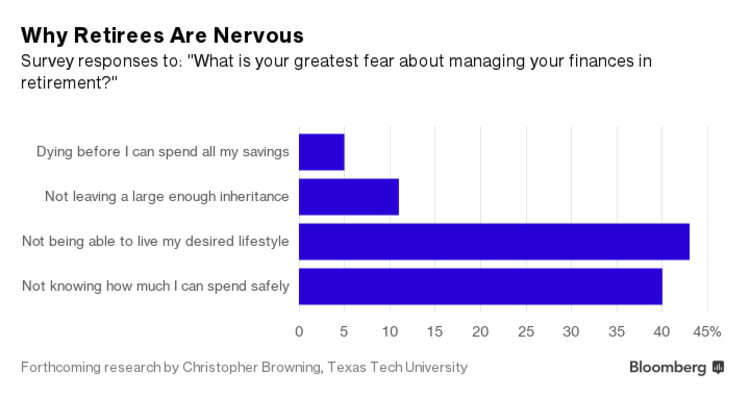

What can get rich elderly Americans spending more? One way is to reassure them they’re not going to run out of cash. Tools such as annuities and bond-ladders can turn a retirement account into a regular stream of income, mimicking a paycheck. Insurance products could also protect retirees against huge, late-in-life expenses from medical care—a dominant fear. Browning likes longevity insurance, an annuity that kicks in only if you live to 80 or 85. Other options are reverse mortgages or long-term care insurance.

Maybe the problem requires more creative solutions. Financial planners need to help retirees realize they have a “cognitive bias” that makes them too gloomy about the future, said United Income’s Fellowes. Survey data often show older Americans are less optimistic about financial matters then younger people. Fellowes analyzed the data further and found this optimism gap has been widening over the last four decades.

Even as retirees live longer, healthier lives, they’ve become more pessimistic about the economy, the stock market, and their own financial situation.

After a lifetime of saving, it requires some psychological gymnastics to start spending your nest egg. Browning’s suggestion is that financial planners urge their thriftiest clients to make big purchases–like a second home or a fancy car–before they retire, out of their pot of savings. The idea, he said, is “training people to spend.”

This article was provided by Bloomberg News.