Wealthy Americans, who were girding for the biggest set of tax increases in three decades just a year ago, now look mostly safe from higher levies for years to come.

But there’s one big, glaring exception: investment fund managers. If Democrats succeed in passing Wednesday’s surprise fiscal deal between Senate Majority Leader Chuck Schumer and Senator Joe Manchin of West Virginia, the carried interest tax break will end -- eliminating a benefit used by private equity and hedge fund managers.

Only a few items from President Joe Biden’s set of ambitious, wide-ranging tax increases are still alive in the Senate. In the 50-50 chamber, Manchin has made clear he’s only willing to proceed with three tax measures: ending carried interest, increasing Internal Revenue Service audits on businesses and wealthy households, and a 15% minimum levy on corporate profits.

The American Investment Council, which represents the private equity industry in Washington, immediately attacked the plan.

“Over 74% of private equity investment went to small businesses last year,” Drew Maloney, the group’s president, said in a statement. “As small business owners face rising costs and our economy faces serious headwinds, Washington should not move forward with a new tax on the private capital that is helping local employers survive and grow.”

The proposal to single out carried interest as the sole tax increase on high earners is rooted in Democrats’ longstanding disdain for a tax preference that lets fund managers pay much lower capital gains rates on much of their income. Senator Kyrsten Sinema, an Arizona Democrat whose vote is also crucial to the plan’s passage, has in the past declined to support ending that tax break. A spokeswoman for Sinema said she has yet to make a decision on the proposal.

Most rich Americans can largely thank inflation for escaping bigger payments to the IRS. Manchin has tied his opposition to tax increases on most individuals and small business profits to the surge in consumer prices, which he has argued could be worsened by Biden’s long-term economic plan. At the same time, Republicans are using inflation as a key theme in their midterm election campaign, which could see them take control of Congress, and remove the possibility of more expansive tax hikes.

“There is clearly a sense of relief from most people who are earning near or over the thresholds proposed in the various tax plans,” said Ken Eyler, chief executive officer at financial advising firm Aquilance.

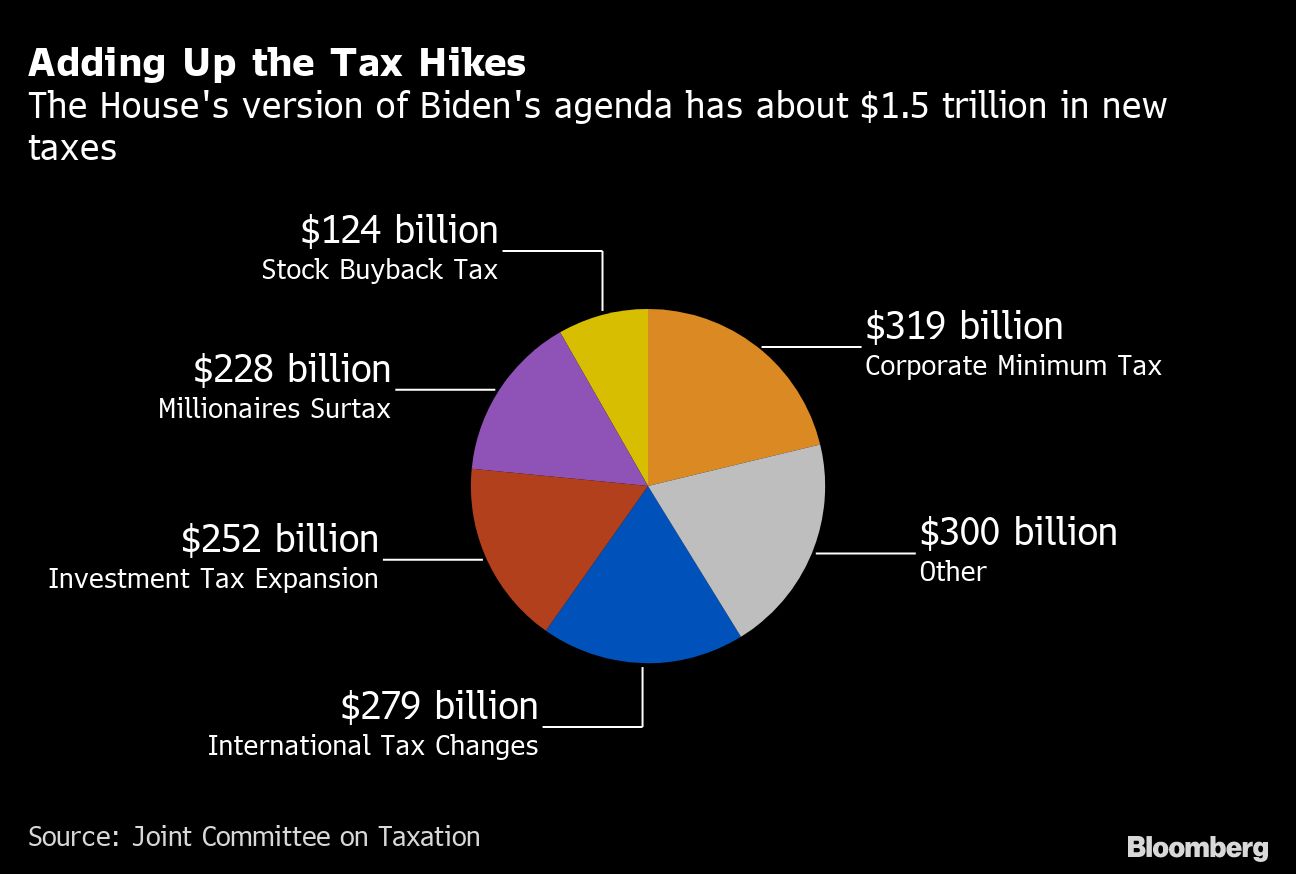

House’s 2021 Version

The Manchin-Schumer bill falls short of many Democrats’ hopes after a 2020 campaign that featured tax-hike promises and produced unified control of the White House and Capitol Hill. Advocates of more progressive tax laws are set to keep up the fight, using proposed levies on billionaires and other measures as a messaging tool. But that’s far from where they thought they’d be.

“The American people understand that it is virtually insane that you have some billionaires in this country in a given year and large multinational corporations that make billions of profits paying zero in federal taxes,” said Senate Budget Committee Chair Bernie Sanders, the Vermont independent who caucuses with Democrats.

Biden in the first months of his presidency proposed a sweeping list of tax increases that would kick in for individuals earning at least $400,000 a year, including:

• Raising the top individual rate to 39.6% from 37%

• Nearly doubling the capital gains rate, to 39.6%, for those earning $1 million or more

• The end of longstanding tax breaks, such as a portion of “step-up in basis,” which allows heirs to pay less on the wealth they inherit

• An expansion of the 3.8% net investment income tax on profits from limited partnerships and LLCs

• Ending popular tax benefits for real estate investors.

Wealth managers quickly mobilized to advise their clients to realize gains, make adjustments to their estate plans and other tax-saving maneuvers before the end of 2021 -- when Democrats were targeting the tax increases to begin.