Creating long-term family relationships is part of what Lintz's money camps are about. She says about 30 kids had gone through the program as of mid-July. Another 20 high school and college kids have taken courses on budgets and taxes.

Creating long-term family relationships is part of what Lintz's money camps are about. She says about 30 kids had gone through the program as of mid-July. Another 20 high school and college kids have taken courses on budgets and taxes.

"The firms that are growing are committed to this kind of work," Lintz says.

The big banks, she says, had better upgrade their services-and maybe hire some camp directors-or risk losing clients to their smaller and more nimble competitors.

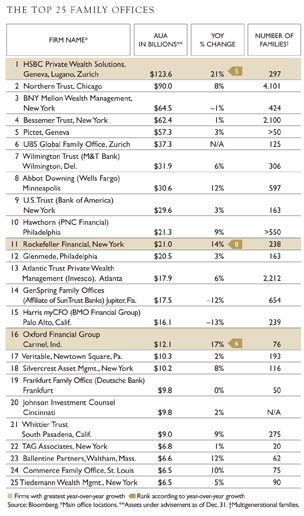

Our ranking of family offices is based on data compiled by Bloomberg from information self-reported by multifamily firms. The list was compiled through research by the Bloomberg Rankings team, and via a survey of more than 1,000 firms worldwide, using a database obtained from the Portland, Ore.-based Family Offices Group. More than 115 firms responded to the survey.

We ranked the top 50 by assets under advisement, which includes wealth directly managed by the family offices and funds outsourced to money management firms. Single-family office firms were excluded. Family offices that are part of banks were included if the bank has a unit that offers direct and comprehensive investment and noninvestment services to high-net-worth families. Figures for assets under advisement include only assets managed by the family-office unit of the bank. Money managed for pension funds was excluded; money managed for private foundations was included.

The ranked firms provide a variety of noninvestment services, including organization of family meetings, financial education, art consulting, estate planning, family governance consulting, foundation management, business consulting and concierge services such as property management, private travel arrangement and shopping assistance.